Decision to Improve the Operating Method of Online Loan Brokerage Sites

[Asia Economy Reporter Yu Je-hoon] The provision of consumer personal information to third parties by online loan brokerage sites will be halted. This measure aims to block illegal private lenders from accessing personal information and approaching consumers.

The Financial Services Commission announced on the 13th that starting from the 16th, the provision of consumer personal information to third parties by online loan brokerage (advertising) sites will be stopped. Online loan brokerage sites refer to websites operated by loan brokerage companies registered with local governments.

Authorities have previously strengthened supervision by forming and operating the "Government-wide Task Force to Eradicate Illegal Private Financing," but online loan brokerage sites still serve as a major channel through which consumers come into contact with illegal private lenders.

A survey conducted last year targeting about 4,000 applicants for debtor representatives found that 80% of respondents reported encountering illegal private financing through online loan brokerage sites.

Under the current system, authorities believe that consumers' personal information leaked through online loan brokerage sites can be exposed to illegal private lenders.

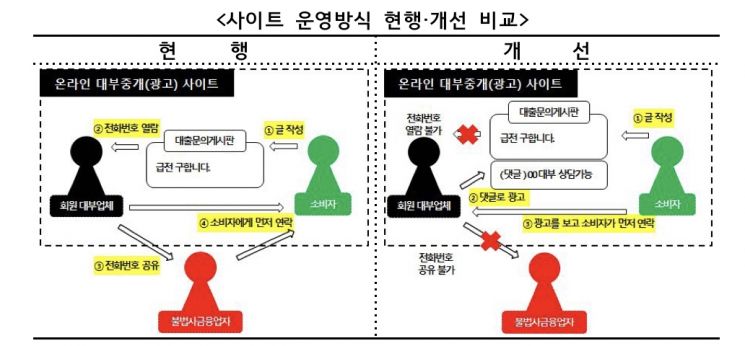

Typically, online loan brokerage sites operate a ‘loan inquiry bulletin board.’ When consumers agree to provide their personal information to third parties and post loan inquiry messages on this board, member loan companies registered on the site can view the consumers' personal information and contact them directly for business. In this process, if some member loan companies are connected to illegal private lenders and leak personal information, consumers may be contacted by an unspecified number of illegal private lenders.

Accordingly, the Financial Services Commission will improve the current operation method of online loan brokerage sites to block illegal private lenders from approaching consumers. When consumers post inquiry messages on the bulletin board, loan companies capable of consultation will post advertising banners as comments, and consumers who see these can contact the loan companies directly.

The Financial Services Commission stated, "If the operation method is improved, illegal private lenders connected to member loan companies will not be able to obtain consumer personal information, significantly reducing contact between consumers and illegal private lenders."

In addition, the Financial Services Commission will strengthen crackdowns on illegal activities related to online loan brokerage sites and enhance consumer protection. Since improving the operation method alone makes it difficult to prevent member loan companies from leaking consumers' phone numbers to other loan companies or illegal private lenders, continuous inspections and crackdowns will be maintained.

Furthermore, as illegal private financing through online loan brokerage sites occurs covertly and related data is not accumulated, research institutions will conduct year-round status analyses to review whether system improvements are necessary. To prevent illegal private financing damage among low-income groups, the commission plans to actively supply policy financing such as emergency livelihood microloans and strengthen damage regulation through the debtor representative system.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)