Companies Complain "Audit Fees Increasing Burden"

Financial Authorities Push to Ease Current '6 Years Voluntary + 3 Years Designated' Rule

Differences Among Accounting Firms... '6+2' Method Likely Selected

[Asia Economy Reporter Lee Seon-ae] The 'Periodic Auditor Designation System,' which requires companies to change their auditors periodically, is expected to be eased after more than four years of implementation. However, intense negotiations are anticipated as companies and the accounting industry clash over the extent of the easing.

According to the Financial Services Commission and the accounting industry on the 2nd, the Korean Accounting Association will hold a symposium titled 'Evaluation and Improvement Measures of Accounting Reform System' on the 10th at the Federation of Korean Industries building in Yeouido, Seoul. Although this event is to disclose the results of a research project commissioned by the Financial Services Commission, it is essentially a public hearing. After the Korean Accounting Association's keynote presentation, discussions will be held involving the Korea Listed Companies Association, accounting firms, and the Korean Institute of Certified Public Accountants. The Financial Services Commission stated, "We plan to announce the final plan reflecting the research results presented that day and the opinions of various stakeholders." The final plan is expected to be released in the first half of the year.

The industry's greatest interest lies in the degree of easing of the Periodic Auditor Designation System. This system was introduced under the amended External Audit Act (New External Audit Act), which came into effect in November 2018. If a company freely appoints an auditor for six consecutive years, it must have an auditor designated by the financial authorities for the next three years. This was implemented from 2019 after a full revision of the External Audit Act following the 2015 accounting fraud scandal at Daewoo Shipbuilding & Marine Engineering to enhance accounting transparency and reliability.

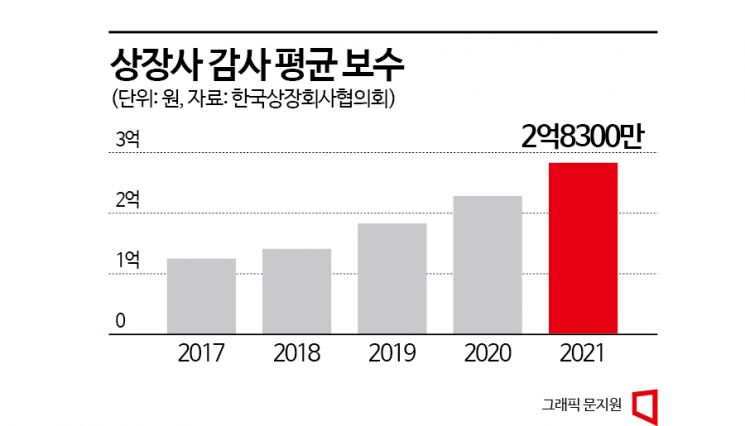

Although the introduction of the Periodic Auditor Designation System has been credited with improving accounting transparency, companies have expressed dissatisfaction due to significantly increased audit time and fees, demanding improvements to the system. According to data from the Korea Listed Companies Association, the average audit fee for domestic listed companies rose from 125 million KRW in 2017 to 283 million KRW in 2021, more than doubling. The annual average growth rate reached 20%. The industry claims this figure is not unrelated to the implementation of the periodic auditor designation system. Since companies must pay audit fees as demanded by the government-designated accounting firms, they feel a considerable burden. Some companies even saw audit fees surge more than 18 times after contracting with designated accounting firms. For example, fees increased from 23 million KRW in 2020 to 422 million KRW in 2021.

Moreover, companies argue that accounting transparency has not been secured. According to the International Institute for Management Development in Switzerland, South Korea ranked last (63rd out of 63 countries) in accounting transparency in 2017. Although it rose to 46th in 2020, it fell back to 53rd in 2021. Consequently, economic organizations mainly composed of small and medium-sized enterprises have called for the abolition of the system. The Korea Federation of SMEs and the Korea Federation of Medium-sized Enterprises criticized it as a "Galapagos regulation," arguing that excessive intervention in the audit market infringes on corporate autonomy and distorts market functions.

The financial authorities currently view the '6+3' system (6 years of free appointment and 3 years of designated appointment) as excessively increasing the burden on companies and believe easing is necessary. Accordingly, they are considering system improvements by extending the free appointment period or reducing the designated audit period. The Korean Accounting Association, which conducted the Financial Services Commission's research project, is seriously considering two alternatives to the current '6+3' system: a '9+3' system where companies freely appoint auditors for 9 years followed by 3 years of designated audit, and a '6+2' system with 6 years of free appointment followed by 2 years of designated audit.

Companies welcome these easing moves, but the accounting industry shows discomfort. However, there is no unified voice. The Big Four accounting firms (Samil PwC, Samjong KPMG, Deloitte Anjin, EY Han Young) are taking a wait-and-see approach, believing the system changes will have no impact. On the other hand, small and medium-sized firms argue that easing is unnecessary as the system has not been in place for long. They insist that the '6+3' system should be maintained to uphold the purpose of strengthening audit independence. A representative of an accounting firm said, "The Periodic Auditor Designation System was difficult to establish, and it is not reasonable to ease it so soon after implementation," adding, "Since accounting is important, the free appointment period should rather be reduced by even one year from six years."

However, medium-sized firms seem to have stepped back, judging that opposing the financial authorities' emphasis on easing is futile. They favor the '6+2' alternative over '9+3' and are leaning toward accepting the proposal.

Park Yoon-jong, CEO of Anse Accounting Firm, said, "Since forced designation for three years in an era of free contracts is itself a communist socialization concept, easing is appropriate, but for accounting transparency, leaving it completely free is problematic, so forced designation is also necessary," adding, "Ultimately, the current cycle must be carefully decided, and as a compromise between companies and accounting firms, 6+2 is better." He continued, "Nine years is too long to provide checks and balances and to secure accounting transparency," and added, "If the free appointment period is kept at six years, a two-year designated period is a reasonable compromise for both sides."

Besides easing the Periodic Auditor Designation System, the reduction of reasons for ex officio designation may also become an issue. Ex officio designation is a system where the financial authorities directly designate auditors when a fair audit is necessary. The New External Audit Act added companies with deteriorating financial conditions and frequent changes in major shareholders or CEOs among listed companies to the ex officio designation targets. Accordingly, ex officio designation applies to companies that are ▶ about to be listed ▶ under audit inspection ▶ have not appointed an auditor ▶ fail financial criteria (such as debt ratio exceeding 200%) ▶ have inadequate internal accounting control systems ▶ have experienced embezzlement or breach of trust.

There is also significant conflict between companies and accounting firms over this. Companies view auditor appointments through ex officio designation as a factor driving up audit costs, not just the periodic auditor designation system. Accounting firms argue that reducing the reasons for designation would be problematic for securing transparency. Before the introduction of the New External Audit Act in 2017, the proportion of designated audits among listed companies was 8.4%, but it surged to 52% in 2021.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.