Counterpoint Research "System Sector Weak Outlook for First Half"

Qualcomm, Intel, and TSMC All Expected to See 1Q Revenue Decline

Samsung Electronics and DB HiTek Also Unavoidably Affected by Market Impact

[Asia Economy Reporter Kim Pyeonghwa] The system semiconductor market is freezing amid the economic downturn. Although it was a market relatively less affected by the economy, it is struggling as an unprecedented recession hits. Both fabless (semiconductor design) and foundry (semiconductor contract manufacturing) domestic and international system companies are seeing reduced performance early this year.

Market research firm Counterpoint Research released a report last week on the performance of Qualcomm, the number one mobile application processor (AP) company. It analyzed that "the fabless semiconductor industry experienced sluggish sales in Q4 last year due to the global macroeconomic downturn." It also added that "the first half of this year is expected to remain weak."

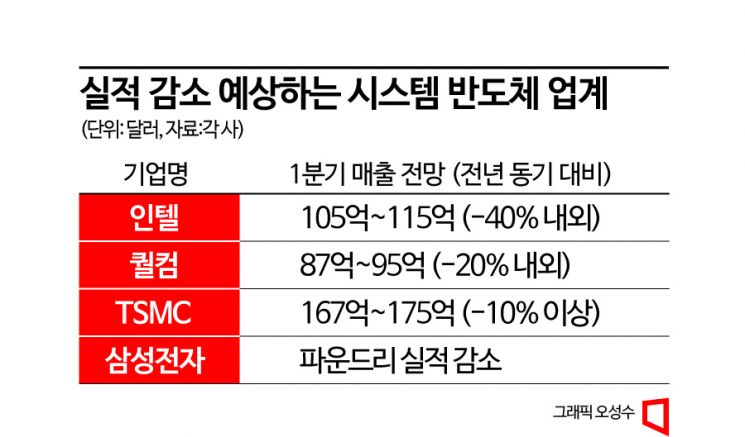

Qualcomm recently reported Q1 (October to December 2022) revenue of $9.5 billion, down 12% from the same period last year. Business weakness is expected to continue into the first half of the year. The Q2 revenue forecast is $8.7 billion to $9.5 billion, which could be up to 22% lower than $11.2 billion in the same period last year.

Intel, a leader in central processing units (CPU), also announced its Q4 results last month and forecasted a decline in Q1 revenue this year. It predicted revenue between $10.5 billion and $11.5 billion, which is more than a 37.5% decrease compared to the same period last year. This is a self-forecast lower than market expectations. It anticipated further declines following already reduced Q4 revenue last year.

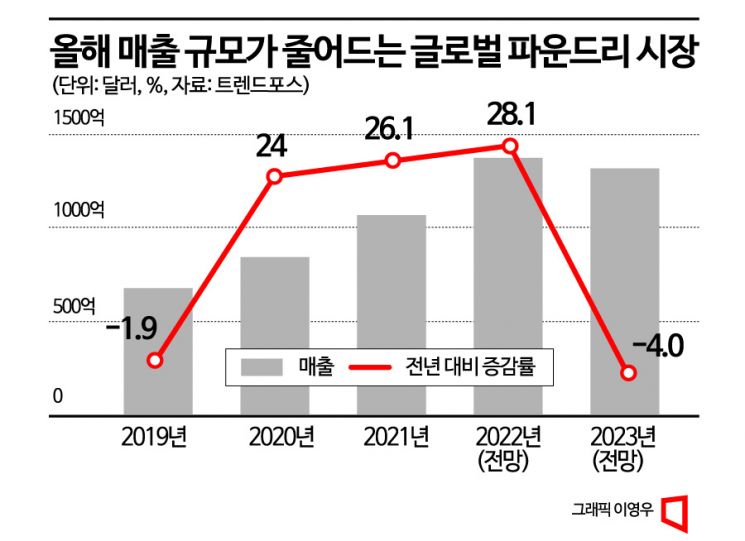

The foundry industry is also inevitably facing a decline in performance this year. Market research firm TrendForce predicted that the foundry market size will shrink by 4% compared to last year. Although the market recorded over 20% annual growth from 2020 through last year, it is expected to slow down this year.

TSMC, which controls more than half of the global foundry market, recorded January revenue of 200.051 billion Taiwan dollars, a 16.2% increase compared to the same month last year. Despite the sluggish industry conditions and the overlap with the Lunar New Year holiday, this performance is considered resilient, but it is a disappointing result compared to past growth. In January 2020, which also had the Lunar New Year holiday, TSMC’s revenue growth rate was 32.8%, twice as high. TSMC’s Q1 revenue forecast is $16.7 billion to $17.5 billion, implying a potential decline of more than 10% compared to the same period last year.

Another Taiwanese foundry company, UMC, is already experiencing a decline in performance. UMC’s January revenue was 19.58952 billion Taiwan dollars, down 4.31% from the same month last year. In January last year, revenue had increased by 31.83%.

The domestic market is also on a worsening path. The Ministry of Science and ICT announced that ICT exports in January amounted to $2.9 billion, down 25% from the same month last year. System items, which had maintained growth despite the semiconductor downturn, recorded negative growth for the first time in 33 months.

Samsung Electronics has already forecasted a decline in foundry business performance in Q1. At its earnings announcement last month, the company expected "performance to decline due to reduced demand from the global economic slowdown and inventory adjustments by major fabless companies." Securities firms also predict that the System LSI division’s Q1 revenue may decrease compared to the same period last year.

For domestic foundry company DB HiTek, the possibility of negative growth in Q1 is high. Financial information firm FnGuide’s Q1 revenue forecast for DB HiTek is 346.4 billion KRW, a 12.3% decrease from the same period last year. Operating profit for Q1 is also expected to decrease by 19.83% to 145.5 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.