New Storage Device Replacing Hard Disks 'SSD'

Samsung Electronics and SK Hynix Actively Expanding Business

Usage Expanding from PCs and Laptops to Servers

Omdia "Annual Growth of 11.1% Expected Until 2026"

[Asia Economy Reporter Kim Pyeonghwa] The memory semiconductor industry is focusing on the solid-state drive (SSD) market. As the use of SSDs expands from PCs and laptops to servers, the industry expects to create high value-added opportunities. The SSD market is projected to grow at an average annual rate of 11.1%, reaching $57.5 billion (approximately 72.6225 trillion KRW) by 2026.

Samsung Electronics and SK Hynix have recently been expanding their SSD businesses. They are actively promoting their products through various exhibitions while launching a range of SSD products. SSDs are devices that store information using flash memory. They are made by combining NAND flash and controllers. They serve as replacements for hard disk drives (HDDs), which store information using mechanical parts (rotating disks). Compared to HDDs, SSDs generate less heat and noise and offer faster data processing speeds.

Last month, Samsung Electronics began mass production of the new high-performance SSD for PCs, the 'PM9C1a.' In October last year, they released the '990 Pro,' a high-performance consumer SSD. At G-STAR, the largest gaming exhibition in Korea held in November of the same year, Samsung set up the largest exhibition booth ever and showcased several SSD products supporting high-spec games.

SK Hynix showcased its enterprise SSD 'PS1010 E3.S' as a representative exhibit at CES, the world's largest electronics and IT exhibition held last month. In April last year, they launched the enterprise SSD 'P5530' in collaboration with their SSD subsidiary Solidigm. Thanks to these achievements, data center SSD sales quadrupled compared to 2021. Solidigm introduced consumer SSDs in Korea last year and plans to release new products in the first half of this year.

The memory industry is growing the market by overcoming SSD drawbacks such as higher cost and capacity limitations compared to HDDs. An industry insider explained, "SSDs have almost completely replaced HDDs in the PC and laptop markets," adding, "The share of SSDs in the server storage market has also increased to 50%."

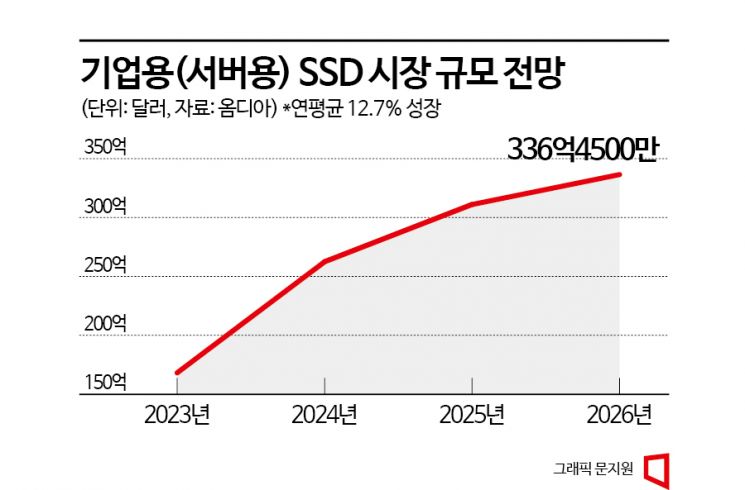

In fact, in the server (enterprise) storage market divided between SSDs and HDDs, the SSD market size reached $18.542 billion (approximately 23.4185 trillion KRW) in 2021, surpassing HDDs at $15.455 billion. Market research firm Omdia forecasts that by 2026, the server SSD market will grow to $33.645 billion (approximately 42.4936 trillion KRW), widening the share gap with HDDs to 60% versus 40% in the overall storage market.

Samsung Electronics and SK Hynix presented their server SSD business blueprints during conference calls held last month. Kim Jaejun, Vice President of Samsung Electronics' Memory Business Division, stated, "We will focus on selling high value-added products centered on high-capacity server SSDs." Kim Woohyun, Chief Financial Officer (CFO) of SK Hynix, said, "We have secured world-class technology in enterprise SSDs based on 176-layer NAND," adding, "We will quickly achieve a turnaround when the market rebounds."

Omdia expects the global SSD market to grow at an average annual rate of 11.1% through 2026. It also predicts the market size will increase from $29.54 billion (approximately 37.2636 trillion KRW) this year to $57.512 billion (approximately 72.6377 trillion KRW) in 2026. As of the third quarter of last year, Samsung Electronics and SK Hynix held market shares of 39.6% and 20.6%, ranking first and second, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)