Spinning Off Is Advantageous for Increasing Customer Trust

Variables Such as Investment, Business Synergy, and R&D

Since 2004, Samsung Has Said "Difficult" Regarding Spin-Off Rumors

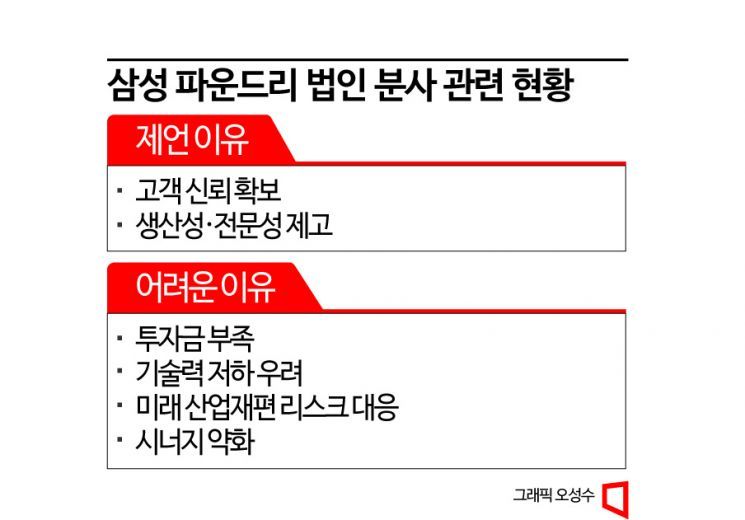

[Asia Economy Reporter Moon Chaeseok] There is an organization that has been plagued with inquiries about why it has not established a separate corporation from before its inception until now. It is Samsung Foundry (semiconductor foundry) division. To gain trust from major clients like Apple, it is better to spin off. Apple has been competing head-to-head with Samsung Electronics’ Galaxy for over 15 years with the iPhone. It is inevitably awkward to have to make iPhones using parts made by Samsung Electronics’ Foundry division. Samsung says, "Spinning off is difficult" due to investment funds and technical issues.

Samsung Foundry is seven years old this year. It was originally part of the System LSI (high-density integrated circuit) division and was reborn as a separate division in 2017. Even before its birth, since 2004, it has been plagued by spin-off rumors. At that time, Hynix Semiconductor (now SK Hynix) spun off its foundry division to create MagnaChip Semiconductor. There was speculation that Samsung would follow suit. However, nothing like that happened for 20 years.

The spin-off rumors resurfaced again in July last year. In early July, a securities firm released a report titled "Geopolitical Paradigm Change and Industry." It suggested spin-off as a measure to attract excellent talent. It urged the application of the "catfish effect," a phrase often used by the late Chairman Lee Kun-hee. The idea was to remove the Samsung Electronics name tag and make the members feel a strong sense of crisis so that they work with desperate determination.

At the end of July, during Samsung Electronics’ Q2 earnings conference call, Kang Moon-soo, Vice President of the Foundry division, said, "We are focusing on the business with the goal of achieving profitability that can secure our own investment resources by 2025." This sparked speculation that internal investment means spin-off. The logic is that if the division has enough money, it does not need to rely on the parent company. For Samsung Foundry, which is significantly trailing market leader TSMC in market share, it is necessary to enhance customer trust through spin-off. Morris Chang, founder and former chairman of TSMC, often remarks, "We do not compete with our customers," indirectly criticizing Samsung Electronics.

Samsung Electronics Chairman Lee Jae-yong inspecting semiconductor equipment with Peter Wennink, ASML CEO, and Martin van den Brink, ASML CTO, at ASML headquarters in Eindhoven, Netherlands, on June 14 last year (local time). [Image source=Yonhap News]

Samsung Electronics Chairman Lee Jae-yong inspecting semiconductor equipment with Peter Wennink, ASML CEO, and Martin van den Brink, ASML CTO, at ASML headquarters in Eindhoven, Netherlands, on June 14 last year (local time). [Image source=Yonhap News]

There are four reasons why it is difficult to establish a separate foundry corporation: securing investment funds, potential weakening of business synergy, concerns about reduced R&D momentum, and responding to long-term industrial restructuring risks.

It is analyzed that it is difficult to establish self-sufficiency after spin-off with Samsung Foundry’s sales. Last year’s estimated sales were in the 20 trillion won range. It is difficult to properly set up even one production line that costs 20 to 30 trillion won annually. Without sufficient funds, it is difficult to hastily push for spin-off.

There is also concern that if spun off, it would be difficult to properly utilize Samsung Electronics’ cash assets of about 120 trillion won. There is speculation that Samsung Electronics is accumulating cash for a system semiconductor mega deal. If merger and acquisition (M&A) discussions proceed, it seems difficult to separate the foundry division as a separate corporation.

It is also hard to ignore the possibility of disruption in joint R&D work with the memory division. Samsung’s memory division is interested in making semiconductors that not only store but also compute well. Early last year, the group’s advanced R&D organization, the Comprehensive Technology Institute, led a paper on magnetic resistance memory (MRAM) and in-memory computing published in the British academic journal Nature, which attracted attention. After the paper’s publication, Samsung collaborated with US-based AMD to develop HBM-PIM (High Bandwidth Memory-Processing in Memory) semiconductors. HBM-PIM is a product that combines memory semiconductors and artificial intelligence (AI) processors. Unlike conventional DRAM, which only stores data, it also performs computation. In-memory technology is incorporated here. If the foundry corporation is spun off, synergy could weaken.

In the long term, if the foundry business shifts from competition in fine process technology to advanced packaging competition, there is an opinion that maintaining the current integrated device manufacturer (IDM) model is better. Currently, competition is fierce in engraving nanometer (nm, one-billionth of a meter) scale fine circuits on wafers. It is expected that in the future, competition will focus on heterogeneous integration design. This means that instead of obsessing over drawing circuits finely on a single chip, technologies that combine multiple chips into one to improve efficiency will become important. At that time, it may be better to remain as an IDM and strengthen collaboration with surrounding upstream and downstream companies rather than spinning off the foundry corporation. The meaning is "united we survive."

For the past 20 years, those who have led Samsung Electronics’ semiconductor business as heads of the DS (Device Solutions) division have repeatedly said, "There will be no foundry spin-off." Even now, the stance of "no spin-off" is firm. Even if customers like Apple doubt Samsung Foundry, Samsung responds by saying, "We have properly established a Chinese wall (information exchange blocking device)."

It is difficult to ignore voices that say a foundry corporation spin-off could be pursued in 2025. Samsung Foundry is losing both customer acquisition and yield (ratio of good products) to TSMC. A turnaround card is desperately needed. The more financially stable the foundry division becomes, the stronger the spin-off rumors may become. The market may take Vice President Kang Moon-soo’s remark about "securing own resources by 2025" as a hint.

Coincidentally, on the 31st of last month, during the Q4 earnings conference call, Samsung Electronics announced, "The foundry division achieved the highest quarterly and annual sales through expansion of sales to major customers." In September last year, Kyung Kye-hyun, head of the DS division, also said about spin-off, "It is difficult to talk about." Compared to the repeated responses over 20 years of "We won’t do it," "It’s unthinkable," and "It’s absurd," the tone seems to have softened.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)