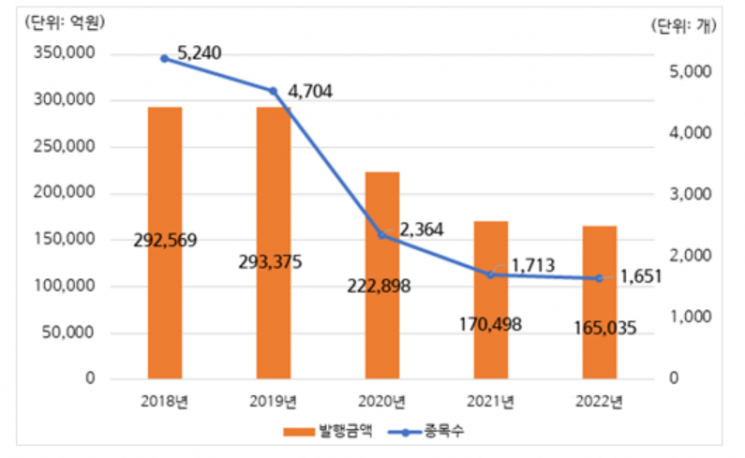

[Asia Economy Reporter Minji Lee] The Korea Securities Depository announced on the 30th that the issuance amount of DLS (including DLB) last year recorded 16.5 trillion won, a 3.2% decrease from the previous year (17 trillion won).

By issuance type, the public offering amount accounted for 59.2% (9.2697 trillion won) of the total DLS issuance amount, and the private placement amount accounted for 43.8% (7.2338 trillion won). The public offering amount increased by 127.3% compared to last year (4.0779 trillion won), while the private placement amount decreased by 44.2% compared to last year (12.9719 trillion won).

By underlying asset, DLS based on interest rates accounted for the largest portion with 12.8355 trillion won (77.8%), followed by credit at 3.591 trillion won (21.8%), and mixed type at 43.6 billion won (0.2%).

By issuing company, Hana Securities had the largest DLS issuance amount at 3.8278 trillion won. The combined DLS issuance amount of the top five companies (Hana Securities, Shinhan Investment Corp., Hanwha Investment & Securities, Samsung Securities, Meritz Securities) was 9.7266 trillion won, accounting for 58.9% of the total DLS issuance.

Last year's DLS redemption amount was 12.3233 trillion won, a 28.5% decrease compared to the previous year. Among the redeemed DLS, maturity redemptions amounted to 9.2 trillion won, accounting for 74.8% of the total redemption amount. Early redemptions amounted to 2.6 trillion won, accounting for 21.3%. The early redemption amount decreased by 65.5% compared to last year (7.6256 trillion won).

The outstanding balance was 32.4306 trillion won, a 17.9% increase compared to last year (27.5206 trillion won).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.