Sale by Hyosung Heavy Industries, SK Chemicals, OCI, POSCO International, etc.

Reflecting positive factors such as strengthened shareholder returns and strong ramen exports

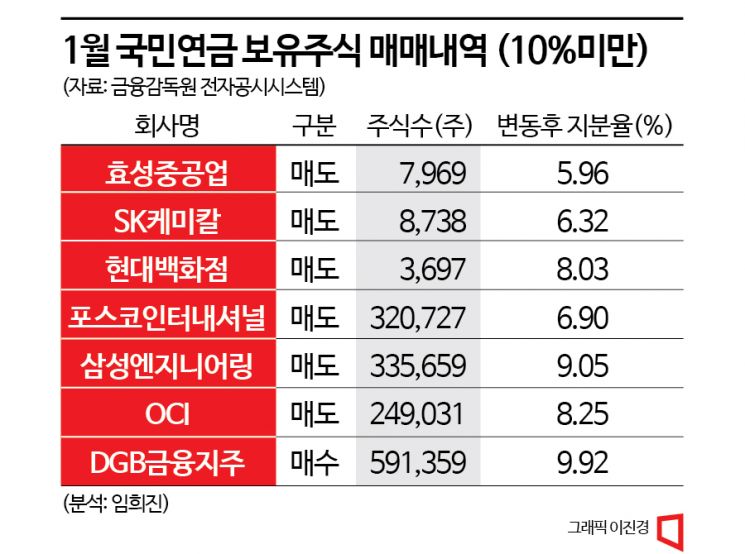

[Asia Economy Reporter Park So-yeon] The National Pension Service (NPS) has been steadily selling off domestic stocks this year. Major targets included 'heavy and chemical' stocks such as KT, which the NPS is pressuring for corporate governance improvement, as well as Hyosung Heavy Industries, SK Chemicals, OCI, POSCO International, and Samsung Engineering.

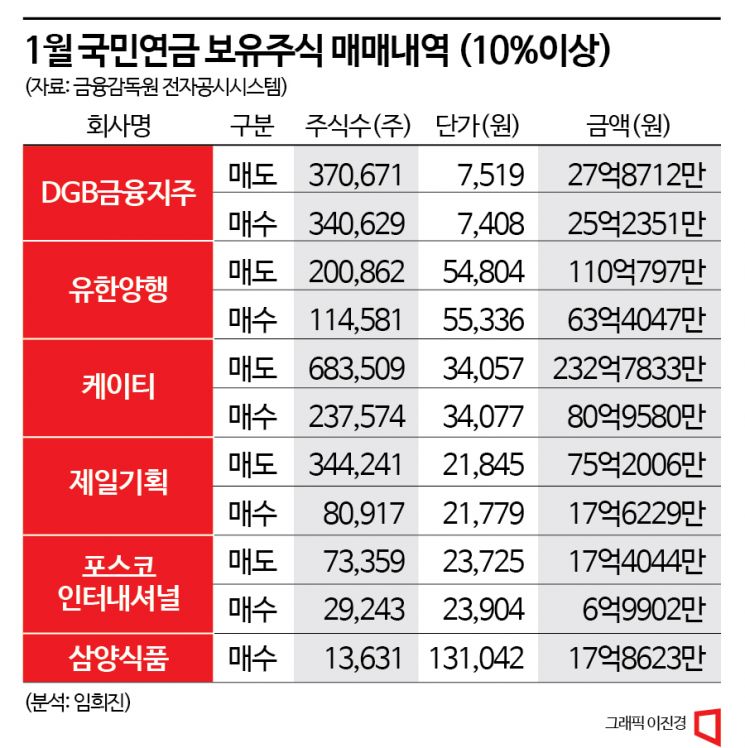

According to financial information provider FnGuide and the Financial Supervisory Service's electronic disclosure system on the 1st, the NPS net sold KT shares worth 15.182 billion KRW (445,935 shares) over one month this year. As a major shareholder and institutional investor, the NPS is pressuring KT, a widely held company, to improve its corporate governance by exercising its shareholder rights.

Due to the NPS's selling pressure, KT's stock price fluctuated from the beginning of the year. On the 2nd, when the NPS sold 355,319 shares, KT's stock price dropped 1,300 KRW (3.85%) from the previous trading day to 32,500 KRW, but it recovered to 35,050 KRW by the closing price on the 31st.

This year, the NPS showed heavy selling particularly in 'heavy and chemical,' heavy industries, and construction sectors. The most notable sell-offs were in Samsung Engineering and POSCO International. Both companies showed remarkable performance improvements, which boosted their stock prices. The NPS realized profits by selling large volumes during the upward trend.

On the 17th of last month, the NPS sold 335,659 shares of Samsung Engineering common stock at 24,200 KRW per share, totaling approximately 8.12295 billion KRW. After the sale, its stake stands at 9.05%. Samsung Engineering recorded its highest annual performance in 10 years last year.

POSCO International also sold 348,647 shares at 22,550 KRW per share in a single transaction. The amount was about 7.86199 billion KRW, and the stake after the sale is 6.9%. Recently merged with POSCO Energy, POSCO International surpassed 1 trillion KRW in combined operating profit for the first time in history.

While Samsung Engineering and POSCO International sold during the upward trend ahead of earnings announcements, OCI experienced a significant rebound after the NPS recovered its investment. The NPS sold 249,031 shares of OCI at 78,100 KRW per share, totaling approximately 19.4 billion KRW. OCI's stock price rebounded about 15% from the NPS's selling price at the beginning of the year, closing at 89,800 KRW on the 31st. After the sale, the NPS's stake in OCI is 8.25%.

In addition, the NPS sold 8,738 shares of SK Chemicals at 81,000 KRW per share and 7,969 shares of Hyosung Heavy Industries at 67,100 KRW per share. It also net sold Yuhan Corporation and Cheil Worldwide, worth approximately 4.66758 billion KRW and 5.75765 billion KRW respectively.

The stocks the NPS net bought include DGB Financial Group, which has been gaining attention recently for its shareholder return policies and is on an upward trend. The pension fund net purchased 561,317 shares of DGB Financial Group and 13,631 shares of Samyang Foods (worth approximately 1.786 billion KRW). DGB Financial Group's stock price rose 20% from its lowest point at the end of last year (6,630 KRW) to 7,950 KRW as of the closing price on January 31. Samyang Foods is expected to improve its performance this year despite domestic demand decline, thanks to increased overseas exports of ramen. Samyang Foods accounts for 60% of Korea's ramen exports. The export ratio of Samyang Foods' sales first exceeded 50% in 2019 (52.39%), then rose to 58.64% in 2020, 61.61% in 2021, and reached 67.26% by the third quarter of last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.