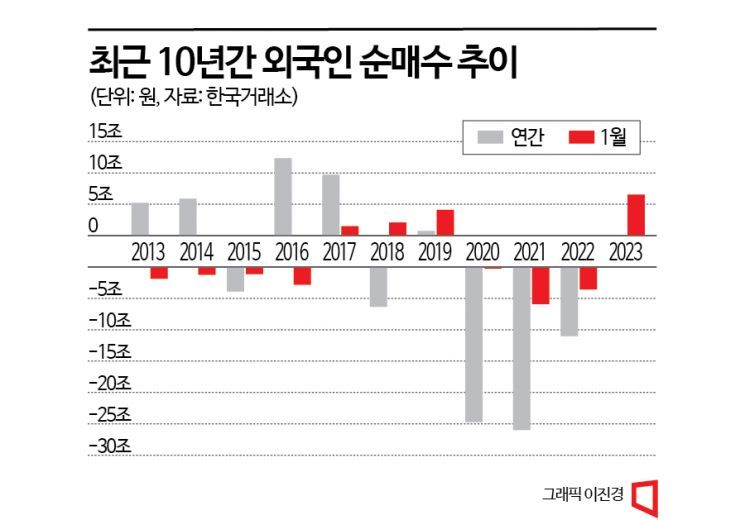

Second Largest Net Purchase in a Decade in January

KOSPI PBR at 0.8x Level...Key Signal of Fundamental Improvement

[Asia Economy Reporter Kwon Jae-hee] In January, the domestic stock market experienced a short-term surge driven by net purchases from foreign investors. The peak-out of tightening, expectations of a bottom in the semiconductor industry, and China's reopening (resumption of economic activities) were cited as the main reasons behind the foreign investors' net buying. Amid mixed optimism and pessimism in the securities industry, there is keen interest in whether the foreign investors' net buying rally will continue into February. The securities industry sees room for expansion in foreign investors' supply and demand, but the pace depends on fundamentals.

According to the Korea Exchange on the 3rd, the KOSPI rose about 10% during January (January 2?31), from 2,225.67 points at the close on January 2 to 2,425.08 points on the 31st. The clear driver of the January rally was foreign investors. Foreigners purchased stocks worth 6.5495 trillion KRW in the domestic stock market during January. This is the second-largest monthly amount on record (7.8263 trillion KRW in September 2013) and surpasses the annual net buying volume of foreigners in 2013?2014.

There are three main reasons that led foreigners to 'Buy Korea.' The first factor is the consensus that the global central banks' tightening policies have reached their later stages. The U.S. Federal Reserve (Fed) raised interest rates by 0.25 percentage points on the 1st (local time). This is interpreted as a return to a normal rate hike size compared to last year’s unprecedented 'giant steps' of 0.75 percentage points four times in a row. Additionally, expectations of a bottom in the semiconductor industry confirmed by earnings announcements from Samsung Electronics and SK Hynix, along with China’s reopening, are seen as factors attracting foreign inflows.

Will the foreigners' 'storm buying' continue in February? The securities industry analyzes that fundamentals are key. Choi Yoo-jun, a researcher at Shinhan Financial Investment, said, "In the past, periods when foreign ownership expanded were times when fundamentals were solid or undervaluation attractiveness was highlighted in terms of valuation." He added, "There is no absolute standard for foreign ownership ratio, but looking at past cases, foreigners generally started buying when the KOSPI price-to-book ratio (PBR) was around 0.8 times." Currently, the KOSPI PBR is about 0.8 times, near historical lows. Researcher Choi predicted, "Exports are still declining, but if the export decline rate peaks and begins to improve, the speed of foreign inflows into the stock market will also accelerate."

However, supply and demand by sector are expected to be differentiated. Considering the current ownership levels and sectors that saw inflows in January, it is analyzed that foreign buying momentum can be expected in cosmetics, apparel, secondary batteries, shipbuilding, automobiles, and semiconductors. Researcher Choi Yoo-jun said, "In January, foreign net buying was concentrated in semiconductors, but the supply and demand gap is large compared to the past." He added, "If additional signals of industry improvement are confirmed in the second half of the year, semiconductors could again become the center of supply and demand."

Some voices call for caution. Kim Seung-hyun, a researcher at Yuanta Securities, said, "The January stock market not only had a large rise but also had 81% of all stocks increasing." He explained, "In the past 20 years, there have been only 10 instances, excluding this January, where more than 80% of all stocks rose, and none of those cases maintained an 80% rise ratio one month later." He added, "Going forward, attention should be paid to sectors that rose relatively less during the strong rebound in January or those that still have room to rise compared to their highs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)