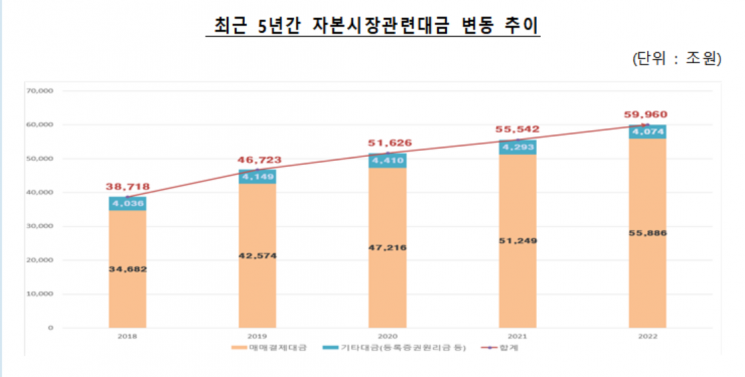

[Asia Economy Reporter Minji Lee] The Korea Securities Depository (KSD) announced on the 1st that the capital market-related funds processed through the KSD last year amounted to 599.6 quadrillion won, an 8% increase compared to the previous year (555.42 quadrillion won). The average daily processed amount was 243 trillion won, approximately 1.7 times higher than five years ago (2018, 142 trillion won).

Capital market-related funds refer to the funds processed in connection with the KSD's operations in the capital market. The scale of capital market-related funds was composed of trading settlement funds for stocks and bonds at 558.86 quadrillion won (93.2%), registered securities principal and interest (short-term bonds, CP, ELS, DLS, etc.) at 230.2 trillion won (3.8%), and collective investment securities funds (fund subscription and redemption funds, etc.) at 127.6 trillion won (2.1%), in that order.

Among the trading settlement funds, over-the-counter (OTC) Repo settlement funds accounted for the largest portion at 491.17 quadrillion won (87.9%). This was followed by bond institutional settlement funds at 573.1 trillion won (0.6%), stock institutional settlement funds at 34.6 trillion won (0.6%), and on-exchange stock settlement funds at 16.9 trillion won (0.3%).

Among these, OTC Repo settlement funds increased by 11.2% compared to last year (441.71 quadrillion won). Bond-related settlement funds decreased by 2% during the same period, and stock-related settlement funds of 51.5 trillion won declined by about 26%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.