2022 Performance Announcement

[Asia Economy Reporter Choi Seoyoon] POSCO's operating profit has nearly halved compared to a year ago. This is largely due to the suspension of operations at the Pohang Steelworks caused by flooding damage from Typhoon Hin Nam No in September last year. More than half of the POSCO Group's total sales come from the steel business.

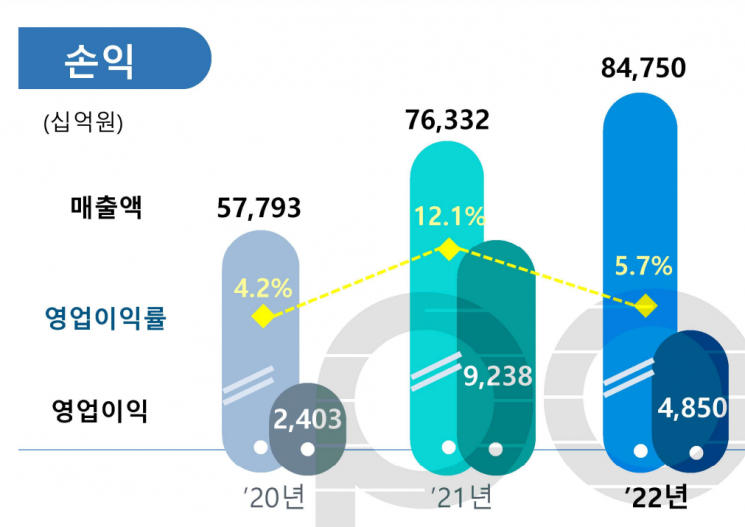

POSCO Holdings announced on the 27th that it recorded sales of 84.8 trillion KRW and an operating profit of 4.9 trillion KRW last year. Sales increased by 11.1% compared to the previous year, while operating profit fell by 46.7%.

The sharp decline in operating profit is due to adverse conditions in the core steel business. POSCO Holdings stated, "Since the second half of last year, domestic and international steelmakers alike have experienced a decline in steel prices and sluggish demand industries. In particular, the flooding of Naengcheon caused by Typhoon Hin Nam No led to a decrease in production and sales volume, one-time recovery costs, and the cargo union strike, which collectively impacted our performance."

During the earnings conference call held that day, Han Youngha, head of POSCO Holdings IR team, said, "If we look only at the fourth-quarter results, we posted an operating loss of 425 billion KRW," adding, "We suffered losses of about 1.7 trillion KRW due to typhoon recovery costs and sluggish sales."

Lee Seongyu, POSCO's Chief Financial Officer, also said, "The operating profit target for last year was 4 trillion KRW. From January to August, we were on track with 3.2 trillion KRW, but the Naengcheon flooding incident caused inventory valuation losses and recovery costs amounting to about 1.3 trillion KRW. Due to poor sales caused by worsening market conditions in the fourth quarter, we incurred an additional loss of about 400 billion KRW, resulting in a total loss of 1.7 trillion KRW."

POSCO received approximately 234 billion KRW in insurance payouts related to this and expects to receive a larger amount this year. Lee said, "The amount received last year is expected to cover about 70% of the estimated flooding damage. This year, we anticipate additional insurance payments exceeding last year's amount, and the specific scope of compensation will be determined around the second half of the year."

To reduce costs and secure liquidity, POSCO has been operating an emergency management task force (TF) for the steel division since the 25th. Through an email addressed to all employees under the name of Vice Chairman and CEO Kim Hakdong, POSCO emphasized, "We must re-examine each task from a zero base, improve processes, save even 1,000 KRW, and overcome the crisis through thorough profit and loss management."

POSCO Holdings expects this year’s performance to strengthen after bottoming out in the fourth quarter of last year. The 17 rolling mills at the Pohang Steelworks were fully normalized from the 20th, and international iron ore and steel prices are rising due to China's reopening. According to market research firm Trading Economics, international iron ore futures prices fell to around $80 per ton in November last year but recently recovered to about $120 per ton. Domestic hot-rolled coil prices in China and the U.S. also rose by 6% and 8%, respectively, compared to a month ago.

The scene of the Pohang Steelworks flooded in the early morning of September 6 last year due to the impact of Typhoon Hinnamnor [Photo provided by POSCO]

The scene of the Pohang Steelworks flooded in the early morning of September 6 last year due to the impact of Typhoon Hinnamnor [Photo provided by POSCO]

It is positive that operating profit from non-steel businesses such as electric vehicle battery materials and lithium increased to about 3.1 trillion KRW. Han explained, "About 47% of the group's investments were allocated to new growth businesses, resulting in a 27% increase in non-steel operating profit compared to last year, and its share of total group operating profit expanded to 35%." He added, "Once production starts at the HY Clean Metal plant in Gwangyang, Jeollanam-do, we will produce materials such as lithium for the first time this year."

POSCO also announced that the first phase of the 25,000-ton project in Argentina is progressing smoothly. Major equipment is scheduled to be installed by the end of this year, with completion planned for April next year. Lee Kyungseop, head of POSCO's secondary battery materials business promotion team, said, "The second phase of the Argentina brine plant was approved by the board last October to be built with a capacity of 25,000 tons. The Gwangyang lithium hydroxide plant has completed corporate establishment, and the third plant in Argentina and the fourth plant in Gwangyang are scheduled to begin construction as planned in June." Lee projected that the price of lithium hydroxide this year will be $68,800 (about 84.86 million KRW) and will remain at around $60,000 to $70,000 (about 74 million to 86 million KRW) in 2025 and beyond.

Choi Jung-woo, Chairman of POSCO Group (center), the Governor of Salta Province, Argentina (left), and the Governor of Catamarca Province commemoratively pose for a photo after completing the groundbreaking ceremony for the first phase of brine lithium in Argentina on March 23 last year.

Choi Jung-woo, Chairman of POSCO Group (center), the Governor of Salta Province, Argentina (left), and the Governor of Catamarca Province commemoratively pose for a photo after completing the groundbreaking ceremony for the first phase of brine lithium in Argentina on March 23 last year. [Photo by POSCO Holdings] [Image source=Yonhap News]

Regarding the European Union's Carbon Border Adjustment Mechanism (CBAM) preparation period starting in October, POSCO expressed "no major concerns." Kim Kyunghan, head of POSCO's Trade and Commerce Office, explained that from October this year to December 2025 is a "transition period" during which there is no obligation to purchase carbon emission allowances. However, there is an obligation to report carbon emissions to the EU government. Kim said, "From 2026, we will be required to purchase emission allowances for the carbon emissions of the volumes we export, but we only need to bear the same level as EU domestic companies, and this will be gradually reduced until 2034. Considering POSCO's carbon reduction capabilities compared to competitors, this could actually be an opportunity."

POSCO also announced it will proceed with additional investment in the third blast furnace at its Indonesian plant. Um Gicheon, head of POSCO's Marketing Strategy Office, explained, "Since the local partner is a state-owned enterprise, financing and decision-making have been slow, causing delays in the 10 million-ton project." When asked if proceeding with construction would increase carbon emissions, Um said, "We are reviewing additional projects of 3 to 4 million tons with the partner, and after that, we plan to handle it with eco-friendly methods such as hydrogen reduction steelmaking or electric methods."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.