Recovery of 60% of $95.5 Billion Crude Oil Imports Through Exports

Export Strategy Amid Global Demand Increase and Higher Operating Rates

[Asia Economy Reporter Choi Seoyoon] Last year, the export value of petroleum products in the refining industry reached an all-time high. This was due to the continuation of high oil prices amid geopolitical risks and the rise in export unit prices. In response, the refining industry’s strategy to maximize operating rates since the COVID-19 pandemic and focus on product production and export also proved effective.

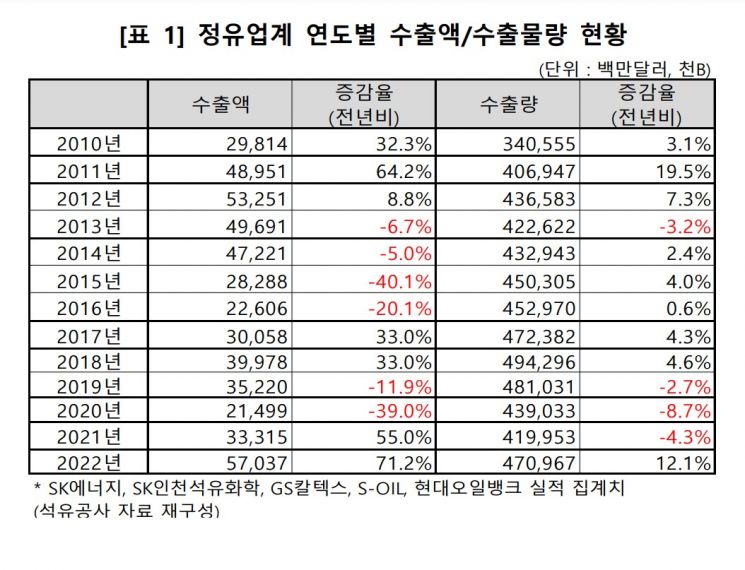

The Korea Petroleum Association (KPA) announced on the 29th that the export value of petroleum products from domestic refiners such as SK Energy, GS Caltex, S-OIL, and Hyundai Oilbank last year was $57.037 billion (approximately 73.74 trillion KRW). This is the highest figure since 2012 ($53.251 billion).

The export value growth rate also recorded 71.2% compared to the previous year, the highest since 2011 (64.2%). In particular, last year, the refining industry’s crude oil import value was $95.45 billion, and about 60% was recovered through petroleum product exports, significantly contributing to the improvement of the national trade balance.

Since 2012, the refining industry has recovered more than half of the crude oil import amount through exports. Last year, the recovery rate also reached an all-time high. As a result, last year’s petroleum product export value ranked second among the country’s major export items announced by the Ministry of Trade, Industry and Energy, rising three places from fifth in 2021.

The sustained high oil prices and rising export unit prices caused by global oil supply disruptions due to the Russia-Ukraine war are cited as factors for the increase in export value. In line with this situation, the refining industry raised the operating rate to a maximum of 79.4% after the pandemic, focusing on product production and export, which also drove the increase in export value.

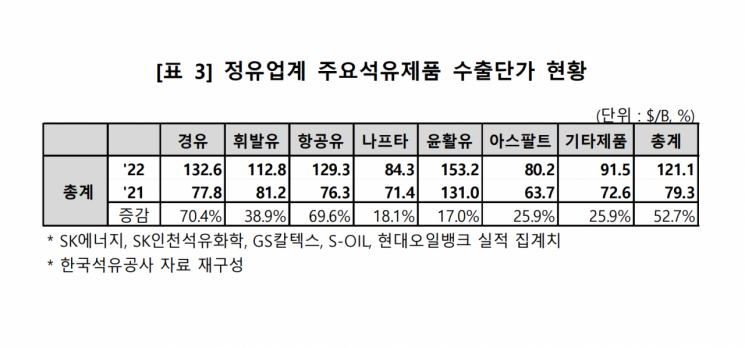

Last year, the export unit price of petroleum products was $121.1 per barrel, an increase of about 53%. The export profitability, calculated by subtracting the crude oil import price from the petroleum product export unit price, recorded $18.5 per barrel, more than doubling compared to $8.7 in 2021, greatly contributing to the improvement of the refining industry’s export structure and business performance. Export volume increased by 12.1% to 471 million barrels. This volume is enough to fill the Sangam World Cup Stadium 31 times.

By product, diesel accounted for the largest share of petroleum product exports at 46.3%. This was followed by gasoline (19.4%), jet fuel (18.0%), and naphtha (4.9%). In particular, jet fuel had the highest export growth rate at 130.8%. The largest export destination was the United States, interpreted as the refining industry actively responding to increased air travel demand after COVID-19.

In fact, the number of passengers at U.S. airports last year, as compiled by the U.S. Transportation Security Administration (TSA), was 756.22 million, a 30.2% increase from the previous year.

The number of export countries increased from 58 in 2021 to 64 in 2022, actively expanding export markets. Based on export value by country, the order was Australia (18.3%), Singapore (12.1%), the United States (8.3%), China (7.9%), and Japan (7.7%).

Australia recorded the largest petroleum product export destination every quarter last year. China had been the largest export partner for six consecutive years since 2016, but due to the zero-COVID policy, export value sharply declined, and the share of exports to China dropped from 20% to 8%.

Meanwhile, exports to Vietnam increased 3.8 times, ranking seventh among export countries and emerging as a major export destination. This was a response to disruptions in crude oil imports and reduced product production at Vietnam’s largest refinery, Nghi Son, last year. Korea ranked second among Vietnam’s petroleum product import countries.

A Korea Petroleum Association official said, “This year, there are mixed factors such as positive export conditions including the EU’s expansion of sanctions on Russian petroleum product exports and increased demand due to China’s easing of quarantine measures, as well as negative factors such as a slowdown in global economic growth. The refining industry will overcome these challenges by exporting high value-added products and diversifying export regions based on excellent refining capabilities.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)