1.5 Trillion KRW Demand Forecast Attracts 2.19 Trillion KRW

No Additional Allocation to Institutions Participating at High Interest Rates

[Asia Economy Reporter Lim Jeong-su] GS Construction is facing controversy for deciding to issue bonds with a lower-than-market interest rate by bypassing the price determination principles of the corporate bond market. The company is accused of abusing its dominant position to force investors to accept interest rates lower than those determined during the bidding (demand forecasting) process. Institutional investors who participated in the demand forecast are inevitably suffering losses. Critics warn that if such irregularities spread, the price determination principles of the corporate bond market will collapse, causing various problems. Responsibility is also being questioned for NH Investment & Securities, the lead manager.

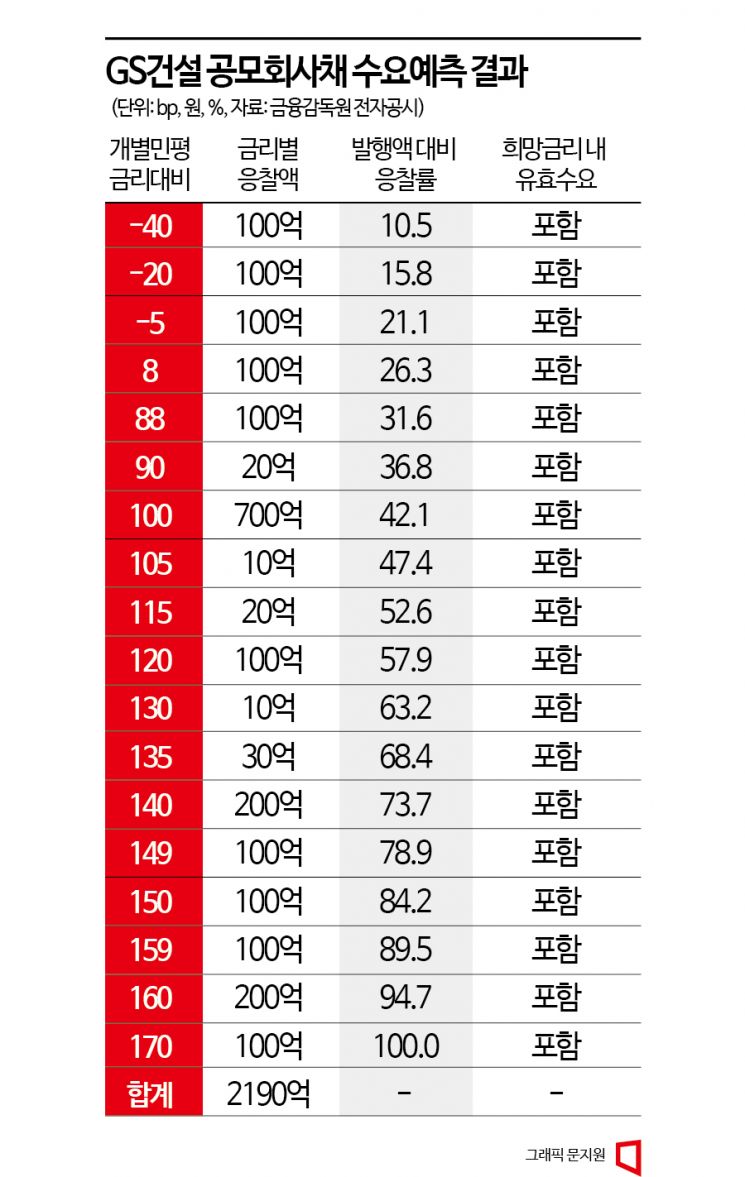

According to the investment banking (IB) industry on the 28th, GS Construction decided to issue 150 billion KRW worth of 2-year maturity corporate bonds and conducted demand forecasting targeting institutional investors over two days last week. The desired interest rate was presented as a range from -30 basis points (bp, 1bp=0.01%) to +170bp compared to the GS Construction corporate bond rate (individual private average rate) evaluated by a private bond rating agency. The company announced that if investment demand exceeding 150 billion KRW is gathered within the desired interest rate band, it plans to increase the issuance up to 300 billion KRW.

The bidding results were relatively favorable. Despite the construction sector being out of favor in the recent corporate bond market, investment applications totaling 219 billion KRW were received within the desired interest rate band. This was attributed to GS Construction being a major builder with the country’s top apartment brand ‘Xi’ and having relatively lower risks such as unsold units compared to other construction companies. The investment demand was sufficient to allow for an increased issuance.

The problem arose during the process of finalizing the issuance amount and interest rate after the demand forecast ended. GS Construction decided to increase the corporate bond issuance to 250 billion KRW based on the demand forecast results. Since the valid demand within the desired interest rate band was 219 billion KRW, issuing more bonds than this amount would require setting the issuance interest rate at the highest point of the desired band, which is individual private average +170bp. The cumulative demand exceeding 2.09 trillion KRW corresponds to +170bp.

However, GS Construction fixed the issuance interest rate at +140bp, the point where cumulative demand reached 150 billion KRW. This final rate is 30bp lower than the highest point of the desired interest rate band. In other words, while increasing the issuance amount, the company refused to raise the interest rate accordingly.

Although GS Construction lowered its funding cost, institutional investors inevitably suffered interest losses. Under normal procedures, investors should have received interest about 30bp higher than the fixed rate, but this did not materialize. An IB industry official said, "GS Construction ignored the corporate bond market’s price determination principles by not allocating increased issuance volumes to some institutions that participated in the demand forecast at higher interest rates to lower the issuance rate," adding, "This is a case that undermines the price (interest rate) determination principles during public corporate bond issuance."

Concerns Over Issuer ‘Gapjil’ Expansion... Responsibility of Lead Manager

If the behavior of corporate bond issuers like this incident is tolerated, concerns are growing that more companies will try to lower their bond issuance interest rates through such irregular methods.

A securities firm bond (DCM) market official said, "Companies will demand to lower corporate bond funding costs using methods like GS Construction," adding, "If securities firms that do not comply with such demands are excluded from underwriting or managing bond issuance, ‘adverse selection’ will occur where securities firms that uphold principles suffer losses." He continued, "If similar cases repeat, the market price determination principles will be completely destroyed."

The securities industry has devoted considerable effort since 2012 to reduce unfair practices by establishing the ‘Demand Forecast Best Practices’ for IPO pricing or corporate bond interest rate determination during public securities issuance. According to these guidelines, valid demand within the interest rate band after corporate bond demand forecasting should not be excluded from bond allocation simply because the requested interest rate is high. The purpose is to ensure that the corporate bond issuer follows market principles when deciding bond interest rates. However, this is an industry self-regulation, and there are few enforceable sanctions for violations.

Therefore, responsibility is also being raised for NH Investment & Securities, the lead manager of GS Construction’s corporate bond issuance. NH Investment & Securities is one of the top securities firms in the domestic IB industry, well aware of the demand forecast best practices and one of the firms actively involved in introducing the demand forecast system. A bond market official criticized, "It is an act of undermining the fair market process and breaking the best practices voluntarily established to increase corporate bond underwriting performance by tolerating unfair practices to meet corporate demands."

An executive in charge of DCM at a major securities firm pointed out, "Violating the demand forecast principles established through years of industry effort is tantamount to returning to the past of cutthroat competition," adding, "Such destruction of principles, rarely seen in the past decade, could taint the entire market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.