First Increase Since Early April Last Year Excluding Stagnation

Seoul Reduces Decline for 4th Week... Jeonse Sees 'Increase in Inquiries'

Apartment prices in Songpa-gu turned positive for the first time in 11 months, becoming the only district among Seoul's 25 autonomous districts to show an increase. Seoul apartment prices have reduced their decline for four consecutive weeks, centered around the Gangnam 3 districts (Seocho, Gangnam, and Songpa-gu). This is attributed to the depletion of urgent sale properties in highly preferred major complexes despite a strong wait-and-see sentiment.

Urgent sales in Helio City and Jamsil Jugong 5 complexes disappear, prices rise

View of apartments from Lotte World Tower Seoul Sky in Songpa-gu, Seoul / Photo by Jinhyung Kang aymsdream@

View of apartments from Lotte World Tower Seoul Sky in Songpa-gu, Seoul / Photo by Jinhyung Kang aymsdream@

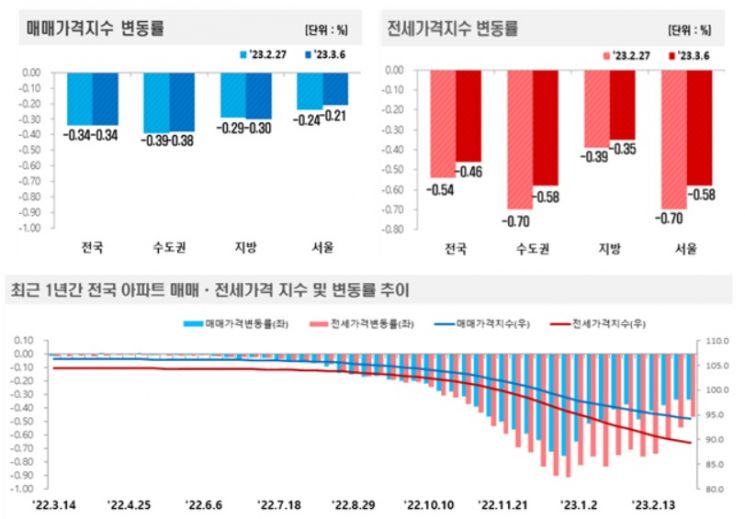

According to the weekly apartment price trend announced by the Korea Real Estate Board on the 9th, Seoul apartment prices fell by 0.21% in the first week of March (as of the 6th), narrowing the decline compared to the previous week (-0.24%).

The Real Estate Board explained, "While transactions continue mainly for urgent sale properties, a mild price increase trend is emerging. However, the wait-and-see attitude among buyers remains due to expectations of further declines, and the gap between buyers' and sellers' desired prices has not narrowed."

By district, only Songpa-gu (0.03%), where urgent sales moved quickly, returned to an increase. Excluding stable prices, this is the first rise in 11 months (48 weeks) since the first week of April last year (0.02%). Prices rose as urgent sale properties in the large complex Helio City, which has a total of 9,510 households, were cleared, and complexes like Jamsil Jugong 5 also sold at prices higher than previous transactions.

According to the Ministry of Land, Infrastructure and Transport's real transaction price disclosure system, an 84㎡ unit in Helio City was traded for 1.89 billion KRW on the 23rd of last month. Although this does not reach the highest price of 2.38 billion KRW in September 2021, it increased by 360 million KRW compared to the first transaction price this year (1.53 billion KRW). The transaction volume totaled 64 cases in January and February this year, approaching last year's annual transaction volume of 71 cases. A 82.61㎡ unit in Jugong 5 complex also changed hands for 2.576 billion KRW on the 28th of last month, about 400 million KRW higher than the lowest price in January (2.175 billion KRW). This was the highest price since September 16 last year (2.676 billion KRW).

Among the Gangnam 3 districts, Seocho-gu and Gangnam-gu also reduced their decline, falling by 0.01% and 0.10% respectively. Following last week, the southeastern region, which includes the Gangnam 3 districts and Gangdong-gu (-0.15%), recorded the lowest decline rate at 0.05%.

Elsewhere, Dongjak-gu (-0.14%), Seongbuk-gu (-0.17%), Nowon-gu (-0.18%), Seongdong and Eunpyeong-gu (each -0.19%), and Mapo-gu (-0.20%) showed smaller declines than the Seoul average. On the other hand, Jongno and Yongsan-gu (each -0.23%), Jungnang-gu (-0.24%), Dongdaemun-gu (-0.31%), Gwanak-gu (-0.33%), and Dobong-gu (-0.39%) saw their declines widen compared to the previous week due to reasons such as inventory accumulation.

Amid this atmosphere, Seoul apartment transaction volume recorded the highest level in 16 months. According to the Seoul Real Estate Information Plaza, the transaction volume last month (based on contract date) was 1,845 cases, the highest since October 2021 (2,198 cases). Considering the remaining reporting period, the transaction volume is expected to increase further.

Decline widens in Gyeonggi and five major metropolitan cities... Jeonse inquiries "slightly increase"

Gyeonggi (-0.49%) saw a wider decline compared to the previous week. In Suji-gu, Yongin (-0.87%), prices fell mainly in Pungdeokcheon, Dongcheon, and Jukjeon-dong, while in Siheung (-0.72%), prices dropped in large complexes in Baegot, Jeongwang, and Eunhaeng-dong. Incheon (-0.36%) showed the same decline for three consecutive weeks. Seo-gu (-0.58%) saw notable declines in Wondang, Dangha, and Cheongna-dong, and Jung-gu (-0.45%) experienced declines mainly in Jung-san, Unnam, and Unseo-dong, which include Yeongjong Sky City, all heavily influenced by accumulated supply.

The five major metropolitan cities in the provinces also fell by 0.42%, with the decline widening compared to the previous week. Except for Daegu (-0.43%), Busan (-0.46%), Gwangju (-0.27%), Daejeon (-0.44%), and Ulsan (-0.42%) all saw increased declines. Sejong fell by 0.30%.

Apartment jeonse (long-term lease) prices nationwide fell by 0.46%, with the decline slowing. Among the 17 cities and provinces, seven areas including Seoul (-0.58%), Gyeonggi (-0.60%), Incheon (-0.52%), Busan (-0.49%), Daegu (-0.63%), Daejeon (-0.49%), and Ulsan (-0.67%) saw jeonse prices fall more than the national average.

The Real Estate Board stated, "In Seoul, although transactions at lower prices are occurring due to concerns about prolonged inventory accumulation influenced by regional supply volumes, additional decline contracts are gradually decreasing, and jeonse inquiries are slightly increasing after urgent sale properties are depleted."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.