Historical Average Below January Competition Rate and Offering Amount

Recent Rookie Companies' Offering Prices Decided at Upper End of Desired Range

[Asia Economy Reporter Hyungsoo Park] The initial public offering (IPO) market has recently been stirring. Thanks to the rising stock prices of newly listed companies that entered the domestic stock market last month, funds are pouring into demand forecasting and public offering subscriptions.

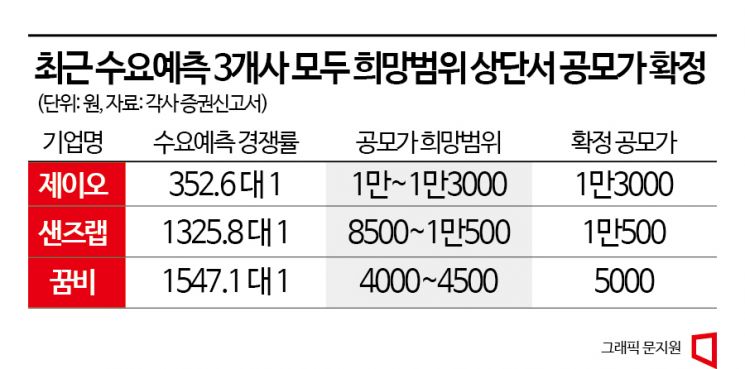

According to the financial investment industry on the 7th, three companies?Kkumbee, J.O, and SandsLab?that recently conducted demand forecasting succeeded in attracting strong interest and set their public offering prices above the upper limit of their expected price ranges.

SandsLab conducted demand forecasting targeting institutional investors from the 2nd to the 3rd. A total of 1,541 institutions participated, recording a competition rate of 1,325.8 to 1. The expected price range was set at 8,500 to 10,500 KRW, and over 97% of the total subscription volume was at the upper price limit. This result reflects the expectation that the stock price will continue to rise after listing, given that SandsLab utilizes artificial intelligence (AI) technology, which has recently attracted attention in the domestic stock market. SandsLab analyzes cybersecurity threats in real time using AI and big data technologies.

J.O conducted demand forecasting from the 1st to the 2nd and finalized the public offering price at 13,000 KRW, the upper limit of the expected range. J.O succeeded in mass-producing carbon nanotubes domestically for the first time in 2006 and supplies carbon nanotube materials used in secondary batteries.

Kkumbee, which conducted demand forecasting over two days starting from the 26th of last month, set its public offering price more than 10% above the upper limit of the expected range. The public offering price was 5,000 KRW, exceeding the expected range of 4,000 to 4,500 KRW. The demand forecasting competition rate was 1,547.1 to 1. Kkumbee is a company that manufactures and sells playroom mats for infants, bedding, and wooden furniture. Kkumbee conducted public offering subscriptions for general investors on the 31st of last month and the 1st of this month. While offering 500,000 shares, subscription orders reached 886.3 million shares. Deposits alone exceeded 2.2 trillion KRW.

SandsLab and J.O have attracted attention as companies related to secondary batteries and AI, which have led the rebound in the domestic stock market. The success of infant product company Kkumbee in the public offering subscription has also increased expectations that the IPO market is recovering.

Last month, the IPO market fell below past averages in terms of public offering size and competition rate. The atmosphere continued the downturn that started in the second half of last year. Last month, the IPO public offering amount was 106.1 billion KRW, which is only 16% of the January average public offering amount of 662 billion KRW from 1999 to 2022.

According to Eugene Investment & Securities, the average demand forecasting competition rate for IPO companies last month was 676 to 1. The demand forecasting competition rates in 2021 and 2022 were 1,345 to 1 and 1,369 to 1, respectively. The subscription competition rate was 378 to 1, which, considering last year's 975 to 1, indicates that interest in the IPO market has sharply declined over the past year.

Researcher Jongseon Park of Eugene Investment & Securities explained, "Among the companies listed last month, Mirae Semiconductor and Obzen saw their stock prices rise 160% compared to the public offering price on the first day of listing," adding, "Interest in the IPO market is gradually increasing." He also added, "The expected market capitalization of the IPO market in February is estimated to be between 1.8 trillion and 2.3 trillion KRW, exceeding the historical average February listing market capitalization of 1.3 trillion KRW and the recent five-year average market capitalization of 2 trillion KRW."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)