Samsung Electronics Semiconductor Faces Estimated Q1 Loss of Over 2 Trillion Won

SK Hynix Actively Reduces Investment

[Asia Economy Reporters Sunmi Park, Yeju Han, Pyeonghwa Kim] As the severe semiconductor winter continues and memory prices keep falling, the industry's earnings have entered a loss phase. This is the background behind major players choosing to reduce wafer supply to curb oversupply, which is the cause of the price decline. Samsung Electronics aims for a practical reduction effect through line maintenance and equipment relocation rather than artificial production cuts.

On the 1st, market research firm DRAMeXchange reported that the average fixed transaction price of PC DRAM general-purpose products (DDR4 8Gb 1Gx8) in January fell 18.10% from the previous month to $1.81. After a sharp drop of 22.46% to $2.21 in October last year, prices have again fallen significantly.

The average fixed transaction price of NAND general-purpose products for memory cards and USB (128Gb 16Gx8) in January was $4.14, unchanged from the previous month. After prices continuously fell from June to October last year, there has been no sign of recovery. The fixed transaction price refers to the contract transaction amount between semiconductor manufacturers and IT companies and is a key indicator for monitoring the semiconductor market situation.

The market expects memory prices to continue declining this year. Although prices were adjusted downward once due to last year's sluggish market conditions, the bottom has not yet been reached. Market research firm TrendForce forecasts that DRAM and NAND prices will fall by 20% and 10%, respectively, in the first quarter.

On the 31st, when Samsung Electronics announced its consolidated Q4 results with sales of KRW 70.4646 trillion and operating profit of KRW 4.3061 trillion, this is the exhibition hall inside the Samsung Seocho Building in Seocho-gu, Seoul. Samsung Electronics' annual performance recorded sales of KRW 302.2314 trillion and operating profit of KRW 43.3766 trillion. Compared to the previous year, sales increased by 8.09%, but operating profit decreased by 15.99%. Photo by Hyunmin Kim kimhyun81@

On the 31st, when Samsung Electronics announced its consolidated Q4 results with sales of KRW 70.4646 trillion and operating profit of KRW 4.3061 trillion, this is the exhibition hall inside the Samsung Seocho Building in Seocho-gu, Seoul. Samsung Electronics' annual performance recorded sales of KRW 302.2314 trillion and operating profit of KRW 43.3766 trillion. Compared to the previous year, sales increased by 8.09%, but operating profit decreased by 15.99%. Photo by Hyunmin Kim kimhyun81@

The reason memory prices keep falling is related to increasing inventory. Despite a decline in IT demand due to the global economic downturn, supply has continued, causing inventory to accumulate in the market. The industry estimates that inventory has surged more than threefold compared to before, with stockpiles covering 3 to 4 months of supply.

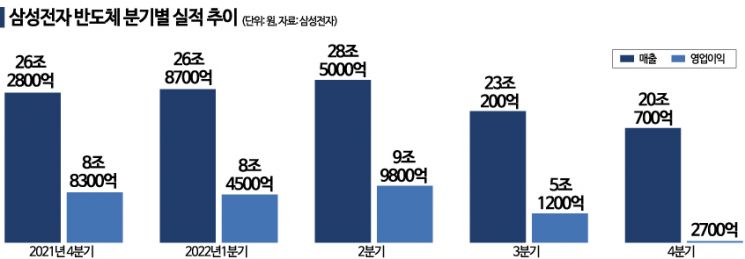

As memory prices decline, industry profitability is also deteriorating. The earnings downturn for domestic and international companies that began in the third quarter of last year continued into the fourth quarter. Samsung Electronics announced that its semiconductor (DS division) operating profit for the fourth quarter of last year was 270 billion KRW, a sharp drop of 96.94% compared to a year earlier. The memory business in the DS division is effectively operating at a loss. SK Hynix, which announced its earnings on the same day, confirmed an operating loss for the first time in 10 years.

In the securities industry, it is expected that semiconductor companies' first-quarter earnings this year will be even worse. Samsung Electronics, which barely avoided losses, is estimated to post operating losses in the 2 trillion KRW range in the first quarter. NH Investment & Securities forecasts a first-quarter loss of about 2.76 trillion KRW, while Kiwoom Securities projects 2 trillion KRW. Mirae Asset Securities predicts that SK Hynix will continue to incur losses throughout this year.

TrendForce believes that to stop the downward trend in memory prices, the industry needs to expand production cuts. Major players have already announced investment reductions and production cut plans. SK Hynix plans to reduce investment by more than 50% compared to last year (19 trillion KRW) and cut production mainly for low-profit products. US-based Micron and Japan's Kioxia have also announced production cuts of 20% and 30%, respectively.

Samsung Electronics maintains its stance that there will be no artificial production cuts such as adjusting wafer input volume but has left open the possibility of practical (technical) production cuts. Dongwon Kim, an analyst at KB Securities, estimates that Samsung's practical production cuts (equipment relocation, enhanced line maintenance, expansion of R&D production capacity within capital investment) will be more effective than artificial cuts (adjusting operating rates, reducing wafer input). He said, "Samsung Electronics stated that its capital investment this year will be similar to last year, but most of the investment is allocated to future investments (EUV, infrastructure) unrelated to memory supply this year," adding, "In fact, memory semiconductor capital investment this year will decrease by 13% compared to last year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.