Q4 Earnings Improvement, ShinIn Group Debut, etc.

Brokerage Firms Rush to Raise Target Prices for Entertainment Stocks

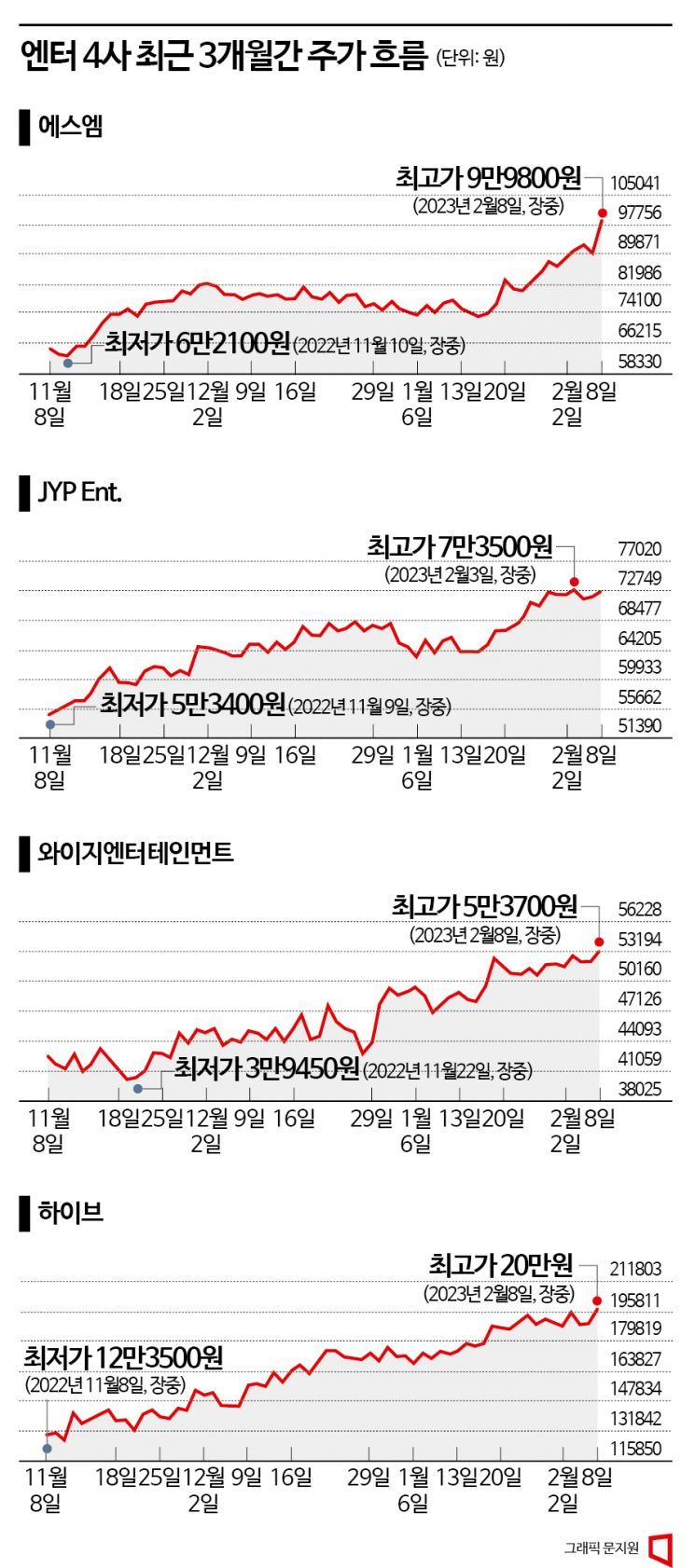

[Asia Economy Reporter Kwon Jae-hee] The stock prices of the four major domestic entertainment companies (SM, JYP, YG Entertainment, HYBE) have been soaring since the beginning of the year. Factors driving the stock prices include fourth-quarter earnings, anticipation of rookie group debuts, and China's reopening of economic activities. The securities industry is also issuing positive outlooks, raising target prices for entertainment stocks.

According to the Korea Exchange, on the 8th, SM closed at 98,700 KRW, up 9.54% from the previous trading day. The stock price rose to a high of 99,800 KRW during the session before giving up some gains. On the same day, JYP Ent. closed at 72,600 KRW, up 1.11%, and YG Entertainment closed at 53,300 KRW, up 2.11%. HYBE also reached an intraday high of 200,000 KRW before closing at 197,600 KRW, up 4.27%.

Compared to the beginning of the year, SM rose about 30%, JYP Ent. 16%, HYBE 24%, and YG Entertainment about 16%, recording growth rates exceeding the KOSPI average.

Supported by this, ETFs containing entertainment-related stocks are also strong. KODEX Media & Entertainment rose about 20.5% since the beginning of the year, TIGER Media Contents increased by 19% during the same period, and HANARO Fn K-POP Media also rose about 18%.

The outlook for fourth-quarter earnings is also bright. According to financial information provider FnGuide, JYP Ent.'s fourth-quarter revenue is expected to reach 106.6 billion KRW, and operating profit 29.9 billion KRW, representing increases of 67% and 83.4% respectively compared to the same period last year, marking record-high results. SM is also estimated to record a 72% increase in fourth-quarter operating profit to 19.8 billion KRW compared to the previous year. YG Entertainment is expected to set a new record for fourth-quarter operating profit as well. However, HYBE is observed to possibly fall short of consensus due to decreased contribution from BTS and increased selling and administrative expenses.

The securities industry is raising target prices amid expectations for rookie groups to be launched by entertainment companies this year. JYP Ent. is preparing to debut a total of four rookie groups this year, and YG Entertainment released a teaser video for 'Baby Monster' earlier this year. SK Securities raised SM's target price from 90,400 KRW to 120,000 KRW, and Samsung Securities adjusted it upward from 104,000 KRW to 124,000 KRW. Meritz Securities raised JYP Ent.'s target price from 78,000 KRW to 82,000 KRW.

Park Soo-young, a researcher at Hanwha Investment & Securities, analyzed, "In the case of JYP Ent., the lineup will double this year by adding four new IPs to the existing five main IPs (TWICE, Stray Kids, ITZY, NiziU, NMIXX). Expectations for the growth potential of the new lineup are increasing." Jeong Ji-soo, a researcher at Meritz Securities, forecasted, "HYBE is expected to diversify revenue through new IPs despite BTS's absence, thanks to TXT's comeback in Q1, SEVENTEEN unit albums, and the growth of NewJeans. YG Entertainment, which had no groups guaranteeing success other than BLACKPINK, will see its valuation discount resolved depending on the success of Baby Monster."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)