Last Year's Tax Reform Bill, Effectiveness ↓ During National Assembly Approval Process

[Asia Economy Reporter Kim Pyeonghwa] There have been calls to swiftly pass the bill to increase semiconductor tax credits, which is currently stalled in the National Assembly. The explanation is that the bill's promotion is essential as the semiconductor industry has emerged as a key national asset.

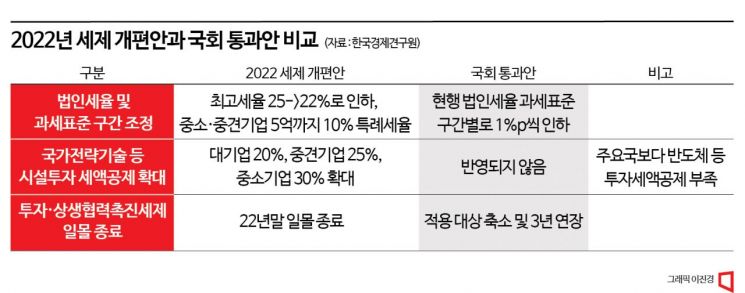

The Korea Economic Research Institute stated this in its report titled 'Comparison and Evaluation of the 2022 Tax Reform Proposal and the National Assembly Passed Bill,' published on the 15th. This report contains the content that although last year's tax reform proposal was a desirable policy direction, its effectiveness diminished as it passed through the National Assembly.

The Korea Economic Research Institute pointed out that while major competing countries lowered their corporate tax top rates to attract investment, our government raised the rates contrary to international trends. It also added that the government tried to correct this by lowering the top rate to 22% through last year's tax reform proposal, but it was not realized due to opposition from the opposition party.

Currently, excluding local income tax, the domestic corporate tax top rate is 24%, which is higher than Germany (15%), the United Kingdom (19%), the United States (21%), and Japan (23.2%). Including local income tax, while the OECD average corporate tax top rate fell from 24.6% in 2017 to 23.2% in 2021, Korea's rate rose from 24.2% to 27.5%. It only decreased by 1.1 percentage points last year.

Contrary to the purpose of the system's introduction, the investment and win-win cooperation promotion tax system, which was ineffective in corporate investment and wage increases, was extended for three years without sunset. In the comprehensive real estate tax reform plan, the abolition of heavy taxation on multiple homeowners was proposed, but it was revised to only exempt two-homeowners from heavy taxation. The relaxation of the major shareholder criteria for capital gains tax on domestic listed stocks was also not processed.

The Korea Economic Research Institute also pointed out that despite semiconductor and other national strategic technologies being national security assets, tax support measures were not sufficiently discussed. Unlike major competing countries that relaxed regulations and announced large-scale support measures to foster their domestic semiconductor industries, the Korean National Assembly is ignoring this, the report added.

The government recently submitted a revision bill to the Restriction of Special Taxation Act to the National Assembly to raise the semiconductor company investment tax credit rate to a maximum of 25% for large corporations and 35% for small and medium enterprises. The plan is to have this bill passed during the extraordinary session of the National Assembly. However, the bill's passage is uncertain due to significant differences between the ruling and opposition parties.

Lim Dongwon, a research fellow at the Korea Economic Research Institute, said, "We need to lower the high levels of corporate tax and inheritance tax burdens that dampen corporate morale and increase investment tax credits for national strategic technologies such as semiconductors," adding, "As global semiconductor competition intensifies, the government's proposal must be promptly processed in the extraordinary session of the National Assembly to support the domestic semiconductor industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.