35% Increase Compared to 2021

Expectations for Further Growth This Year

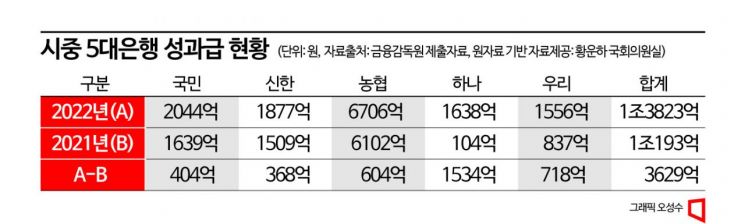

[Asia Economy Reporter Naju-seok] The total amount of performance bonuses paid by the five major commercial banks (Kookmin, Shinhan, NongHyup, Hana, and Woori) last year amounted to 1.3823 trillion KRW. There are criticisms that banks held an unprecedented money party during the period of interest rate hikes.

According to data from the Financial Supervisory Service disclosed by Hwang Unha, a member of the Democratic Party of Korea, on the 14th, the performance bonuses of the five major commercial banks increased by 35% (362.9 billion KRW) compared to 2021. Looking at each bank, last year NongHyup Bank paid 670.6 billion KRW, Kookmin Bank 204.4 billion KRW, Shinhan Bank 187.7 billion KRW, Hana Bank 163.8 billion KRW, and Woori Bank 155.6 billion KRW in performance bonuses, respectively.

Compared to 2021, the bank with the largest increase in performance bonuses was Hana Bank, which saw an increase of 153.4 billion KRW (from 10.4 billion KRW to 163.8 billion KRW).

Among executives of the five major commercial banks, the highest performance bonus recipient came from Kookmin Bank. This executive received 1.578 billion KRW. Looking at the average performance bonuses for executives, Kookmin Bank was 216 million KRW, Shinhan Bank 172 million KRW, Hana Bank 163 million KRW, Woori Bank 104 million KRW, and NongHyup 48 million KRW, in that order.

Regarding employees' performance bonuses, one employee at NongHyup received 75 million KRW, the highest among employees. Looking at the average performance bonuses per employee by bank, NongHyup Bank was the highest at 39 million KRW, with Shinhan Bank and Hana Bank each receiving 13 million KRW. This was followed by Kookmin Bank at 11 million KRW and Woori Bank at 10 million KRW.

Moreover, it is expected that even larger performance bonuses will be paid this year compared to last year, setting a record for the highest performance bonuses ever. Representative Hwang explained, "Typically, performance bonuses generated in the current year are confirmed and paid after performance evaluations the following year, so the performance bonuses for last year's results to be paid this year will be the largest ever." Last year, banks recorded enormous profits through interest rate margins amid rising interest rates.

Representative Hwang criticized, "While the majority of the public struggles with increased loan interest and household debt due to steep interest rate hikes and inflation, banks holding an 'unprecedented money party' with performance bonuses is an act that betrays the public nature of banks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)