Planned Liquor Tax Increase from April 1

Muhak Stock Rises 16% in One Month

[Asia Economy Reporter Son Sunhee] Shares related to alcoholic beverages are fluctuating ahead of price increases for soju and beer. This is interpreted as reflecting expectations of price hikes following the government's announcement of an increase in liquor tax starting April 1.

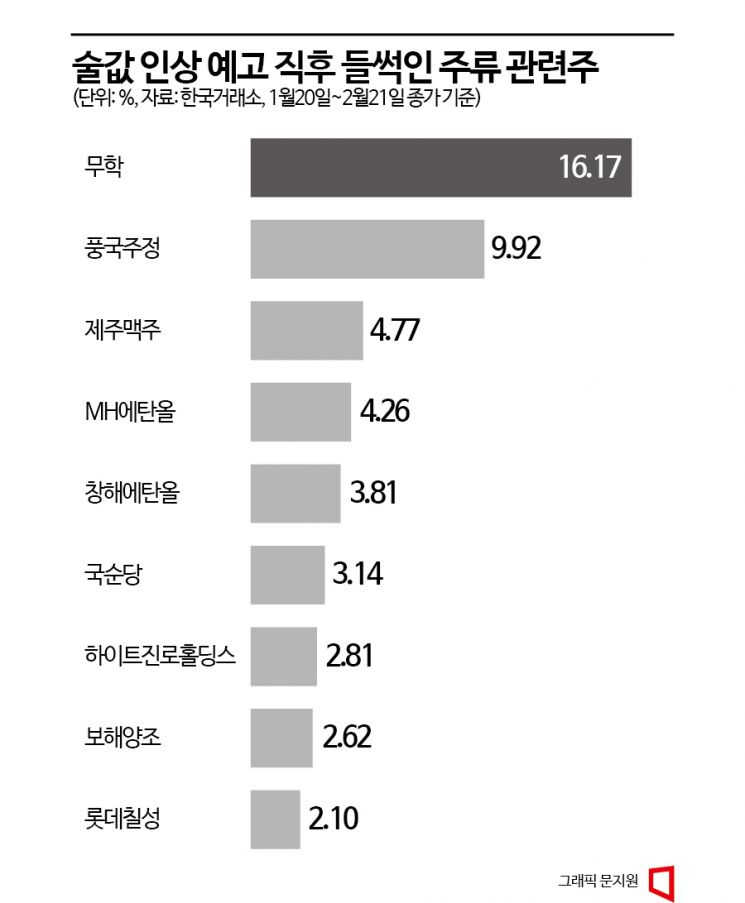

According to the Korea Exchange on the 22nd, stock prices of liquor raw material production and manufacturing companies listed on the stock market have all risen over the past month (based on closing prices from January 20 to February 20). The company with the largest stock price increase was Muhak, which produces soju brands like "Joeun Day" and plum wine "Maesil Maeul," closing at 5,820 won the previous day, up 16.17% over the past month. The stock price of Pungkuk Soju, which produces ethanol, a main raw material for various alcoholic beverages, also closed at 13,740 won the previous day, rising 9.92% during the same period.

Chungha Ethanol and Jeju Beer saw their stock prices surge more than 20% intraday on the 20th, when more detailed plans for the liquor tax increase were announced. Jeju Beer closed at 1,582 won, up 4.77% over the past month, and Chungha Ethanol closed at 11,160 won, up 3.81%. Kooksoondang, which mainly produces traditional liquors subject to liquor tax reductions, also saw its stock price rise 3.14% accordingly.

Strictly speaking, what the government announced was not a direct increase in liquor prices but an increase in taxes imposed on alcoholic beverages. According to the revised Liquor Tax Act Enforcement Decree announced by the Ministry of Economy and Finance on the 18th of last month, starting April 1, the tax rate on beer will increase by 30.5 won per liter to 885.7 won, and on takju (unfiltered rice wine) by 1.5 won to 44.4 won. However, based on past cases, liquor tax hikes have inevitably led to consumer price increases by liquor companies, so this time is unlikely to be an exception.

Unlike beer, which is taxed based on volume (specific taxation), soju adopts a specific tax system based on price. Therefore, soju is excluded from this liquor tax increase. However, soju is also under strong pressure to raise wholesale prices due to increases in raw materials such as ethanol and soju bottle supply costs. The industry expects that soju prices will also rise alongside beer and other alcoholic beverages during the price increase period.

Price increases in alcoholic beverages are perceived as factors improving profitability for related companies, so they are expected to act as positive factors for stock prices. Moreover, the liquor industry, which suffered significant sales damage during the COVID-19 pandemic due to restrictions on outdoor activities, has been gradually recovering since last year and is currently experiencing an upward trend in performance.

However, in the ongoing high inflation environment since last year, repeatedly raising prices of alcoholic beverages, one of the representative consumer products for ordinary people, is also a burden for related companies. Jiwoo Oh, a researcher at Ebest Investment & Securities, said, "Considering that there was a price increase last year (soju in February, beer in March), they are likely to respond comprehensively by taking into account the related market conditions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.