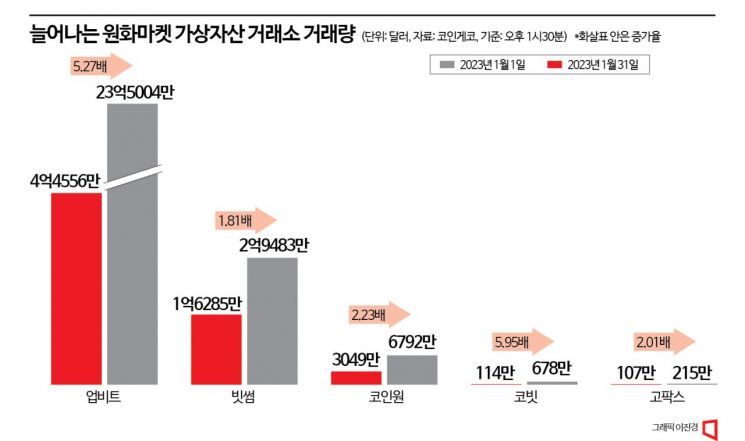

Upbit Trading Volume Surges 5.27 Times... Bithumb Also Up 1.81 Times

Exchange Concentration Phenomenon Intensifies

[Asia Economy Reporter Lee Jung-yoon] Recently, as the virtual asset market has revived, the trading volumes of major domestic exchanges operating the Korean won market have also significantly increased. Exchanges that suffered performance declines during last year's so-called 'crypto winter,' when major coin prices including Bitcoin continued to weaken, have been able to ease their concerns thanks to the rise in trading volumes.

According to CoinGecko, a virtual asset market relay site, Upbit, which holds the number one share in domestic coin trading, recorded an average daily trading volume of $2.35004 billion (approximately 2.892 trillion KRW) as of 1:30 PM on the 31st. This represents a 5.27-fold surge compared to the trading volume of $445.56 million at the same time on the 1st of this month.

Other exchanges also experienced increases in trading volume during the same period. Bithumb's volume rose from $162.85 million to $294.83 million, an increase of 1.81 times. Coinone's volume grew from $30.49 million to $67.92 million, a 2.23-fold increase, and Korbit's surged from $1.14 million to $6.78 million, a 5.95-fold jump. Gopax also saw its trading volume approximately double.

The increase in trading volumes at major domestic exchanges is attributed to the rise in virtual asset prices amid expectations that the U.S. Federal Reserve (Fed) will slow the pace of interest rate hikes. On this day, Bitcoin traded at around $22,800, more than 37% higher than on the 1st of this month. Ethereum also rose by about 31%. The significant increase in trading volumes of well-known coins such as Bitcoin and Ethereum, as well as altcoins popular among domestic investors like Ripple and Aptos, also appears to have contributed to the overall volume growth. In the case of Aptos, reports indicated that nearly half of its daily trading volume on the 26th occurred on the domestic exchange Upbit.

With the increase in trading volume, exchanges that struggled with declining sales due to last year's weak virtual asset market are expected to breathe easier. Previously, Dunamu, the operator of Upbit, reported third-quarter sales last year of 271.9 billion KRW, a 66.29% decrease compared to the same period the previous year. Operating profit fell sharply by 76.65% to 168.8 billion KRW, and net profit dropped 72.68% to 159.9 billion KRW. Bithumb's third-quarter sales also decreased by 52.4% to 69 billion KRW. Operating profit was 28.7 billion KRW and net profit was 32.6 billion KRW, down 72.7% and 73%, respectively.

However, despite the increase in trading volumes across exchanges, the concentration of trading volume in Upbit, which boasts an overwhelming market share, has accelerated further. As of the 1st of this month, Upbit's daily trading volume was 2.74 times that of Bithumb, but on this day, the gap widened to 7.97 times. Comparing Upbit and Coinone, the volume difference increased from 14.61 times to 34.60 times.

Experts explain that this concentration of trading volume does not solely imply problems such as monopolization. Professor Hong Ki-hoon of Hongik University's Department of Business Administration stated, "From an investor's perspective, it is advantageous to trade on exchanges with many users and high liquidity," adding, "High liquidity ensures that prices are maintained transparently and competitively without distortion." He further noted, "However, the lack of competition among exchanges could be an issue, but this can be resolved by allowing competitive players such as securities firms to enter the coin market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)