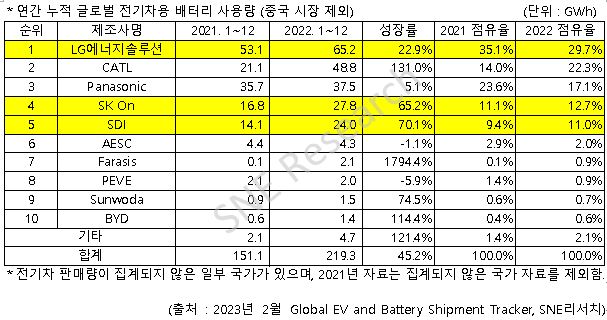

[Asia Economy Reporter Donghoon Jeong] The battery usage in global electric vehicles excluding the Chinese market sold last year was approximately 219.3 GWh. This represents a growth of about 45.2% compared to the previous year. The battery usage for this year is projected to be around 310 GWh.

In the ranking of battery usage installed in electric vehicles by company, South Korea's LG Energy Solution maintained its lead as number one. SK On and Samsung SDI also secured positions within the top five. Consequently, the combined market share of the three domestic companies grew to 53.4%. Chinese company CATL recorded a high growth rate of 131.0% even in non-Chinese markets, rising to second place with 48.8 GWh.

SK On grew by 65.2% year-on-year to 27.8 GWh, increasing its market share by 1.6 percentage points. Samsung SDI grew by 70.1% year-on-year to 24.0 GWh, maintaining fifth place with a market share increase of 1.6 percentage points.

All three domestic companies showed double-digit growth rates in battery usage compared to the previous year. Their combined market share recorded 53.4%, down 2.2 percentage points from the previous year. The growth of the three domestic companies is mainly due to strong sales of their battery-equipped models. LG Energy Solution continued its growth with increased sales of Tesla Model 3 and Y, Volkswagen ID.3 and ID.4, and Ford Mustang Mach-E. SK On showed high growth driven by the global popularity of Hyundai Ioniq 5 and 6, and Kia EV6. Samsung SDI demonstrated growth through sales of BMW i4 and iX, Audi e-tron lineup, and Fiat 500.

Japanese companies showed relatively low growth rates and a decrease in market share compared to the previous year. Panasonic, a representative Japanese company, grew by 5.1% year-on-year but saw its market share decrease by 6.5%. Panasonic, as one of Tesla’s main battery suppliers, was able to continue its growth due to increased sales of Tesla vehicles in the North American market and Toyota’s BZ4X.

In contrast, several Chinese companies including CATL showed explosive growth with high growth rates. CATL ranked second in non-Chinese markets due to increased sales of Tesla Model 3 (Chinese-made exports to Europe, North America, and Asia), Peugeot e-208 and 2008, and MG ZS. Among the top 10 companies, Parasis showed the highest growth rate, driven by strong sales of Mercedes’ EQ series for the European market, which has high global demand. Parasis experienced explosive growth last year and is expected to maintain steady growth this year as well.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.