KOSPI Up 10.3% This Year, KT Up 1.1%

Share Buybacks and Cancellations Insufficient to Boost Stock Price

Some Time Needed for Management Stabilization... Advising Reduced Holdings

[Asia Economy Reporter Lee Seon-ae] Despite the stock market rebound this year, KT's stock price has shown a sluggish trend. Although there is no issue with the 'fundamentals,' the stock price has declined due to the CEO appointment risk. Aggressive shareholder return policies have also been insufficient to turn investor sentiment around. Securities firms have diagnosed that despite solid fundamentals, it will be difficult for the stock price to break out of its current stagnation for the time being.

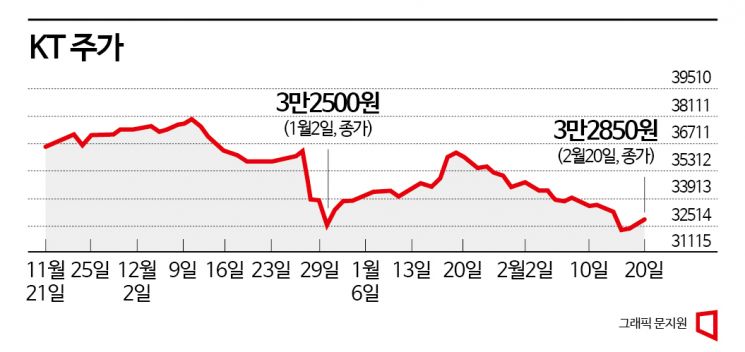

According to the Korea Exchange on the 20th, KT's stock price closed at 32,850 KRW, up 1.55%. Considering it closed at 32,500 KRW on the first trading day of the year (January 2), the stock price is virtually stagnant. The stock price, which soared to 39,300 KRW intraday on August 10 last year, remained in the high 30,000 KRW range afterward but has shown severe weakness this year. In February, despite announcing last year's annual performance and surpassing 25 trillion KRW in sales for the first time since listing, the stock price did not respond accordingly. While the KOSPI rose 10.3% through the 20th this year, KT only increased by 1.1%. Considering that all securities firms' target prices for KT, based on fundamentals, are above 40,000 KRW, there is a significant gap with the current stock price.

Kim Hong-sik, a researcher at Hana Securities, said, "KT showed solid performance with a 21% increase in headquarters operating profit (111.1 billion KRW) in Q4 last year compared to the same period the previous year, and recently has been increasing its shareholder return ratio, so fundamentals are not bad." However, he added, "It will take considerable time for management to stabilize after CEO Koo Hyun-mo's reappointment or the appointment of a new CEO," recommending reducing holdings during a rebound.

KT's board decided on CEO Koo's reappointment in December last year. However, the National Pension Service, the largest shareholder, opposed Koo's reappointment, and criticism grew that the board's decision, close to the incumbent CEO, lacked fairness. Currently, KT plans to nullify Koo's appointment, reselect candidates, and finalize the decision at the next shareholders' meeting next month.

Stock Price Reacts Sensitively to Concerns Over Koo Hyun-mo's Reappointment Failure

As the stock price wavered due to CEO risk and investor complaints increased, KT unveiled a stock price support plan. It announced plans to acquire 300 billion KRW worth of treasury shares by August 10 and then retire 100 billion KRW worth, along with a dividend of 1,960 KRW per share. The shareholder return ratio exceeds 100%. However, despite this bold support plan, the stock price reacted more sensitively to management risk issues. It is interpreted that KT's stock price most sensitively reflected the absence of CEO Koo, who had worked to enhance corporate value.

Opinions diverge on KT's future stock price trend. While there is a common view that the sluggish trend cannot be escaped in the short term, there are differing opinions on the recovery trend. Choi Nam-gon, a researcher at Yuanta Securities, said, "From an investor's perspective, uncertainty continues, exposed to uncertainty about maintaining the three-year plan and delays in personnel appointments," adding, "Despite solid performance and aggressive shareholder return policies, the main reason KT's stock price remains stagnant is the difficulty of a rebound before the next CEO appointment."

Researcher Kim Hong-sik also said, "In the current situation with high concerns about management changes, it is difficult for any positive news to be reflected in the stock price," evaluating, "Investors still remember the KT stock price crash due to dividend reversal when Chairman Lee Seok-chae retired, and during Chairman Hwang Chang-gyu's tenure, the stock price barely rose despite good performance, so the announcement of treasury stock purchases and partial retirements is insufficient to drive stock price increases." Kim Su-jin, a researcher at Mirae Asset Securities, said, "As a company possessing ultra-large artificial intelligence (AI), high growth in new growth businesses is expected, and shareholder return policies are welcome, but the CEO reappointment risk is prolonged more than expected, so it is better to wait and see for now."

There are also opinions that a relatively quick recovery will occur based on fundamentals. Choi Kwan-soon, a researcher at SK Securities, said, "Growth is expected in quality subscriber-based telecommunications business, AI Contact Center (AICC), logistics, and other AI-based new businesses, and strengthening shareholder returns is positive," adding, "Despite uncertainty regarding the next CEO appointment, there are many positive factors such as profitability improvement, so the stock price rise is expected to continue this year."

DB Financial Investment forecasted KT's consolidated sales this year to increase by 4.1% year-on-year to 26.6936 trillion KRW, and operating profit to increase by 7.7% to 1.8202 trillion KRW. Shin Eun-jung, a researcher at DB Financial Investment, emphasized, "The dividend yield based on the current stock price, reflecting KT's treasury stock purchase and retirement plan, is expected to be about 6.2%," adding, "The investment points regarding stable core business performance and the growth story and scale of group companies remain valid." Ahn Jae-min, a researcher at NH Investment & Securities, said, "If CEO Koo Hyun-mo is selected again in the new election, the CEO risk that has caused noise over the past few months is expected to disappear."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.