International credit rating agency Fitch has maintained South Korea's sovereign credit rating at 'AA-/Stable.' It forecasted that this year's economic growth rate will slow to 1.2%, and inflation will fall to 2.0% by the end of the year.

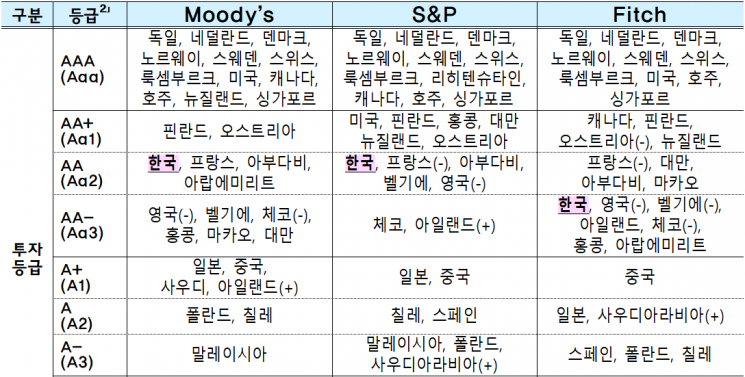

According to the Ministry of Economy and Finance on the 13th, Fitch stated that although South Korea's sovereign credit rating corresponds to AA based on its rating model, it decided on a one-notch lower rating of AA- considering risks related to North Korea.

Fitch analyzed that the growth rate is inevitably slowing this year due to weakened external demand, high interest rates, and inflation. In particular, exports in the first half of the year were sluggish, centered on semiconductors, and the high interest rate level is expected to constrain investment and consumption. While China's reopening will help growth, the positive effect is judged to be limited. However, the growth trend is expected to turn into positive momentum in the second half of this year and rebound to 2.7% in 2024.

Inflation fell to 4.8% last month as domestic price pressures eased, and it is expected to decline further to 2.0%. The policy interest rate is currently maintained at around 3.5%, with a possible 0.5 percentage point cut next year.

Regarding household debt, Fitch expressed concerns that the high burden could weaken consumption. South Korea is one of the countries with the highest household debt-to-GDP ratio globally, with about 80% of it being variable-rate debt. Nevertheless, Fitch evaluated that the possibility of a significant deterioration in asset quality is limited due to strict bank credit screening standards and robust macroprudential policies.

The fiscal deficit-to-GDP forecast was revised down from 2.7% predicted by Fitch last year to 1.0% this year. The national debt ratio is also expected to rise moderately but will improve significantly compared to Fitch's initial forecast. Fitch revised its forecast for national debt-to-GDP from 60% in 2026 to 57.1% in 2027.

Meanwhile, Fitch mentioned that there is a growing possibility of revenue shortfalls against the budget, which may cause the fiscal targets to fall somewhat short.

External soundness is considered sufficient to cope with global uncertainties, given the continuous current account surplus and large net external assets. Considering the slowdown in imports, even if exports are somewhat sluggish, the surplus trend is expected to continue, with the current account balance forecasted at 1.9% of GDP this year.

Although foreign exchange reserves slightly decreased last year, they remain sufficient at 5.9 times the current payment obligations, and reserves are estimated to be replenished this year to reach 6.5 times.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)