The Source of OTT Competitiveness is Original Content

The landscape of the online video service (OTT) market is undergoing significant changes. The competition for positions from 2nd to 6th place, excluding the 'unbeatable' Netflix, is fierce. While Tving and Coupang Play have shown remarkable growth, Wavve and Watcha have continued to decline.

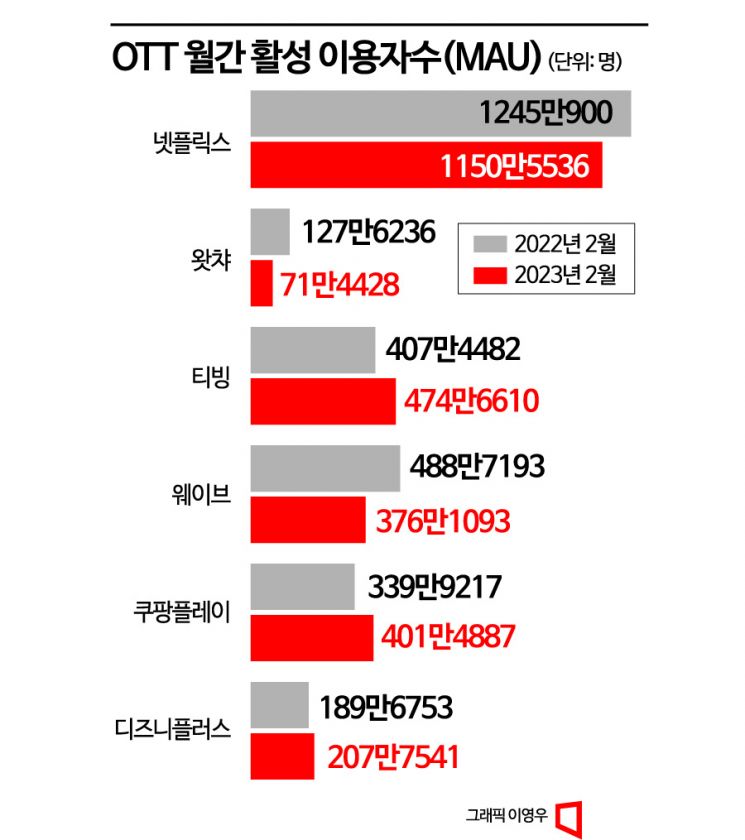

On the 10th, mobile index data from big data platform company IGAWorks revealed that the total monthly active users (MAU) of major domestic OTTs in February was 26,820,095, a decrease of 1,164,686 compared to the same period last year. The OTTs include Netflix, Tving, Wavve, Coupang Play, Disney Plus, and Watcha. During this period, Tving, Coupang Play, and Disney Plus saw an increase in users, while Netflix, Watcha, and Wavve experienced a decline. Tving's user count rose from 4,074,482 to 4,746,610, an increase of 672,128, securing 2nd place. The merger with KT Season and the success of original content such as 'Transit Love 2,' 'Seoul Check-in,' 'Youth MT,' and 'Workaholic City Women' contributed to the user growth.

In the case of Coupang Play, the popularity of 'exclusive live sports broadcasts' and 'SNL Korea Season 3' pushed its user count beyond 4 million. The number of users increased from 3.39 million to 4,014,887, overtaking Wavve to claim 3rd place. Disney Plus, which has been strengthening its investment in original content since last year, also saw an increase from 1,896,753 to 2,077,541 users.

Conversely, Wavve's user count plummeted by over 1 million in one year. The number of users, which was 4,887,193 in February last year, dropped to 3,761,093 last month. Wavve, which was the top domestic OTT, lost its number one spot to Tving in September last year.

Watcha, currently exploring a sale due to financial difficulties, is on a downward trend. Its user count sharply fell from 1,276,236 to 714,428.

Netflix, which maintains the top position, is also experiencing a slowdown in growth. Its user count decreased from 11,509,000 to 11,505,536 compared to the same period last year, a decline of 94,364. While content had a significant impact, it is also analyzed that the mid-roll ads introduced last year contributed to this. Additionally, Netflix's restriction on account sharing, which previously allowed up to four users, has raised concerns about user churn. In fact, a survey conducted by the Korea Press Foundation Media Research Center found that 6 out of 10 Netflix users in Korea said they would stop using the service if they had to pay extra for account sharing. With the endemic phase, OTT usage time is gradually decreasing, leading to expectations that the OTT market growth will slow down.

The source of OTT competitiveness lies in original content that cannot be found elsewhere. The more popular the content, the greater the user lock-in effect, and the more new users are attracted.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)