Last Year China's Beer Import Value Tops $36.44 Million

High Accessibility and Mild Taste Drive Popularity

"When buying imported beer in packs of four at convenience stores, I tend to grab a can of Qingdao each time. I like chicken or fried foods, and they pair well with greasy dishes," said office worker Lee Jeonghwan (35), who often chooses 'Qingdao' for its light and clean taste without any burden. He explained that it is a safe choice as it goes well with various foods and situations.

Last year, the most imported beer in South Korea was found to be Chinese beer. Chinese beer, which has firmly established itself not only in home markets such as convenience stores but also in entertainment markets like restaurants, is increasing its domestic market share by emphasizing a taste that has few dislikes.

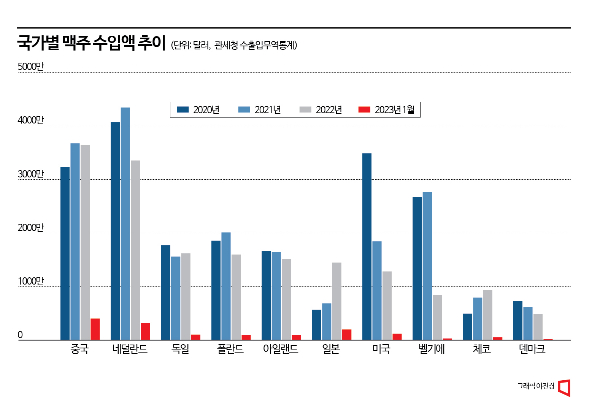

According to customs export-import trade statistics on the 12th, the import value of Chinese beer last year was $36.442 million (about 48.1 billion KRW). This was the highest import value among countries for beer imports last year. Although the import value of Chinese beer decreased by 0.8% from $36.749 million the previous year, it took the top spot as the import value from the Netherlands, which was the leader, decreased more sharply.

The industry views that Chinese beer, represented by Qingdao, is targeting the domestic market by emphasizing high accessibility and an easy-to-drink taste. Chinese beers like Qingdao are distributed evenly across various channels, including large supermarkets, convenience stores for home consumption, and entertainment channels such as Chinese restaurants, thereby increasing accessibility. Qingdao plans to continue strengthening marketing this year to enhance product accessibility. A representative from BeerK, the importer of Qingdao, explained, "We are actively promoting sales to dining establishments and planning various offline events to increase consumer touchpoints."

Along with high accessibility, the easy-to-drink taste is also cited as a reason consumers seek Chinese beer. An industry insider said, "Qingdao is a popular beer that is easy to find and pairs well with various foods. Given the domestic dining market's demand for chicken, fried foods, and spicy dishes, there is a high preference for beers emphasizing refreshing and clean flavors, and Chinese beers like Qingdao seem to be targeting this point well."

On the other hand, the Netherlands, led by 'Heineken,' lost its top position as its import value decreased by 22.7% from $43.43 million in 2021 to $33.54 million last year. During the same period, Belgium's import value also dropped significantly from $27.62 million to $8.48 million, nearly a 70% decrease, due to OB Beer switching 'Hoegaarden' to domestic production.

Other origins of imported beer included Germany (considered the birthplace of beer) with $16.22 million, Poland ($15.99 million) where the French wheat beer 'Kronenbourg 1664 Blanc' is produced, Ireland ($15.13 million), Japan ($14.48 million), the United States ($12.84 million), the Czech Republic ($9.32 million), and Denmark ($4.93 million), among others.

Japan was a country with a notable increase in imports. Last year, the import value of Japanese beer was $14.484 million, a 110.7% increase compared to the previous year. Japanese beer imports, which were $78.3 million in 2018, sharply declined to $39.756 million in 2019 due to the boycott of Japanese products, and further dropped to $5.668 million in 2020. However, it turned to an upward trend afterward, slightly increasing to $6.875 million in 2021 and surpassing the $14 million mark last year, more than doubling. The recovery is expected to continue this year, with January imports reaching $2 million, ranking third after China and the Netherlands.

Meanwhile, the total beer import value continued a recent downward trend, decreasing by more than 10%. Last year, the total beer import value was $195.1 million (about 257.6 billion KRW), down 12.5% from $223.1 million the previous year. Import volume also decreased by 11.3% (29,185 tons) to 228,747 tons. Domestic beer import value has been declining for four consecutive years since peaking at $300.68 million in 2018 after surpassing $200 million in 2017 ($263.09 million). Last year's import value was more than 35% lower than in 2018. This year, January's import value was $16.9 million (about 22.3 billion KRW), down 7.6% from $18.3 million in the same period last year, suggesting a difficult rebound.

Recently, competing imported alcoholic beverages such as whiskey and wine have surged, relatively weakening the momentum of imported beer. Last year, wine imports reached a record high of $581.28 million (about 767.5 billion KRW). For ten consecutive years since 2013, the record for the highest import value has been broken, and compared to $259.27 million in 2019, it more than doubled in three years. During the same period, whiskey imports also increased by 52.2% to $266.84 million (about 352.3 billion KRW) from $175.34 million in 2021. This is the highest level in 15 years since 2007 ($270.29 million).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.