[Asia Economy Reporter Kwak Min-jae] The application volume for the Special BoGeumJaRi Loan has exceeded one-third of the annual supply target within about three weeks of its launch. It was found that about 60% of applicants aimed to repay existing loans borrowed from banks and other financial institutions.

According to data submitted by the Housing Finance Corporation (HF) to Choi Seung-jae, a member of the People Power Party, as of the 17th, the cumulative application amount for the Special BoGeumJaRi Loan was 14.5011 trillion KRW (63,491 cases). This means that 36.6% of the one-year supply target of 39.6 trillion KRW was already applied for within 15 business days since its launch on the 30th of last month.

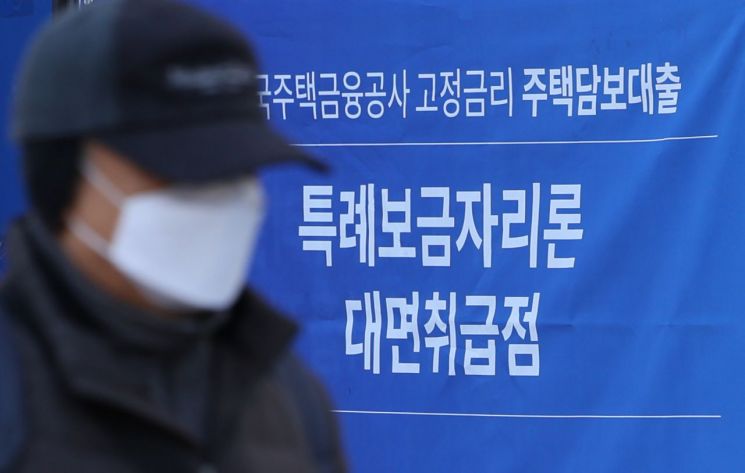

The Special BoGeumJaRi Loan is a product that integrates policy mortgages such as the Safe Conversion Loan and Qualified Loan into the existing BoGeumJaRi Loan and will be operated temporarily for one year. The interest rates for the Special BoGeumJaRi Loan are set at 4.25?4.55% per annum (general type) and 4.15?4.45% per annum (preferential type). For the preferential type, if the maximum limit of various preferential interest rates (0.9 percentage points) is applied, the rate can be as low as 3.25?3.55% per annum.

Immediately after its launch, the Special BoGeumJaRi Loan saw applications amounting to 7 trillion KRW over three days due to high interest, but as the waiting demand was resolved, the application volume in the third week decreased to about 1.5 trillion KRW. It is interpreted that there was a high demand to switch from relatively expensive bank mortgage loans to the Special BoGeumJaRi Loan. New home purchases accounted for 34.2% (21,682 cases), and repayment of rental deposit loans accounted for 7.9% (5,023 cases).

Analyzing the preferential interest rate application status of the Special BoGeumJaRi Loan, 85.7% of the total, or 54,434 cases, were through the electronic contract method via the internet (Akkim e), which allows a 0.1 percentage point interest rate discount. However, applications for other preferential interest rates were low. For low-income youth, it was 8.2% (5,001 cases), for newlyweds 3.5% (2,124 cases), and for socially disadvantaged groups 2.6% (1,630 cases).

Meanwhile, as of the 17th, among the Special BoGeumJaRi Loan applications, 27.8% (17,642 cases) were approved and closed, while disapproval cases accounted for 0.6% (401 cases).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.