Acceptance Rate of 53 Savings Banks at 35.9%

Card and Insurance Companies Around 40-50% Range

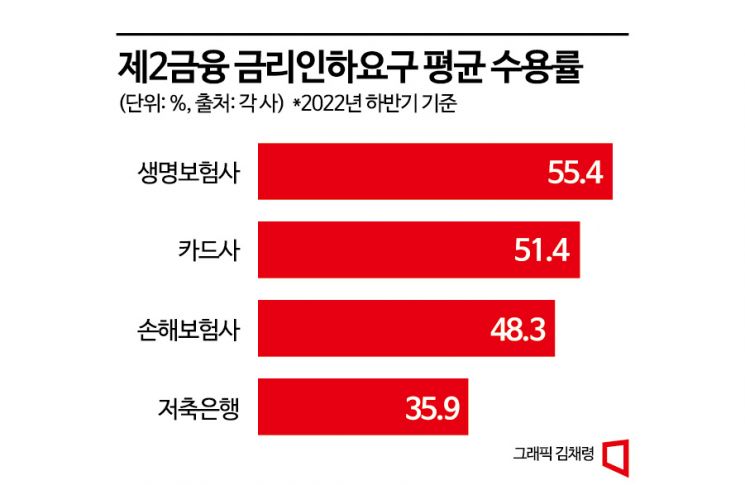

It has been revealed that only about half of the requests for interest rate reductions in the secondary financial sector, including insurance, credit cards, and savings banks, were accepted. In particular, in savings banks, on average, only one out of three loan interest rate reduction requests was approved.

According to the Korea Federation of Savings Banks on the 3rd, the acceptance rate of interest rate reduction requests at 53 savings banks in the second half of last year was 35.9%. The right to request an interest rate reduction allows financial consumers to ask banks to lower interest rates based on reasons such as employment, promotion, or income increase. Although this is a slight improvement compared to 34.5% in the first half of the same year, it is still considered a low level.

There were a total of 52,033 interest rate reduction requests submitted by borrowers at savings banks, but only 18,694 were accepted. The interest reduced through these requests amounted to 2.782 billion KRW. Among savings banks, SBI Savings Bank, which ranks first in asset size in the industry, recorded an acceptance rate of 66.3%. In contrast, OK Savings Bank, ranked second, had an acceptance rate of 23.8%, below the industry average. Korea Investment Savings Bank, ranked third, had a single-digit acceptance rate of 9.9%. IBK Savings Bank (1.23%) and KB Savings Bank (9.6%) also showed low acceptance rates. An industry insider from the savings bank sector explained, "Some borrowers already have loan interest rates at the lowest possible level, and unlike insurance consumers or borrowers from commercial banks, there are relatively many medium to low credit borrowers with limited financial capacity, which causes differences in acceptance rates."

Meanwhile, the average acceptance rates for credit card companies and insurance companies were also in the 40-50% range. A total of 185,900 requests were submitted, and 96,236 were accepted. The total amount of interest reduced was around 4 billion KRW. By sector, life insurance companies had the highest acceptance rate at 55.4%, followed by credit card companies (51.4%) and non-life insurance companies (48.3%). However, the amount of interest reduced through accepted requests was largest for credit card companies at 2.89 billion KRW. Life insurance and non-life insurance companies reduced interest by 780 million KRW and 330 million KRW, respectively.

The company with the lowest acceptance rate for interest rate reduction requests in the credit card and insurance industries was BC Card at 16.29%. Among non-life insurers, Hanwha General Insurance had the lowest acceptance rate at 41.4%. Among life insurers, Dongyang Life Insurance was identified as the lowest with 27.6%.

Meanwhile, the average acceptance rate of interest rate reduction requests at the five major commercial banks?KB Kookmin, Shinhan, Hana, and NH Nonghyup?was 36.2%. When expanding the scope to all commercial banks, the average acceptance rate drops further to 30.7%. A commercial bank official stated, "Borrowers at commercial banks often receive loans with the lowest possible interest rates at the time of the initial loan, and the reduction in interest rates due to credit rating upgrades is smaller for higher (grades 1-3) than for middle to lower (grades 4-10) grades, which results in a lower acceptance rate. We will do our best to alleviate the loan concerns of ordinary people during the high-interest period."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)