Kakao's Public Buyout at 150,000 KRW with Market Cap of 3.5 Trillion KRW

SM's Stock Price Surges but PER Lower Than Competing Entertainment Stocks

Market Cap Expected to Reach About 4 Trillion KRW... Dramatic Agreement Could Trigger Sharp Stock Drop

Attention is focused on how HYBE will respond to Kakao's surprise tender offer announcement to purchase shares of SM Entertainment (SM) at 150,000 KRW per share. The market sees a significant possibility that HYBE will raise the tender offer price in response. However, the prevailing analysis is that it will be difficult to exceed 160,000 KRW per share considering SM's valuation.

According to the Korea Exchange on the 8th, SM's stock price closed at 149,700 KRW, up 15.07% (19,600 KRW) from the previous day. As a result, the market capitalization increased to 3.5644 trillion KRW. The stock price surged after Kakao announced its intention to make a tender offer to SM shareholders at 150,000 KRW per share.

Accordingly, there is speculation that HYBE may counter the tender offer. This is because among major domestic entertainment companies, SM's current price-to-earnings ratio (PER) is lower than the forecast.

PER is an indicator obtained by dividing the current stock price by earnings per share. It estimates the profit a company earns per share of stock. Generally, a PER of 10 or less is interpreted as undervaluation of corporate value, while 100 or more is considered overvaluation.

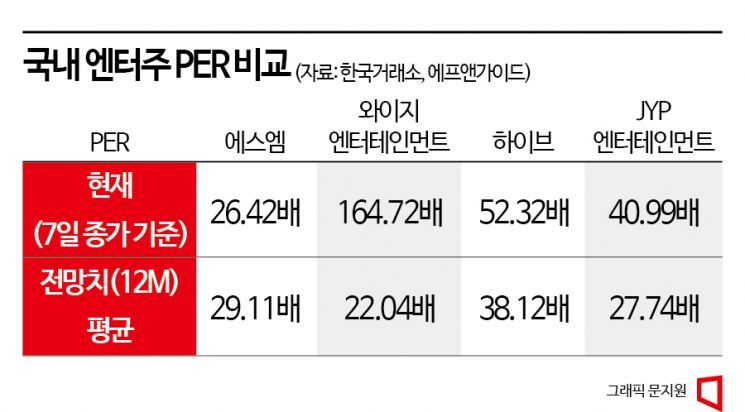

The average PER forecast for the four major domestic entertainment companies (HYBE, SM, YG Entertainment, and JYP Entertainment) is 29.25 times. Despite SM's stock price soaring 99.0% from the beginning of the year (75,200 KRW) due to management disputes, its current PER remains at about 26.42 times.

Comparing the PER based on the closing price on this day with competitors clearly shows SM's stock price level. It is far below YG Entertainment (164.72 times), HYBE (52.32 times), and JYP Entertainment (40.99 times).

The PER forecasts by securities firms are 29.11 times for SM, 22.04 times for YG Entertainment, 38.12 times for HYBE, and 27.74 times for JYP Entertainment, respectively.

An executive at an asset management firm explained, "When forecasting PER, the leading stocks in the same industry are used as a benchmark, but SM's PER is significantly lower than its competitors. Since SM's own PER forecast is about 30 times, considering a management premium, it can be valued up to a multiple of 40 times."

According to FnGuide, SM's operating profit in 2022 is estimated at 133.5 billion KRW. Applying a multiple of 40 times results in a market capitalization of about 4 trillion KRW. This means it could be valued slightly higher than Kakao's proposed tender offer price of 150,000 KRW per share (market capitalization of about 3.5 trillion KRW).

Considering the current shareholding structure between Kakao and HYBE, the speculation about HYBE countering the tender offer gains weight. On the previous day, SM announced, "Following the court's injunction approval, the contract for new shares and convertible bonds issuance with Kakao has been canceled." This is because the court approved an injunction on March 3rd prohibiting Kakao from issuing new shares and convertible bonds.

Accordingly, HYBE holds an advantage in the shareholding battle, owning 14.8% of shares from former chief producer Lee Soo-man. Currently, HYBE has acquired 0.98% through the tender offer, bringing its total to 15.78%.

An accounting expert analyzed, "Even if HYBE wins the voting rights competition and controls the board, if Kakao's tender offer equalizes the shareholding ratio, the dispute will persist. Also, from HYBE's perspective, there is concern that if SM teams up with Kakao to strengthen fandom, it will become a strong competitor, so HYBE is likely to respond to the tender offer."

However, the consensus is that even if HYBE responds to the tender offer, it will be difficult to continuously drive up the stock price. The market values SM at a maximum of about 4 trillion KRW (market capitalization). Individual investors need to approach cautiously. Although stock prices can be overvalued during mergers and acquisitions (M&A), unexpected outcomes such as sharp rises followed by steep declines can occur, so there is significant risk if individual investors chase the stock excessively.

A head of equities at a major asset management firm emphasized, "Since HYBE and Kakao have different purposes and synergy effects for acquiring SM, HYBE may counter the tender offer, but both sides will inevitably suffer losses in terms of reputation and costs, so a dramatic agreement is also possible. The current stock price surged due to M&A issues, so if that happens, a sharp decline in stock price is also likely."

An entertainment analyst at a securities firm drew a line, saying, "The multiple of 40 times is evaluated considering synergy effects after acquisition by Kakao or HYBE, but such M&A synergy effects should be evaluated with concrete plans after seeing the final results. Since the M&A issue could unfold in any direction, discussing tender offer responses and forecasting stock prices is premature."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)