ARM, a UK semiconductor design (fabless) company and a subsidiary of Japan's SoftBank, which is pursuing a sole listing on the US stock market, has selected lead underwriters and begun the formal listing process. ARM is expected to raise at least $8 billion (approximately 10.38 trillion KRW) through this listing.

On the 5th (local time), major foreign media outlets reported, citing sources, that SoftBank and ARM have jointly selected Goldman Sachs, JP Morgan, Barclays, and Mizuho Financial Group as joint lead underwriters and have started discussions on the listing review application and subsequent schedules.

ARM is expected to submit documents for its initial public offering (IPO) confidentially by the end of next month. The listing is anticipated to take place within this year, with the exact timing to be determined based on market conditions, according to sources.

Previously, SoftBank and ARM, which had considered a simultaneous listing on both the US and UK stock markets, recently announced through a statement that they will pursue a sole listing in the US. On the 2nd, Rene Haas, ARM’s CEO, stated in a release, "We have decided that pursuing a listing solely in the US this year is the best path for the company and its shareholders."

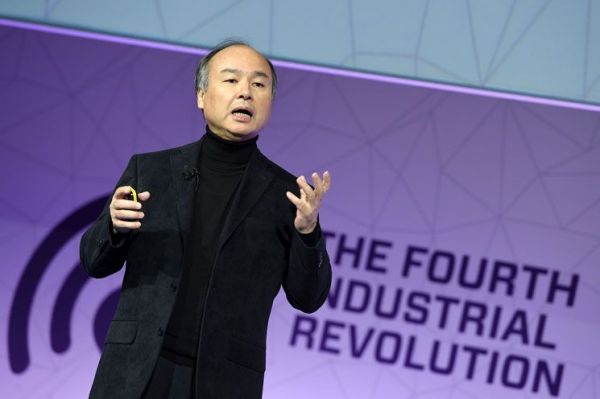

The sole US listing is said to strongly reflect the intentions of SoftBank Chairman Masayoshi Son. Chairman Son believes that the US stock market has a more solid investor base and is more favorable for achieving a higher corporate valuation compared to the UK market.

Headquartered in Cambridge, UK, ARM holds core technologies in semiconductor design that serve as the ‘brain’ of IT devices such as PC central processing units (CPUs) and smartphone application processors (APs). SoftBank acquired ARM in 2016 for $32 billion (approximately 41.6 trillion KRW).

In September 2020, SoftBank attempted to sell ARM to US semiconductor company Nvidia for $40 billion. Nvidia was eager to acquire ARM to strengthen its server CPU development capabilities and expand its artificial intelligence ecosystem, but the deal was ultimately blocked by regulatory authorities citing concerns over 'neutrality impairment.'

Subsequently, Intel, Qualcomm, SK Hynix, and others expressed interest in participating in a consortium to acquire ARM, but the deal did not materialize. After failing to sell ARM, SoftBank ultimately shifted its exit strategy to an IPO.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.