Most Businesses in Q4 Last Year Posted Losses

Finding a Way Out Through Business Diversification

The in vitro diagnostic kit industry, which benefited from the "COVID-19 boom," is rushing to restructure its business.

According to industry sources on the 14th, LG Chem is reportedly pursuing the sale of its in vitro diagnostic medical device division under the Life Sciences Business Unit. The in vitro diagnostic division produced COVID-19 diagnostic gene amplification (PCR) reagents and self-diagnostic kits, but it is evaluated that it did not enjoy the diagnostic kit boom due to slower product launches compared to other companies. An LG Chem official stated, "We are reviewing various options to strengthen business competitiveness," but added, "Nothing has been finalized yet."

Some companies are seeking alternatives for the "post-COVID" era through business diversification. SD Biosensor has identified rapid molecular diagnostic devices and continuous glucose monitors (CGM) as future growth engines. To this end, in October last year, they invested 188 billion KRW in an industrial complex in Jeungpyeong, Chungcheongbuk-do, and completed a factory for producing cartridges for the rapid molecular diagnostic device "Standard M10." The company explains that the Standard M10 combines the high accuracy of gene amplification (PCR) tests with the speed and convenience of rapid antigen tests. Additionally, they plan to launch continuous glucose monitors in key markets such as Korea, the United States, and Europe starting in 2024. Seegene is also preparing to enter the European market with "syndromic testing," which simultaneously tests for all pathogens that can cause similar symptoms.

Some companies are diversifying diagnostic kits. Suzen Tech received manufacturing approval last month from the Ministry of Food and Drug Safety for a combo rapid diagnostic product that can simultaneously test for COVID-19 and influenza. Suzen Tech explains that this product allows separate diagnosis of two diseases with a single test, which will help infection diagnosis during the "twindemic" (simultaneous outbreak of COVID-19 and influenza). Saliva diagnostic kits that detect COVID-19 infection without nasal swabbing are also entering the market. AMS Bio announced on the 10th that it received product approval from the Ministry of Food and Drug Safety for the COVID saliva PCR kit "A+CheQ." This is the first approval case in Korea for a professional-use PCR kit utilizing saliva.

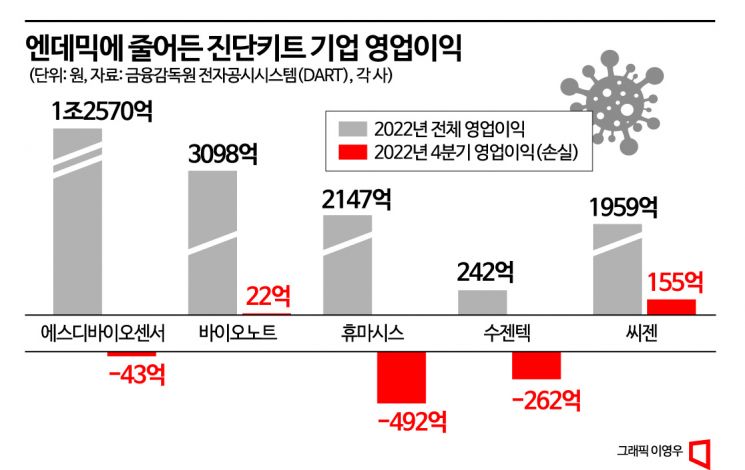

SD Biosensor recorded sales of 2.9284 trillion KRW and operating profit of 1.257 trillion KRW on an annual basis last year. Compared to the previous year, sales decreased by 0.1% and operating profit by 9.4%. Although the annual performance was solid, the company recorded an operating loss of 4.2 billion KRW in the fourth quarter. BioNote, which operates both human and animal diagnostics businesses, posted sales of 479.7 billion KRW and operating profit of 309.8 billion KRW last year. Compared to the previous year, sales decreased by 22.9% and operating profit by 33.9%. Humasis achieved a record high operating profit of 214.7 billion KRW last year but recorded a loss of 49.2 billion KRW in the fourth quarter alone. Suzen Tech also recorded an operating loss during this period, turning to a deficit compared to the previous year. BioNote and Seegene recorded operating profits in the fourth quarter last year, but these fell sharply by 94.9% and 92.2%, respectively, compared to the same period the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.