Telecom Company Performance Analysis①

[Asia Economy Reporter Oh Su-yeon] The three major telecom companies are posting record-breaking quarterly earnings. However, this is evaluated as a result of generating more profits from their core telecommunications business rather than growth in new businesses. From the consumer's perspective, this means paying higher telecom fees. In particular, a reduction in marketing expenses has been effective. Although profits from telecommunications are being invested in non-telecom new businesses, notable results have yet to be achieved.

According to the 'Wireless Communication Service Statistics Status' recently announced by the Ministry of Science and ICT, the number of 5G subscribers as of December last year was 28,059,343. It is now assessed that the subscriber growth rate has slowed and entered a stable phase. As the growth rate of 5G subscribers has become gradual, subsidy competition has also calmed down. This means that telecom companies' marketing cost burdens have significantly decreased.

In the case of SKT, which separately disclosed marketing expenses in last year's performance, the amount was 3.063 trillion won (separate basis), down 4.8% from the previous year. This accounts for 24.7% of sales. SKT stated, "Despite an increase in year-end advertising expenses, marketing expenses decreased by 4.8% compared to the same period last year due to the downward stabilization of market operating costs." The competition to steal subscribers in the number portability market has calmed down.

Marketing expenses for KT and LG Uplus are also steadily decreasing. The trend of reduced marketing expenses is expected to continue this year as well. Kim Ji-hyung, SKT's Head of Integrated Marketing Strategy, said at the 2022 earnings conference call, "The market has recently shown a consistently stable appearance," adding, "The possibility of subscriber acquisition competition reoccurring is low." This means competition has disappeared from the market, leaving only stability.

The telecom companies' strong performance is largely due to an increase in subscribers to 5G plans, which are more expensive than LTE, and a reduction in marketing expenses rather than differentiation in telecom services. As the competition to steal subscribers became so fierce that it overheated, the government implemented the so-called DanTong Law (Act on the Improvement of Distribution Structure of Mobile Communication Devices). After the DanTong Law, the latest smartphones, which were virtually free before, changed to being "only nominally free." Unlike before, when buying a smartphone that was said to be free, consumers are forced to choose expensive plans reluctantly. From the consumer's perspective, it is like purchasing the latest device on installment. Since the commercialization of 5G, the atmosphere to refrain from excessive subsidy competition for subscriber acquisition has become even stronger.

Additionally, recent economic downturns and improvements in smartphone performance have extended the smartphone replacement cycle. Counterpoint Research reported that last year the smartphone replacement cycle reached a record high of 43 months. At the time of the DanTong Law's implementation, the smartphone replacement cycle in South Korea was 16 months. Before the DanTong Law, smartphone manufacturers made huge profits. The policymakers who created the DanTong Law had a simple idea: "Let's eliminate the practice of continuously exchanging expensive phones for free and instead reduce communication fees." However, the result for consumers is old smartphones and expensive telecom bills.

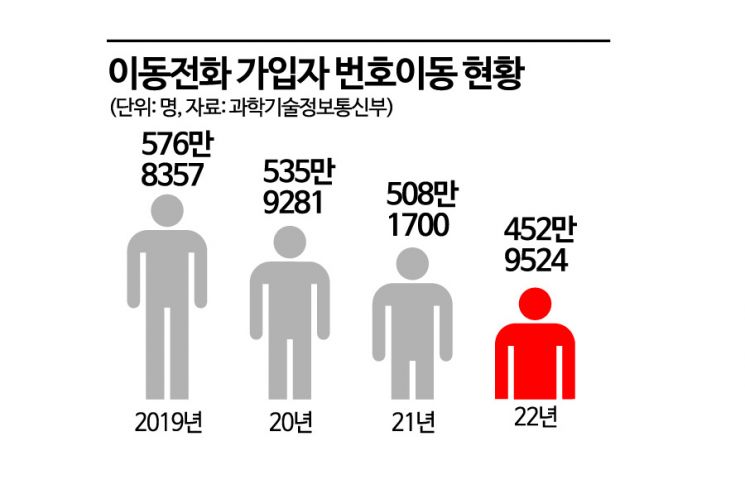

Thanks to this, the number of number portability customers in the telecom market has been rapidly decreasing recently. Number portability is a key indicator of overheating in the telecom market. According to the Ministry of Science and ICT's 'Number Portability Status of Mobile and Landline Subscribers,' the number of mobile number portability cases last year was 4,529,524, down 10.9% from 5,081,700 cases the previous year. The number of portability cases has been steadily decreasing since 2019.

The three major telecom companies are competing to foster non-telecom new businesses such as artificial intelligence (AI), cloud, and content, but they are still in the investment stage. New businesses are not yet golden geese but money-eating hamsters. For example, SKT's sales (separate basis) last year came 84% from telecommunications. Currently, the proportion of new business in telecom companies' sales or profits is very small. In other words, more money is invested in new businesses than the sales generated by them. Also, investment in new businesses itself is not enough to prevent the overall increase in telecom companies' profits.

The meaningful sales in non-telecom businesses come from B2B sectors such as corporate lines. Data centers and cloud boast high growth rates but account for only 156 billion won and 127 billion won in sales respectively, making their share negligible. AI, metaverse, and subscription sales, which are considered core new businesses such as A.Dot, have not yet been disclosed. UAM commercialization is two years away. It is the stage of starting full-scale investment and spending money. It is difficult to expect substantial sales or profits. Despite this situation, the fact that telecom companies' profits are increasing points to problems in the telecom fee calculation structure.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)