Bitcoin Price Recovers to $25,000 Range

Related Stocks and ETFs Rise... MicroStrategy Up 102%

[Asia Economy Reporter Lee Jung-yoon] As the prices of virtual assets such as Bitcoin show an upward trend, the coin market is reviving. Accordingly, virtual asset-related stocks have also risen sharply, attracting investors' attention.

According to the global virtual asset market status relay site CoinMarketCap on the 21st, as of 4:11 PM, the price of Bitcoin was recorded at $25,014 (approximately 32.43 million KRW), up 2.08% from the previous day. Bitcoin prices have continued their upward trend, rising nearly 15% over the past week. In particular, a sharp rise began on the 12th of last month, with a surge of more than 10% in a single day on the 14th of the same month. On this day, by surpassing $25,000, it recovered to the level of June last year.

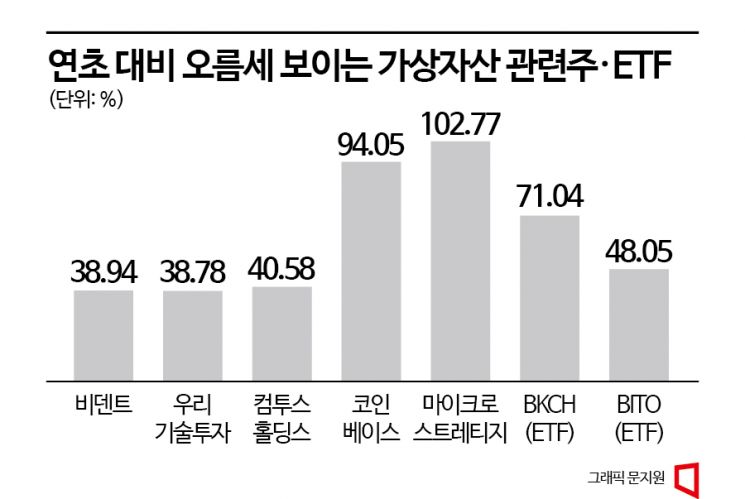

As the virtual asset market revives, related stocks are also on the rise. On this day, the stock price of Bident surged 38.94% compared to the beginning of the year. Bident holds a 34.2% stake in Bithumb Holdings, the major shareholder of Bithumb Korea, which operates the domestic virtual asset exchange Bithumb. Woori Technology Investment, which holds a 7.24% stake in Dunamu, the operator of Upbit, the number one domestic exchange, also saw its stock price rise 38.78% during the same period. The stock price of Com2uS Holdings, the second-largest shareholder of another exchange Coinone, remained at 37,700 KRW at the beginning of this year but recorded 53,000 KRW as of the closing price on the 21st, rising 40.58%.

Not only domestically but also overseas related stocks are on the rise. The stock price of Coinbase, a US virtual asset exchange, rose more than 94% compared to the beginning of the year as of the 17th (local time), and MicroStrategy, a US software developer known as a 'big player' for holding a large amount of Bitcoin, also rose more than 102% during the same period. Virtual asset-related exchange-traded funds (ETFs) are also showing favorable returns. The Global X Blockchain ETF (BKCH), which invests in virtual asset-related companies, rose 71.04%, and the ProShares Bitcoin Strategy ETF (BITO), a Bitcoin futures ETF, also rose 48.05%.

The reason why virtual asset prices and related stock prices have risen like this is due to expectations of the US Federal Reserve (Fed) slowing the pace of interest rate hikes. In addition, regulatory actions by US authorities have acted as positive factors. The New York Department of Financial Services (NYDFS) ordered Paxos, which issues the stablecoin BUSD for Binance, the world's number one virtual asset exchange, to stop issuance. The US Securities and Exchange Commission (SEC) also imposed sanctions on Kraken, the world's third-largest virtual asset exchange, for its staking service. Typically, such sanctions cause investment sentiment in the virtual asset market to shrink, but as analyses suggest they help reduce uncertainty, coin prices are also showing stability.

Lee Mi-seon, head of the Bithumb Research Center, explained, "It seems to be a point close to the end of the interest rate hikes, so we judge that the macro conditions have improved further," adding, "As the market experienced issues such as the global exchange FTX bankruptcy, factors that could be problematic have surfaced, reducing uncertainty." She continued, "Legislative efforts related to virtual assets in countries such as the US are also positively affecting market participation conditions, including infrastructure development," and added, "These factors are being reflected in the prices of virtual assets, related stocks, and ETF returns."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.