Korean Steel and Shinpung Pharmaceutical Individual Shareholders Demand "Cancel Treasury Shares"

Increase in Individual Shareholder Proposals Amid Rising Calls for Shareholder Returns

[Asia Economy Reporter Hwang Yoon-joo] This year, the domestic stock market in Korea is witnessing a strong wave of 'shareholder proposals.' Demands for shareholder returns initiated by private equity funds such as Align Partners Asset Management are spreading among individual investors as well. Kim Nam-hoon, the leader of the Small Shareholders' Rights Recovery Movement at Gwangju Shinsegae, made a shareholder proposal to the Gwangju Shinsegae board in January, requesting a cash dividend of 3,750 KRW per share. He is a small shareholder who has held more than 1% (80,000 shares) of the shares for over six months, meeting the conditions for shareholder proposals. This case attracted attention as an example of a single small shareholder meeting the requirements for a shareholder proposal and voicing demands for expanded dividends and shareholder rights. Vice Chairman Chung Yong-jin of Shinsegae Group profited from a management premium during the sale of his shares, but small shareholders suffered losses due to the stock price plunge, he explained. Subsequently, individual investors are accumulating 1% stakes in mid-sized and small companies such as Korea Steel and Shinpung Pharmaceutical, demanding dividend increases and treasury stock cancellations.

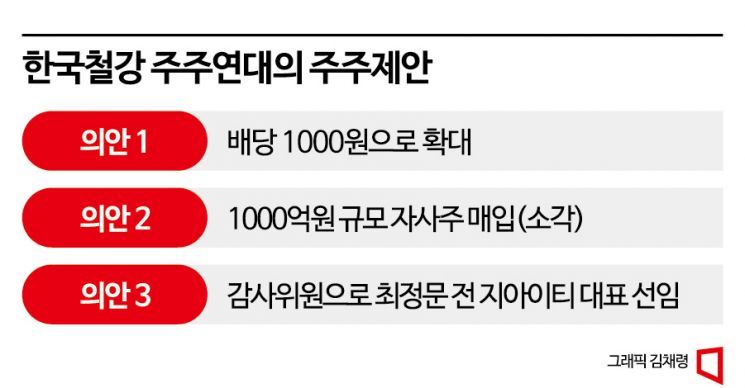

According to the financial investment and steel industries, eight individual shareholders have filed a provisional injunction to propose an agenda against Korea Steel as early as possible. On the 7th, they sent a certified shareholder proposal containing three items to the company and its CEO. However, due to disagreements over one of the shareholder proposals concerning treasury stock repurchases, they filed a provisional injunction to propose the agenda.

Eight Individual Investors Acquire 1% Stake to Submit Shareholder Proposal to Korea Steel

This has attracted market attention because it is individual shareholders, not capital-rich private equity funds like KCGI or Align Partners or institutional investors, who are actively exercising shareholder rights by submitting shareholder proposals against companies.

Under the Commercial Act, to submit a shareholder proposal, one must hold 3% of the total issued shares (42.45 million shares). However, proposals are allowed if 1% is held for more than six months. Eight shareholders, including individual investor Son Kyung-jun, secured 424,500 shares and sent a shareholder proposal containing three agenda items.

Minority shareholders have different rights depending on thresholds such as 1%, 3%, and 10%. Shareholders holding more than 1% can submit shareholder proposals and file derivative suits. Holding more than 3% grants rights such as requesting inspection of accounting books, calling (extraordinary) shareholder meetings, and demanding cumulative voting. Shareholder meetings are generally convened by the board of directors. However, shareholders holding more than 3% can also request the board to convene a shareholder meeting. If the company (board) refuses, they can file a lawsuit to have the court order an extraordinary shareholder meeting.

"Korea Steel's Dividend Payout Ratio Should Be Increased to 48%"... Lower Than China

The shareholder proposal by Son Kyung-jun and others consists of three main demands. First, they request increasing the dividend per share to 1,000 KRW. Korea Steel paid a year-end dividend of 250 KRW in 2021, totaling 9.7613 billion KRW in dividends. The dividend payout ratio was 9.98%, significantly reduced from 48.24% in 2019.

According to Korea Steel's business reports, over the past three years (2019?2021), the company recorded profits of 19.08415 billion KRW in 2019, a loss of 8.46114 billion KRW in 2020, and profits of 97.252 billion KRW in 2021. During the same period, retained earnings were 125.9 billion KRW, 106 billion KRW, and 185.8 billion KRW, respectively. In 2022, Korea Steel was fined 31.83 billion KRW by the Fair Trade Commission for price-fixing of rebar. Shareholders expect that even after accounting for this fine as a non-operating expense, the net income for 2022 will reach approximately 80 billion KRW.

Retained earnings are an accounting indicator used to gauge a company's dividend policy. Simply put, retained earnings are the net income remaining after dividend payments. An accounting expert said, "Companies accumulating retained earnings are consistently profitable but pay low dividends," adding, "Generally, companies hold about 20?30% of retained earnings in cash, so it is reasonable for shareholders to demand an appropriate level of dividend increase."

Low dividend payout ratios are considered a major cause of the Korea discount. According to KB Securities, Korea's average total shareholder return rate over the past decade (2010?2020) was 28%, lower than China's 31%. The total shareholder return rate refers to the proportion of net income returned to shareholders through dividends and treasury stock repurchases. The U.S. total shareholder return rate reaches 89%.

The Korea Steel Shareholders' Coalition argued, "Raising the dividend payout ratio to 50% will not hinder stable operations and growth investments," and "Increasing the dividend per share to 1,000 KRW would raise total dividends to 38.8 billion KRW, increasing the payout ratio to 48.5%."

Korea Steel Rejects Treasury Stock Repurchase Proposal: "Board Resolution Matter"

The second demand was for the cancellation of treasury stock worth 100 billion KRW. Treasury stock cancellation is one of the strongest shareholder return measures. It tends to have a greater impact on stock prices than dividends. In Korea, treasury stock repurchases and cancellations are viewed separately, but in the U.S., repurchases mostly lead to cancellations. Cancelling treasury stock reduces the total number of shares, increasing the value per share.

Meta in the U.S. is a representative example. On the 1st, it announced that its Q4 2022 revenue fell 4% year-on-year to 32.165 billion USD. Net income plunged 55% to 4.652 billion USD, marking its first negative growth since its 2012 IPO. However, after announcing cost-cutting measures and a 40 billion USD treasury stock repurchase plan, its stock price surged 20% in after-hours trading.

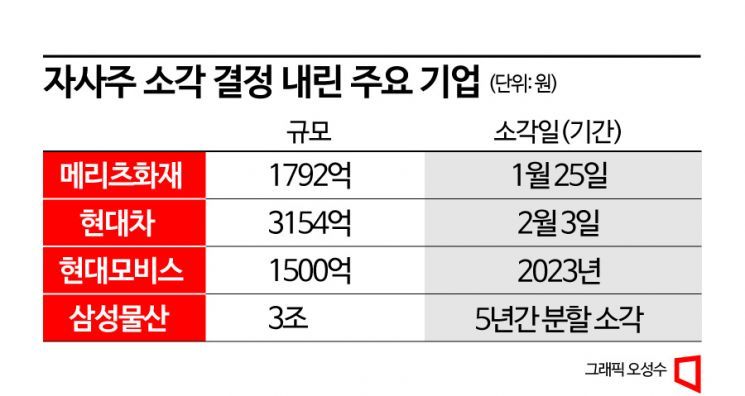

This year, companies such as Meritz Fire & Marine Insurance, Kolmar Holdings, Hyundai Motor, Hyundai Mobis, and Samsung C&T have attracted market attention by deciding to cancel treasury stock. However, most mid-sized listed companies remain reluctant to cancel treasury stock. Lee Sang-heon, a researcher at Hi Investment & Securities, explained, "In Korea, treasury stock repurchases are used as a means to relatively strengthen the voting rights of controlling shareholders. In contrast, listed companies in advanced countries like the U.S. actively use repurchases followed by cancellations as shareholder return policies that boost stock prices and provide stability, which have a greater effect than dividends."

The third demand concerns the appointment of audit committee members. According to Article 542-12, Paragraph 2 of the Commercial Act, "One member of the audit committee must be appointed by a resolution of the shareholders' meeting separately from other directors." The eight shareholders, including Son Kyung-jun, demand the appointment of individuals recommended by general shareholders to monitor management.

Generation 2030 Submits Shareholder Proposals via Apps

As individual investors, not institutions or private equity funds, actively submit shareholder proposals, the methods of gathering opinions and submitting proposals have changed. Individual investors are gaining attention by submitting shareholder proposals through applications. On the 9th, 713 shareholders of Shinpung Pharmaceutical sent a shareholder proposal to the board. They united through an application called 'HeyHolder' and submitted ownership certificates.

HeyHolder is an app created to provide a space for shareholders to communicate. Previously, shareholders had to capture their accounts for verification, but HeyHolder uses MyData to track the stocks held by users daily and grants access only to the relevant stock's bulletin board.

They demanded the cancellation of 1,289,550 treasury shares and the introduction of electronic voting. Shinpung Pharmaceutical sold treasury stock (1,289,550 shares) for 215.4 billion KRW via a block deal on September 21, 2020, to repay debt. Individual investors stated in their proposal, "If there was consideration for small shareholders' property rights, convertible bonds (EB) could have been issued to raise funds," adding, "The block deal caused the stock price to plummet, infringing on small shareholders' property rights." They further demanded, "Please cancel treasury stock in the same quantity as the block deal sale."

Against Korea Alcohol, individuals have gathered in a KakaoTalk group chat, demanding an increase in dividends to 600 KRW, improvement of internal transactions by the largest shareholder, and asset revaluation. Last year, Truston Asset Management, which secured a 5.14% stake, made a shareholder proposal against Korea Alcohol, but individual investors are also actively participating separately.

A representative of an asset management firm said, "Individual investors are increasingly interested in expanding shareholder rights such as dividends rather than focusing on short-term profits through day trading," adding, "Moreover, seeing private equity funds change governance structures in entertainment companies and expand bank dividends through shareholder proposals, individual investors also seem to be actively submitting shareholder proposals."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.