Expected Beneficiaries Including Hugel, Daewoong Pharmaceutical, JC's Medical, and Lutronic

Seasonal Peak, Economic Activity Resumption in China with High Interest in K-Beauty

Amid waning interest in bio stocks due to the 'reopening (resumption of economic activities),' there are bio stocks quietly thriving, drawing attention. While vaccine-related stocks that performed well during the COVID-19 pandemic are fading, medical and beauty device stocks within the bio sector are receiving positive outlooks from the securities industry, attracting investor interest. The seasonal peak and the reopening of major countries, including China, which has a strong interest in K-Beauty, are also expected to act as favorable factors.

According to the Korea Exchange on the 9th, the KRX Healthcare Index fell by 0.48% from January 2 to March 8 this year. This contrasts with most indices, which recorded average gains in the double digits during the same period.

The sluggishness of the KRX Healthcare Index is attributed to the poor performance of large-cap bio stocks, which were beneficiaries of COVID-19. During this period, Samsung Biologics recorded -4.99%, SK Bioscience -4.08%, and SK Biopharm -13.31%. These companies experienced rapid growth through contract manufacturing organization (CMO) services for COVID-19-related pharmaceuticals, but with China? which had been the last to keep its borders closed?also reopening, it is now considered difficult to expect further benefits from COVID-19.

Despite the poor performance of large-cap bio stocks, medical and beauty device-related stocks have welcomed a springtime boost thanks to the reopening. Structural growth driven by high re-treatment rates, expected expansion of exports to overseas markets that have yet to fully bloom, along with the seasonal peak and the reopening of major countries including China, which has strong interest in K-Beauty, are analyzed to be positive factors.

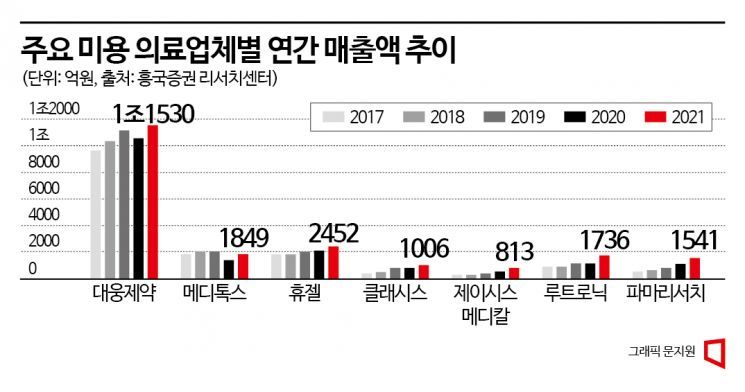

According to Samsung Securities Research Center, botulinum toxin (BTX) has been growing at an average annual rate of 10%. BTX is the most popular cosmetic procedure, commonly known as 'Botox.' The performance of medical and beauty device companies also supports this. Excluding Daewoong Pharmaceutical, which includes prescription drug sales, the sales of BTX and medical and beauty device companies have shown an upward trend except for 2020. The slight decrease or similar sales in 2020 is analyzed to be due to the global shutdown rather than a decline in demand for cosmetic procedures.

High re-treatment rates also raise investor expectations for bio stocks related to medical and beauty devices. According to Heungkuk Securities Research Center, while the number of plastic surgeries decreased by 10.9% from 2019 to 2020, non-invasive procedures (such as Botox, fillers, and lifting) increased despite the impact of COVID-19. Growth rates were 7.6% in 2019, 5.7% in 2020, and 19.9% in 2021, showing significant growth thanks to revenge consumption. In particular, facial lifting recorded a growth rate of 13.9%.

Researcher Inakyung from Heungkuk Securities said, "We recommend JCY Medical and Lutronic as top picks among medical beauty device stocks, and Clasis and ViOL as stocks of interest," adding, "Especially with China's reopening and the crackdown by Chinese authorities on unauthorized distribution mainly by daigou, our companies are expected to see increased sales in China."

Researcher Jeonghyun Kim from Kyobo Securities said, "With China easing COVID-19 prevention measures, companies that produce fillers and other products within the pharmaceutical bio sector and have prepared for business expansion in China are expected to benefit," adding, "Hugel, Daewoong Pharmaceutical, Bioplus, and Humedics, which have officially launched beauty products in China, are considered representative beneficiaries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)