June Launch, Monthly Payment of 700,000 KRW, Interest Rate Under Bank Negotiation

5-Year Term with Preferential Rates for Low-Income Groups

Government Support Reduced from Tens of Thousands to 20,000 KRW per Month Compared to Previous Yoon Pledge

One of President Yoon Suk-yeol's national agenda items, the 'Youth Leap Account,' will be launched in June. It is a product where up to 700,000 KRW per month can be deposited for a maturity period of 5 years, accumulating up to 50 million KRW. The interest rate will be announced once consultations with banks are completed; a fixed interest rate will apply for the first 3 years after enrollment, followed by a variable interest rate for the next 2 years. Government subsidies will also be provided based on individual income, with a maximum support amount of 24,000 KRW per month per person. Kim So-young, Vice Chairman of the Financial Services Commission, announced this during the mid-term presentation of the Youth Leap Account operation direction on the 8th.

The eligibility criteria include youths aged 19 to 34, with government contributions and tax exemptions applied based on individual income: 'Government contributions and tax exemptions apply for total annual salary up to 60 million KRW,' and 'Only tax exemptions apply without government contributions for total annual salary between 60 million and 75 million KRW.' Based on household income, the applicant must meet 'below 180% of the median income.' However, those who have been subject to comprehensive financial income taxation at least once in the past three years (where the sum of interest and dividend income exceeds 20 million KRW) are restricted from enrolling.

The basic interest rate structure of the Youth Leap Account product is planned to apply a fixed interest rate for the first 3 years after enrollment, followed by a variable interest rate for the next 2 years. There are plans to negotiate with banks to also offer products with fixed interest rates exceeding 3 years.

For low-income youths with an annual income of 24 million KRW or less, a preferential interest rate of around 0.5% is also under discussion. Vice Chairman Kim explained, "The final maturity amount will be paid as the sum of the individual's deposits, government contributions, and accrued interest, with tax exemption benefits applied to the interest income."

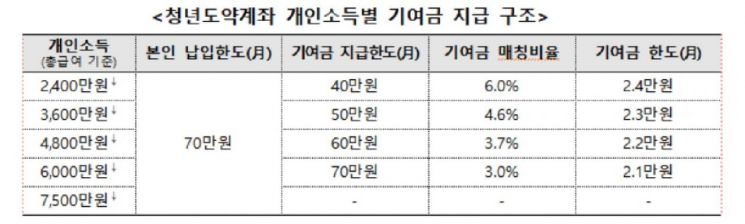

The government subsidy is capped at around 20,000 KRW. Government contributions can be received based on individual income levels and the amount deposited by the individual. For example, if a youth with an annual income of 24 million KRW or less deposits 400,000 KRW monthly, the government sets the contribution matching rate at 6%, adding 24,000 KRW monthly to the deposit amount. For incomes up to 36 million KRW, 20,300 KRW is supported; up to 48 million KRW, 22,000 KRW; and up to 60 million KRW, 21,000 KRW respectively.

The government subsidy portion has been reduced compared to the pledge announced by President Yoon Suk-yeol during his candidacy. For those with an annual income of 24 million KRW or less, the fixed government contribution limit was 200,000 KRW, and the savings-proportional government contribution limit was also 200,000 KRW. If an individual deposited 300,000 KRW monthly, the government would support a total of 400,000 KRW, allowing a monthly accumulation of 700,000 KRW.

Vice Chairman Kim stated, "Although the government contribution is reduced compared to the original pledge, we will ensure that benefits reach more youths within the limited budget." The Financial Services Commission plans to update individual income annually from the enrollment date to adjust the eligibility and amount of government contributions.

Overlapping enrollment with welfare products is also possible. For low-income youths, simultaneous enrollment is allowed with welfare products such as the Youth Tomorrow Savings Account, Youth (Employed) Tomorrow Filling Deduction, local government products, and employment support products for youths working in small and medium-sized enterprises. The Youth Hope Savings, launched last year, will allow sequential enrollment into the Youth Leap Account after maturity.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)