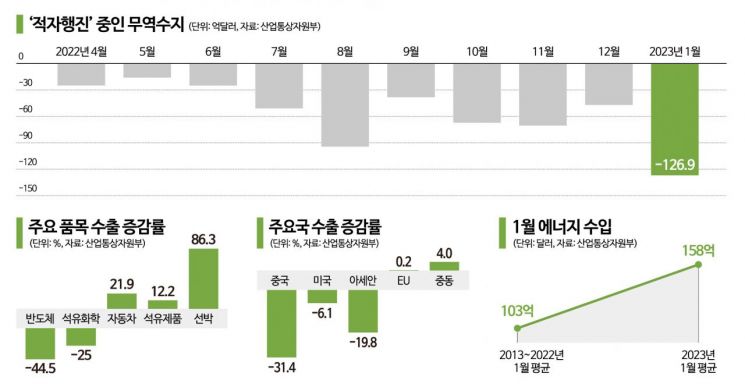

[Asia Economy Sejong=Reporter Dongwoo Lee, Sejong=Reporter Junhyung Lee] The trade deficit in the first month of the new year has approached $12.7 billion. This amounts to 27% of last year's annual trade deficit ($47.467 billion). Exports to China have been declining for eight consecutive months. With energy prices continuing to soar and the "semiconductor winter" compounding the situation, it is expected that a turnaround to a trade surplus will not be easy in the near future.

According to the Ministry of Trade, Industry and Energy on the 1st, the trade balance for January this year recorded a deficit of $12.69 billion. This is $3.23 billion more than the record monthly trade deficit of August last year (-$9.435 billion). Exports fell sharply by 16.6% year-on-year to $46.27 billion, while imports decreased by only 2.6% to $58.96 billion. Compared to the previous month's trade balance (-$4.69 billion), the deficit nearly tripled.

Trade Deficit for 10 Consecutive Months

The trade balance has been in a deficit streak for 10 consecutive months since April last year. As a result, last year alone saw a trade deficit of $47.467 billion. However, the trade deficit accumulated in just one month this year (January's $12.69 billion) accounts for about 27% of last year's annual trade deficit. This is also the first time since trade statistics began in 1956 that the monthly trade deficit has exceeded $10 billion. This indicates that the trade deficit is rapidly expanding at an alarming rate.

The ongoing record-level trade deficit is largely due to the sharp rise in energy prices. In January this year, energy imports including crude oil, gas, and coal amounted to $15.8 billion, accounting for 26.8% of total imports ($58.96 billion). This is $5.5 billion more than the average energy import amount in January over the past 10 years from 2013 to 2022 ($10.3 billion). Energy import amounts have recently exceeded $15 billion every month. This is due to the surge in energy prices caused by supply chain instability triggered by the Ukraine war last year.

To make matters worse, exports have also fallen into a "negative growth swamp." Exports have been in negative growth for four consecutive months since October last year. In fact, last month's export decline (-16.6%) was the largest decrease in 2 years and 9 months since April 2020 (20%) during the early spread of COVID-19. This is analyzed as an effect of global economic slowdown due to high inflation and high interest rates. A Ministry of Trade, Industry and Energy official explained, "The base effect from last January's record-high export performance among all Januaries also partially influenced the export decline."

The background behind the collapse of exports, which have been a pillar of the Korean economy, is complex. However, the deterioration of trade with China, which has played the role of Korea's "dollar box," is considered a major cause. Last month, exports to China were $9.17 billion, down 31.4% from $13.37 billion a year earlier. This was due to shrinking exports of major items such as semiconductors (-46.6%), petrochemicals (-22%), and general machinery (-42.7%). Exports to China have thus declined for eight consecutive months since June last year.

'Flagship Product' Semiconductors Also Unstable

Semiconductors, the "flagship product" of exports, are also in a precarious position. Last month, semiconductor exports were $6 billion, a sharp drop of 44.5% compared to $10.8 billion in the same period last year. The Ministry of Trade, Industry and Energy attributes the significant decrease in semiconductor exports to the continued decline in prices of major products such as DRAM. In fact, the fixed price of DRAM fell from $3.41 during January to April last year to $1.81 in January this year, a drop of $1.6. The export price index for memory semiconductors has also been declining since June last year.

Of course, Korea is not the only country suffering export setbacks. According to the Ministry, China's exports have been declining for three consecutive months since October last year. Japan also experienced nine consecutive months of negative export growth from April to December last year. Taiwan's exports have also been in negative growth since the second half of last year. Initially, Taiwan showed high export growth in the first half of last year due to its semiconductor-centered export structure.

The problem lies in the outlook. While exports have contracted due to economic slowdown, imports continue to increase steadily due to soaring energy prices. According to the "December 2022 and Annual Industrial Activity Trends" released by Statistics Korea on the 31st, the leading index cyclical component, which predicts future economic conditions, fell by 0.5 points from the previous month, marking the largest drop in 12 years. The leading index has been declining for six consecutive months since July last year.

The government's sense of crisis is growing. This is why Ahn Deok-geun, head of the Ministry of Trade, Industry and Energy's Trade Negotiations Bureau, held an "Emergency Export Situation Check Meeting" this afternoon. Minister of Trade, Industry and Energy Lee Chang-yang said, "The large-scale trade deficit can act as a burden on our economy," adding, "In the ongoing situation of external uncertainty, the government will concentrate all support capabilities and mobilize all export support measures to overcome export sluggishness."

Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho said at a fiscal, economic, and financial officials meeting held at the aT Center in Yangjae-dong, Seoul, this morning, "Although various variables will affect the trade balance in the future, seasonal factors will diminish after January, and the effect of China's reopening will be reflected with a time lag, so gradual improvement is expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)