Satellite Communication Overcomes Spatial Limits with 3D Communication

Market to Reach $584.6 Billion by 2040

No Satellite Communication Service in Galaxy S23 Series

[Asia Economy Reporter Lim Hye-seon] This year, overseas private space companies such as SpaceX and OneWeb are flocking to South Korea. Attention is focused on whether the dormant domestic satellite communication market will stretch its wings.

SpaceX and OneWeb Land in Korea

SpaceX, a private space company founded by American Elon Musk, announced that it will start its satellite communication service "Starlink" in South Korea in the second quarter of this year. SpaceX, which is establishing a subsidiary for its entry into Korea, applied for registration as a facility-less telecommunications carrier at the Seoul Radio Management Office under the Ministry of Science and ICT earlier this month. If no domestic facilities are held, the company will use the headquarters' service as is. If a corporation is established in Korea, a supply contract must be signed with the U.S. headquarters, requiring approval of a cross-border supply agreement. Once the cross-border supply agreement approval is obtained, SpaceX will become the first overseas company to enter the domestic market as a global network operator.

OneWeb, headquartered in the UK, is also planning to launch satellite communication services this year in cooperation with Hanwha Systems. They plan to target the satellite internet market mainly with business-to-business (B2B) services. Both companies are preparing related administrative procedures and infrastructure aiming for domestic service launch.

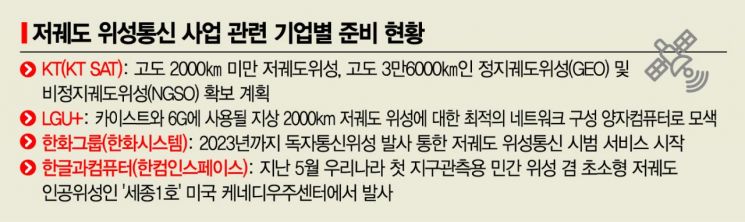

Satellite communication is a three-dimensional communication technology that connects the sky and sea through ground and satellite network connections, overcoming spatial limitations. Satellites are classified into low Earth orbit (LEO), medium Earth orbit (MEO), and geostationary Earth orbit (GEO) satellites. Starlink and OneWeb operate small satellites in low Earth orbit to communicate with the ground. Satellite communication is used in areas with low terrestrial network accessibility such as islands, mountainous regions, and oceans. Major companies include the U.S.'s SpaceX, Blue Origin, Planet Labs; the UK's OneWeb; China's CAST; Japan's i-Space; and Korea's KT SAT.

Market Outlook

The Satellite Industry Association of the U.S. announced that the global satellite industry size was $270.6 billion in 2020. Communication satellites account for about 54% of active satellites. The satellite communication market is expected to grow to $584.6 billion by 2040. Domestic satellite industry sales amount to about 3 trillion KRW, which is only about 1% of the global market. There are a total of 81 satellite broadcasting and communication companies, accounting for 43.5% of total satellite industry sales. Satellite broadcasting and communication companies with sales exceeding 100 billion KRW include KT Skylife, KT SAT, Humax, and Intellian Technologies.

The government is also paying attention to the satellite communication market. The Ministry of Science and ICT announced that new sales in the satellite communication sector will increase by 4.2 trillion KRW over 10 years starting from 2026. The ministry's 590 billion KRW "Low Earth Orbit Satellite Communication Technology Development Project" has entered the first stage of preliminary feasibility study. The Ministry of Science and ICT has applied for a budget of about 590 billion KRW over eight years from 2024 to 2031 to secure core technologies in five areas: communication payload, main body, system and system integration (assembly, launch, operation, etc.), ground stations, and terminal stations. The decision on whether the project will pass is expected in August.

Domestic Impact

The industry believes that the impact of overseas companies in the consumer-to-consumer (B2C) market will not be significant. This is because the speed is slower than domestic optical fiber and the usage fee is also expensive. Starlink currently offers its service in the U.S. at $110 per month (about 136,000 KRW). Also, there are no smartphones in Korea yet that can receive satellite communication services. Apple introduced an emergency SOS service in cooperation with satellite communication operator Globalstar limited to the North American region through the iPhone 14 series. Samsung Electronics' Galaxy S23 series, announced this week, also does not include satellite communication services.

In the business-to-business (B2B) market, where demand for satellite communication is high such as aviation, shipping, and electric vehicle charging station Wi-Fi, competitiveness exists. There is also an aspect of securing leadership in satellite networks in preparation for the 6th generation (6G) era. 6G is the next-generation mobile communication service up to 50 times faster than the currently used 5G. In the 6G era, a completely different communication service combining terrestrial mobile communication and aerial satellite communication will emerge. The communication paradigm itself will change.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)