Major Korean Shipbuilders Turn Profitable This Year, Raising Hopes

Stock Prices Surge 10-26% Since Early Year

[Asia Economy Reporter Lee Seon-ae] Shipbuilding stocks are attracting attention with a strong rebound. It is analyzed that the expectation of ending the deficit streak and turning to profitability this year has been reflected in the stock prices.

According to the Korea Exchange on the 8th, shipbuilding stocks have shown remarkable price increases this year until the previous day, with Samsung Heavy Industries up 10.83%, Daewoo Shipbuilding & Marine Engineering up 26.2%, and Korea Shipbuilding & Offshore Engineering up 12.54%. This is the result of expectations for a performance turnaround. According to financial information provider FnGuide, most companies including Korea Shipbuilding & Offshore Engineering, Hyundai Heavy Industries, Daewoo Shipbuilding & Marine Engineering, Hyundai Mipo Dockyard, and Samsung Heavy Industries are expected to successfully turn profitable compared to the previous year. The expected operating profits are 885.8 billion KRW for Korea Shipbuilding & Offshore Engineering, 422.5 billion KRW for Hyundai Heavy Industries, 220.7 billion KRW for Daewoo Shipbuilding & Marine Engineering, 204.5 billion KRW for Hyundai Mipo Dockyard, and 116.1 billion KRW for Samsung Heavy Industries.

Lee Dong-heon, a research fellow at Shinhan Investment Corp., said, "Samsung Heavy Industries presented a target of 8 trillion KRW in sales and 200 billion KRW in operating profit this year. Considering the usual stance of not announcing operating profits, this is interpreted as expressing confidence in turning profitable," adding, "The 8 trillion KRW sales target also seems achievable considering backlog growth and sales recognition from affiliate orders." He continued, "Daewoo Shipbuilding & Marine Engineering announced a sales target of 9.4 trillion KRW this year, which is 20% higher than the consensus (average forecast), and this can also be interpreted as a will for normalization after being acquired by Hanwha."

Kang Kyung-tae, a researcher at Korea Investment & Securities who raised Samsung Heavy Industries' target price from 6,900 KRW to 7,600 KRW, said, "The increase in order volume, rising ship prices, and orders focused on high value-added ship types clearly indicate performance improvement. This year will be the year to break the chain of operating losses that lasted for the past eight consecutive years," he analyzed.

Shinyoung Securities named Korea Shipbuilding & Offshore Engineering and HSD Engine as the top preferred stocks in the shipbuilding sector. Eom Kyung-ah, a researcher at Shinyoung Securities, explained, "Shipbuilders have received orders exceeding their annual production capacity since 2021. Gas carriers and container ships, which make up the largest portion of the order backlog, have almost no risk of default, so most will translate into operating results." She added, "As we approach the second half of the year, due to the base effect, stocks that recorded poor performance previously may rise relatively sharply. Therefore, we recommend Korea Shipbuilding & Offshore Engineering as the top preferred stock." Korea Shipbuilding & Offshore Engineering's performance this year is expected to improve as the record-breaking order volume since 2021 begins full-scale construction. HSD Engine is expected to surpass 1 trillion KRW in sales for the first time this year and turn profitable.

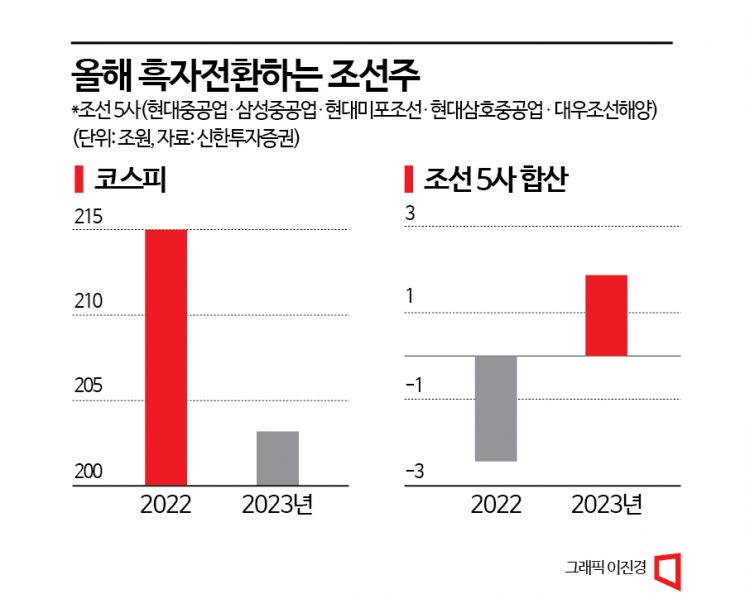

The order backlog of domestic shipbuilders surged to 20.62 million CGT in 2020, 29.66 million CGT in 2021 (a 44% increase from the previous year), and 36.06 million CGT in 2022 (a 21% increase from the previous year). Myung Ji-woon, a senior researcher at Shinhan Investment Corp., emphasized, "The combined sales guidance for this year of the five major shipbuilders (Hyundai Heavy Industries, Samsung Heavy Industries, Hyundai Mipo Dockyard, Hyundai Samho Heavy Industries, and Daewoo Shipbuilding & Marine Engineering) is 39.4 trillion KRW, exceeding the consensus of 37.5 trillion KRW by 5%. Confidence in sales growth is evident as the order backlog is being filled."

The combined order target for the five major shipbuilders this year is 32.2 billion USD (excluding Hyundai Heavy Industries' engine machinery). At the current exchange rate, this is about 40 trillion KRW. Considering Hyundai Heavy Industries' external sales of engine machinery, orders exceed the combined sales target. Research fellow Lee Dong-heon said, "In the first half, order stability is highlighted due to remaining orders for Qatar LNG carriers, FLNG, and container ships, and we expect shipbuilding stocks to have an advantage in sector preference."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.