Baek Jong-won's Meat Jjamppong Ranks 2nd

Omori Kimchi Stew Sells 60 Million Units

Sales of Cup Noodles Rise Due to Popular Differentiated Products

As differentiated cup noodles become the trend in convenience stores, they are shaking up the market landscape. It is very unusual in the conservative ramen market for established strong brands with solid fan bases, such as Yukgaejang Sabalmyeon, Buldak Bokkeummyeon, and Wang Ttukgeong, to be overtaken by new products.

(From the left) Baek Jong-won's Meat Jjamppong, Omori Kimchi Jjigae Ramen, Seven Select Green Onion Ramen.

(From the left) Baek Jong-won's Meat Jjamppong, Omori Kimchi Jjigae Ramen, Seven Select Green Onion Ramen.

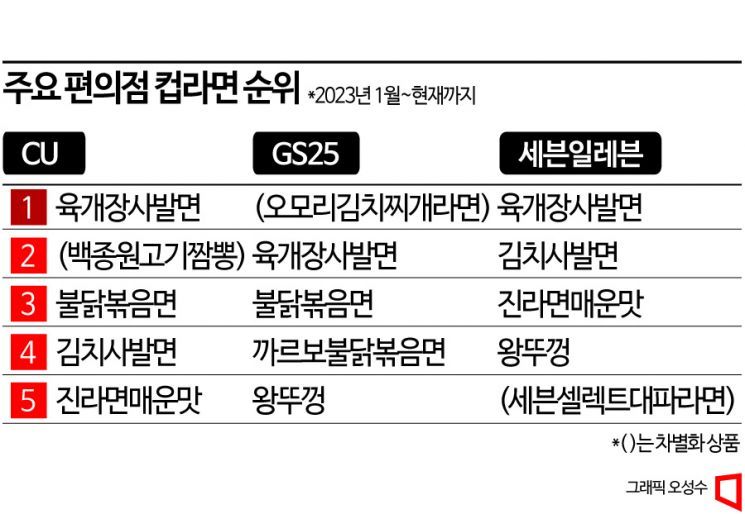

According to CU on the 10th, this year's cup noodle rankings are 1st Yukgaejang Sabalmyeon, 2nd Baek Jong-won Gogi Jjamppong, 3rd Buldak Bokkeummyeon, 4th Kimchi Sabalmyeon, and 5th Jin Ramen Spicy Flavor. Baek Jong-won Gogi Jjamppong has created a sensation by selling 500,000 units within 20 days of its launch. This translates to about 25,000 units per day, 1,041 units per hour, and 17 units per minute, making it the fastest-selling differentiated cup noodle product in CU's history. The sales composition by age group was evenly distributed with 21.2% under 20s, 28.8% in their 30s, and 30.7% in their 40s. The gender ratio was also similar, with males at 53.4% and females at 46.6%.

At GS25, Omori Kimchi Jjigae Ramen has held the top spot since its launch in December 2014. It is the only product that has beaten all absolute strong competitors such as Yukgaejang Sabalmyeon, Buldak Bokkeummyeon, and Wang Ttukgeong. Omori Kimchi Jjigae Ramen contains a separate kimchi soup powder packaged in retort pouches with kimchi brine and kimchi stew seasoning to preserve the authentic taste of aged kimchi. It has surpassed 60 million units in cumulative sales to date. The sales proportion by age group was 32% in their 20s, 30% in their 30s, and 16% in their teens. Unlike traditional strong products, the sales proportion by gender was higher for females (59%) than males (41%).

At 7-Eleven, following Yukgaejang Sabalmyeon, Kimchi Sabalmyeon, Jin Ramen Spicy Flavor, and Wang Ttukgeong, Seven Select Daepa Ramen ranked 5th. This product features a spicy Yukgaejang broth base with plenty of refreshing and clean green onion strips. It uses frozen-dried green onion strip blocks to achieve a crunchy and rich texture. As a hangover relief ramen, sales from ages 30 to 49 account for 50% of total sales, and those over 50 make up 30%. By gender, males (70%) overwhelmingly outnumber females (30%).

As differentiated products gain popularity, cup noodle sales are also on the rise. At CU, cup noodle sales from January 1 to June 6 this year increased by 32% compared to the same period last year. During the same period, GS25 saw a 39.9% increase, and 7-Eleven saw a 40% increase. A convenience store industry official said, "Differentiated cup noodles are not just a fleeting trend but have become steady sellers receiving great responses from customers," adding, "We will continue to develop various cup noodles and lead convenience store trends."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.