Increased Reinvestment Due to Early Redemption of July-August Last Year Issues

Index Funds Expect Up to 8%, Stock Funds Up to 15% Returns

As the KOSPI, which showed a strong upward trend at the beginning of the year, continues to move sluggishly, interest in equity-linked securities (ELS) offering high coupons (returns) in the double digits is growing.

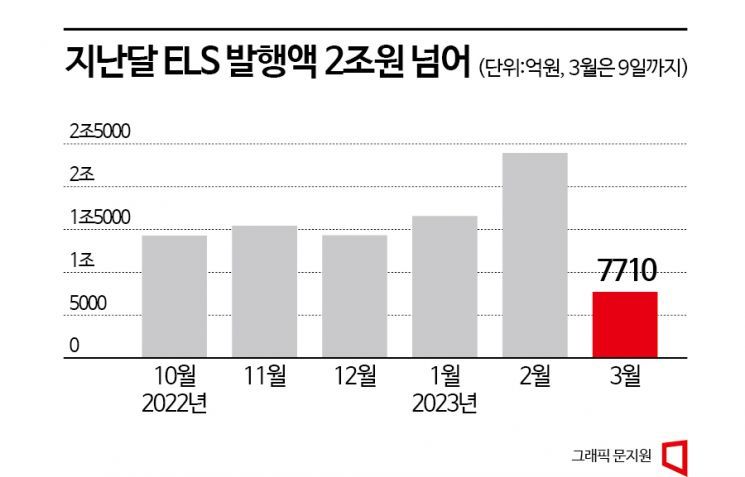

According to the Korea Securities Depository's SaveRo on the 13th, the total issuance volume of ELS in Korean won and foreign currencies last month was 2.3928 trillion won. While the issuance volume had remained in the 1 trillion won range since October last year, it surged to around 2.4 trillion won last month. More than 770 billion won worth of ELS were issued by the 9th of this month. If this issuance trend continues, the issuance volume is expected to remain at last month’s level this month as well.

Since the second half of last year, the issuance volume of ELS sharply contracted. This was due to the strong tightening by the U.S. Federal Reserve (Fed), which led to a continued decline in global indices. As the global indices used as underlying assets dropped sharply, previously issued ELS reached maturity repayment dates in principal loss zones or entered loss zones. Most ELS investments aim for early redemption every 3 to 6 months, but the number of products where early redemption became difficult increased exponentially. Additionally, the ongoing interest rate hike trend further dampened investor sentiment toward ELS.

The mood reversed starting last month. This was because many ELS issued in July and August last year succeeded in early redemption (at 6 months). In terms of the KOSPI, July and August last year were periods when the index fluctuated around the 2300 level, down 20% from the early-year level of 2900 due to the impact of interest rate hikes. Since the index level was lower, the funds from ELS that succeeded in early redemption from last month were reinvested in the market, increasing issuance volume.

The reduced anxiety over index declines also played a key role. Although concerns about interest rate hikes have not completely disappeared, it is expected that even if additional hikes occur, the index will not fall sharply as it did in the second half of last year. Jeong In-ji, a researcher at Yuanta Securities, explained, “Although the index has not confirmed a bottom, the judgment that a sharp decline will not occur is attracting ELS investments. Also, the high coupon yields offered by securities firms compared to other investment products such as bonds or bank deposits are attractive.”

In fact, index-type ELS linked to KOSPI200, Euro Stoxx 50, Nikkei 225, and S&P 500 offer coupon yields of up to 8%. Additionally, stock-type ELS linked to companies such as Samsung Electronics, LG Electronics, LG Chem, and Tesla offer coupon yields approaching 15% per annum. For example, KB Securities’ ‘KB able ELS 2843’ offers an expected annual return of 13% if none of the underlying assets?LG Chem common stock, S&P 500, or Euro Stoxx 50 index?fall below 45% until maturity.

Market experts expect the issuance volume of ELS to gradually increase. As early redemptions become smoother, the amount reinvested in ELS is likely to continue growing, and since the KOSPI is trapped in a box range, the number of investors seeking higher returns is expected to rise. Researcher Jeong In-ji said, “The ELS market moves in line with stock market outlooks, and since a moderate index rise is expected in the second half of the year as the interest rate hike cycle nears its end, investment attractiveness will increase.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)