Intense Battle for 2nd Place Between Oyes and Mon Cher Since 2020

Targeting New Consumer Base with Limited Edition Lineup

In the semi-fresh chocolate cake market, Orion's Choco Pie continues to hold the undisputed No. 1 position, while Haitai Confectionery's Oyes and Lotte Confectionery's Mon Cher are engaged in a battle for second place. Both products plan to target the market by launching seasonal lineups that evoke a sense of the season, leveraging their unique brand power.

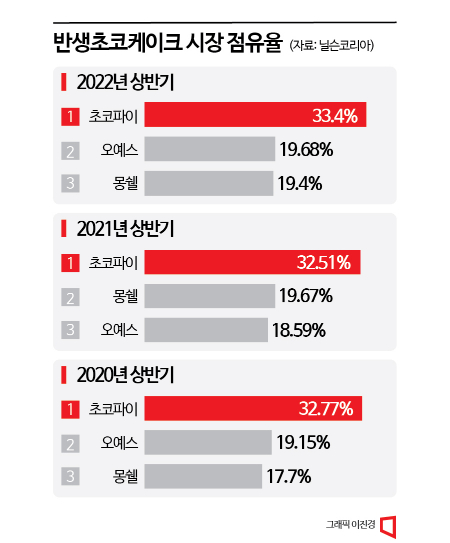

According to Nielsen Korea's survey on the 3rd, Choco Pie held the No. 1 market share in the semi-fresh chocolate cake market for the first half of 2022 with 33.4%. It has been the unshakable leader for 10 years since Nielsen Korea began its survey. Moreover, its market share in the first half of last year increased by 0.89 percentage points from 32.51% in the first half of 2021, further solidifying its market dominance. Sales also recorded 40.47 billion KRW, significantly surpassing Oyes (23.84 billion KRW) and Mon Cher (23.51 billion KRW).

Meanwhile, Oyes and Mon Cher appear to be engaged in a fierce competition for second place every year. The semi-fresh chocolate cake market, which was previously divided between Choco Pie and Mon Cher, has clearly taken the form of a two-way battle for second place since Oyes first overtook Mon Cher in 2020. In the first half of 2020, Oyes (19.15%) led Mon Cher (17.7%) by 1.45 percentage points, but the following year, Mon Cher (19.67%) surpassed Oyes (18.59%) by 1.08 percentage points. In the first half of 2022, Oyes (19.68%) reclaimed second place, pushing Mon Cher (19.4%) to third.

Both products are pursuing a strategy to attract both loyal and new consumers by adding new flavors to their existing taste and quality. Haitai Confectionery released 'Oyes Strawberry Cheesecake' and 'Oyes Einsp?nner' tailored to the spring and winter seasons, respectively, last year. These seasonal flavors added novelty to the original Oyes. Lotte Confectionery also launched 'Mon Cher Nutty Friends,' which includes almonds, nuts, toffee nut, and jam, and has continued various attempts such as planning the 'Monchellin Road' project in collaboration with the traditional bakery Taegukdang.

There are also opinions that the ranking battle between the two products changes every year depending on market conditions rather than reflecting consumer preferences. An industry insider explained, "In the case of Oyes and Mon Cher, the two products combined generate over 40 billion KRW in sales annually, indicating a solid loyal consumer base," adding, "Since the difference in market share between the two products is very narrow and the rankings change every year, it should be seen as changing according to market conditions each year rather than reflecting consumer preferences."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)