Less Rise Compared to KOSPI, Additional Upside Appeal

Focus on Interest Rate Cuts and Government REITs Activation Policy

[Asia Economy Reporter Minji Lee] Although interest rates remain high, market interest rates have been declining since peaking at the end of last year. With the stock market rebounding throughout January, supported by falling interest rates and the won-dollar exchange rate, interest in income-generating assets that can stably generate cash flow is also growing. Market experts advise paying attention to REITs, whose interest rate sensitivity is decreasing and which are expected to benefit from government revitalization measures.

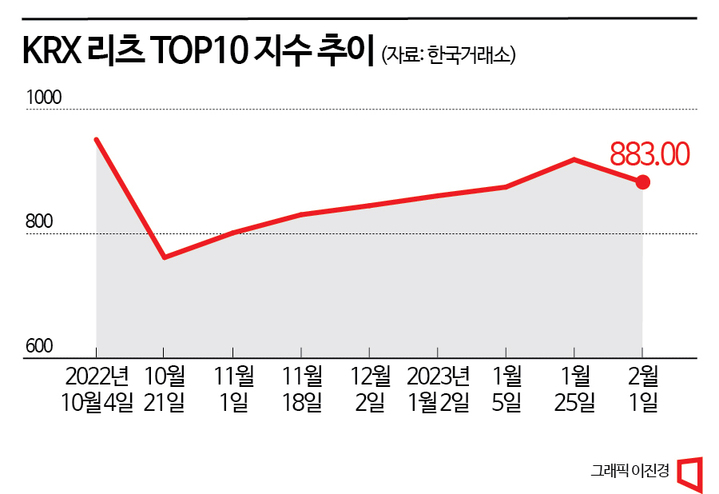

According to the Korea Exchange on the 1st, the KRX REITs TOP10 Index rose 3.07% since the beginning of the year. Considering that the KOSPI increased by 9.54%, from 2236.40 to 2449.80 during the same period, the REITs-related index showed a smaller gain compared to other stocks. During this period, foreign investors focused on the possibility of the U.S. Federal Reserve (Fed) halting interest rate hikes and the low price appeal of domestic stocks, buying large-cap KOSPI stocks centered on semiconductors and secondary batteries. REIT stocks also showed a slight upward trend amid expectations of interest rate cuts but were somewhat sidelined during the sharp market rally.

However, experts believe the investment appeal of REIT stocks will increase. Above all, the trend of declining interest rates is becoming more solid. In October last year, the KRX REITs TOP10 Index plummeted by more than 16% in just one month. This was due to concerns over interest rates caused by the central bank’s aggressive tightening policies and the Legoland incident. In fact, NH All One REIT and Lotte REIT fell by more than 35% and 27%, respectively, after news emerged that they were struggling with refinancing.

The situation has changed since the beginning of this year. As the troubled REITs resolved refinancing issues and market interest rates showed a downward trend, refinancing concerns are considered to have disappeared. The 3-year financial bond (AAA) interest rate, which serves as the collateral loan benchmark for institutional investors, soared to 5.3% in October last year but recently dropped to the 3.8% range.

Researcher Sangyoung Bae of Daishin Securities explained, “Although the interest cost savings cannot be said to be large relative to total sales, the peak of REITs’ borrowing costs has passed,” adding, “If the market interest rate decline trend continues and no unexpected issues arise, the senior loan interest rates for high-quality assets could also decrease further.”

In the long term, attention should also be paid to the government’s announcement of REIT improvement measures. Earlier last month, the government allowed fundraising through corporate commercial paper (CP) issuance to revitalize the REIT market, which has been struggling due to the real estate market downturn. It also revised regulations to enable excess dividends for indirect investment REITs investing in real estate investment companies. Additionally, improvement measures were prepared to allow the emergence of healthcare REITs, which exist overseas but not domestically. Experts commonly agree that these measures have enhanced REIT competitiveness by diversifying investment assets and facilitating fundraising.

If you are considering investing in REITs, it is worth approaching stocks that hold stable office assets even during economic recessions. The key is whether stable dividend income can be received from these assets through inflation-linked rents, etc. Researcher Sera Park of Shin Young Securities said, “It is important to examine whether cash flow can be stably maintained, and the attractiveness by asset type ranks as Office (CBD) > Retail > Hotel > Logistics Center,” adding, “Dividend yields are relatively high for NH All One REIT and iREITs Co-KREIT.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.