President's Critical Remarks Trigger 4-10% Plunge in Bank Stocks

Controversy Over Reversing Stance After Emphasizing Private-Led Growth

[Asia Economy Reporter Son Sun-hee] Foreign investors sold off 200 billion KRW worth of shares in the four major domestic financial holding companies over four days. This is attributed to a sharp deterioration in investment sentiment amid growing concerns over regulatory tightening by authorities, following President Yoon Suk-yeol's continuous strong criticism of private commercial banks.

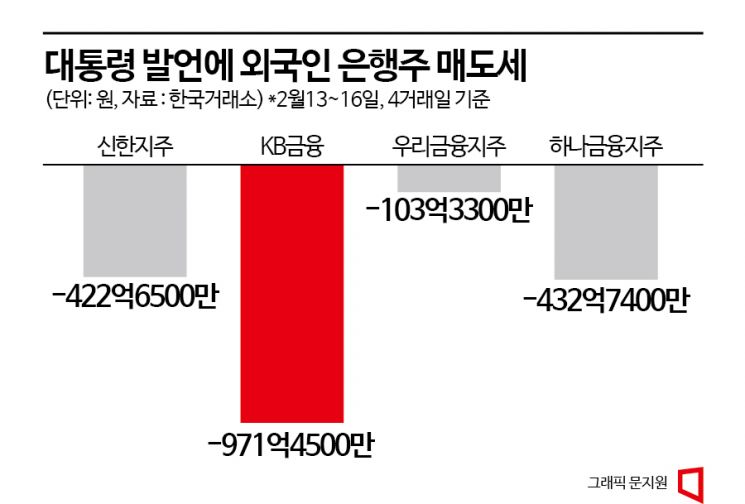

According to the Korea Exchange on the 17th, foreign investors net sold shares worth 193.017 billion KRW in Shinhan, KB, Woori, and Hana Financial Holdings over four trading days from the 13th to the 16th. During this period, net selling amounts were largest for KB Financial at 97.1 billion KRW, followed by Hana Financial Holdings at 43.3 billion KRW, Shinhan Financial Group at 42.3 billion KRW, and Woori Financial Group at 10.3 billion KRW. The concentrated selling pressure in a short period caused stock prices to plunge by 4% to over 10% within four days. KB Financial, which had the largest net selling volume, closed at 49,800 KRW, failing to hold the 50,000 KRW level the previous day. This marked a 10.59% drop compared to 55,700 KRW on the 10th, the largest decline among the four financial holding companies.

The KRX Bank Index, announced by the Korea Exchange, fell from 689.03 on the 10th to 638.9 the previous day. Market capitalization of listed stocks evaporated by about 7 trillion KRW in just four days.

Foreigners' focused selling of bank stocks is interpreted as a fallout from President Yoon's direct and pointed remarks targeting banks recently. On January 30th, during a Financial Services Commission briefing, President Yoon opened by stating that "banks are a public goods system." Subsequently, he made remarks such as "There should be no money feast for banks" (February 13th, private presidential office staff meeting) and "The oligopoly in the banking industry causes significant harm" (February 15th, emergency economic and livelihood meeting). Particularly, by mentioning net interest margin (the difference between loan interest rates and deposit interest rates), which is the source of bank profits and a fundamental principle of the financial industry, he left room for interpretation as government market intervention.

The Yoon Suk-yeol administration initially positioned "private-led growth" as the core slogan of its economic policy. However, the market voices concerns over the sudden targeting of private banks. A financial researcher at a domestic securities firm said, "At the beginning of the year, there was a positive atmosphere as banks emphasized shareholder returns and foreign investors' perception of the Korean financial industry improved, but it seems to be reverting to the old situation," adding, "Overseas, concerns about regulatory uncertainty in Korea still persist."

Some agree that the banking industry has a public nature. However, they point out the need for clear social standards. Another securities firm researcher said, "Banks certainly have a public nature and must fulfill social roles," but added, "The problem is the lack of standards like the U.S. 'stress test'." The U.S. Federal Reserve's annual 'stress test' measures the potential loss amount to assess how well banks can withstand future crisis situations. It was introduced following the 2008 global financial crisis.

He emphasized, "Institutional support is needed to allow shareholder returns to be decided based on clear standards," adding, "Currently, the key to the discount is the lack of predictability regarding government policy direction." He continued, "In the event of a crisis such as household debt defaults, it is ultimately the bank's capital that absorbs the impact," and added, "For public interest, it is necessary to understand that securing bank profitability is rather essential."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)