International Iron Ore Prices at $130 per Ton

Over 60% Increase Compared to Three Months Ago

Concerns Over Inflation Triggered by China's Reopening as the World's Factory

[Asia Economy Reporter Donghoon Jung] The price of iron ore, one of the leading global economic indicators, is showing a sharp rise. This is a 'paradoxical phenomenon' emerging amid growing concerns about a prolonged global economic downturn.

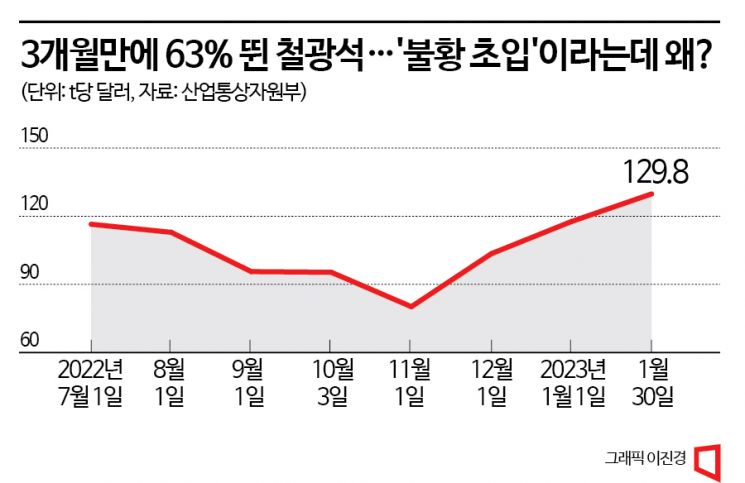

As of the 2nd, the international iron ore (Fe 62%) price stands at $129.8 per ton. This is about a 63.2% increase from $79.5 per ton on October 31 last year. After the Russia-Ukraine war broke out last year, iron ore prices surged to around $160 per ton. However, concerns over a global economic slowdown in the second half of the year led to repeated declines, dropping to $79 per ton.

Iron ore is a mineral essential for producing steel, the foundation of industry. When iron ore prices rise, steel prices also increase accordingly. Industries using steel?such as automotive, shipbuilding, construction, machinery, home appliances, and fabricated metal products?face higher production costs. Downstream industries including raw materials, power, LNG (liquefied natural gas), energy, construction, machinery, and logistics are also affected by steel prices. Thus, iron ore prices influence costs across the entire industrial sector. Iron ore prices are considered one of the representative leading economic indicators.

The recent rise in iron ore prices is largely due to China's reopening (resumption of economic activities). China produces 43% of the world's iron ore and consumes 70%. A large volume is used in manufacturing and infrastructure construction within China, known as the 'world's factory.' This is why China's economic fluctuations have a significant impact on iron ore and steel prices.

Additionally, speculative forces within China have distorted international iron ore prices through hoarding and price collusion. The National Development and Reform Commission (NDRC) of China announced an unusual iron ore market stabilization policy three times on the 6th, 14th, and 18th of this month and cracked down on illegal activities, but failed to stabilize prices.

The problem is that China's 'stretching' could fuel inflation. Kim Woong, Director of the Research Department at the Bank of Korea, cited China's reopening as a major risk factor for the global supply chain at the 1st Bank of Korea (BOK) - Korea Chamber of Commerce and Industry (KCCI) seminar. Kim analyzed, "While reopening will have a significant effect on stimulating the global economy, it will also act as an upward factor by expanding raw material demand in terms of inflation in major countries."

The steel industry's concerns are deepening as well. Originally, rising raw material prices such as iron ore led to higher steel product prices, positively impacting the steel industry's performance. However, during a recession, raising steel product prices can lead to decreased demand. Nonetheless, steelmakers like POSCO expect iron ore prices to peak in the first quarter of this year and then decline and stabilize in the second half. Seo Ji-hyun, Head of Raw Materials Division 1 at POSCO, said in a conference call last month, "Apart from China's reopening, there are no factors to increase iron ore demand, and with the recovery of Brazil's Vale mines, iron ore supply is expected to increase by more than 14 million tons." She analyzed, "In the second half, global supply will increase, leading to a downward stabilization of iron ore prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)