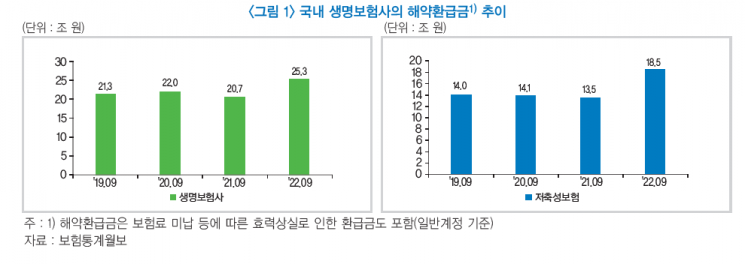

Insurance Cancellations Totaling 25 Trillion Won by Q3 Last Year

[Asia Economy Reporter Minwoo Lee] Since last year, insurance contract cancellations have been rapidly increasing. This is interpreted as a result of overlapping factors such as concerns over economic slowdown, high interest rates, and high inflation amid expanding instability in the financial market.

According to financial authorities and the insurance industry on the 5th, one of the main factors worsening insurers' liquidity is the rapid increase in insurance contract cancellations. In particular, for life insurance companies, the cumulative surrender refunds as of the third quarter of last year reached 25.3 trillion won, a 22% increase compared to the same period the previous year. Among these, the cumulative surrender refunds for savings-type insurance, which accounts for a significant portion, reached 18.5 trillion won, a 37% increase compared to the same period last year.

The background explaining insurance contract cancellations includes emergency funds, interest rates, and inflation. The increase in cancellations by domestic insurers is evaluated as a result of the complex interaction of all these factors.

Emergency funds refer to policyholders who need urgent cash due to economic downturns canceling their insurance or losing contract validity due to non-payment of premiums. According to a survey conducted by the Life Insurance Association in July 2021, reasons for life insurance cancellations such as "difficulty paying premiums (32.8%)" and "need for a lump sum (28.9%)" accounted for more than half of all respondents.

Senior Research Fellow Seokho Lee of the Korea Institute of Finance explained, "As the domestic economy continues to experience sluggish growth and household finances generally become more difficult, it is estimated that such 'livelihood-type insurance cancellations' are increasing mainly among low-income and working-class groups."

The interest rate factor refers to cases where funds move to financial products with higher returns than insurance. Recently, with the global base interest rate hikes causing fixed deposit rates to rise sharply, funds have rapidly shifted to banks. The balance of fixed deposits at the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?increased by more than 163 trillion won in one year, from 654.9359 trillion won at the end of 2021 to 818.4366 trillion won at the end of last year.

Inflation is also cited as a major factor. Due to concerns that the real value of insurance payouts will decline because of rising prices, policyholders are canceling insurance. This reaction was also revealed in surveys by the Life Insurance Association and the Korea Consumer Agency. The proportion citing "decline in insurance payout value due to inflation" as a reason for life insurance cancellation reached 7.2% and 9.0% in each survey, respectively.

Looking ahead, as the economic low-growth phase and the high interest rate and inflation trends are expected to continue for some time, there is a possibility that insurance cancellations will increase further, highlighting the need to prepare appropriate countermeasures. In particular, low-income groups, who are the main targets of livelihood-type insurance cancellations due to economic reasons, are considered to have greater seriousness since the insurance coverage function is more necessary in case of unexpected accidents.

Research Fellow Lee emphasized, "To reduce livelihood-type insurance cancellations, it is necessary to actively promote premium payment suspension systems and insurance policy loans and to explore more realistic contract maintenance systems. Insurance companies also need to strengthen continuous monitoring and liquidity securing efforts, including actively considering developing products that partially reflect inflation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)