Credit Transaction Loan Balance at 16 Trillion Won Level, Same as October Last Year

Current Market Seen Mostly as a 'Short-Term Rally'

[Asia Economy Reporter Kwon Jae-hee] As the stock market has risen sharply this year, the scale of individual investors' 'debt investment (borrowing to invest)' is also increasing. Despite the high interest rates on margin loans reaching 10% due to rising market interest rates amid global tightening, debt investment is increasing, raising concerns. In particular, the securities industry predominantly views the current market as a 'short-term rally.' Debt investors may face a double burden of losses from stock price declines as well as high-interest payments.

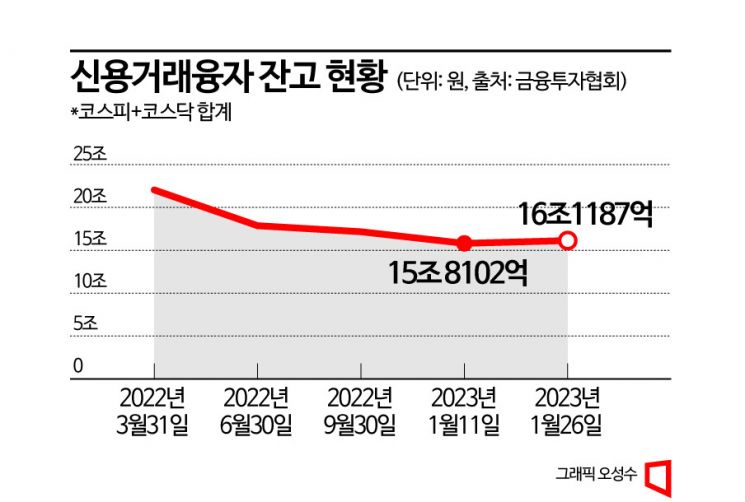

According to the Korea Financial Investment Association, the balance of margin loans (KOSPI + KOSDAQ), which indicates the scale of debt investment, recorded 16.1187 trillion KRW as of January 26. The margin loan balance peaked at 24.9206 trillion KRW at the end of August last year and steadily decreased to the 15 trillion KRW level in early January this year. It has recently increased again to the 16 trillion KRW level, similar to the scale in October last year.

The recent increase in debt investment is due to the domestic stock market's rapid rise in a short period this year. On the first trading day of the year, January 2, the KOSPI started at 2249.95 and dropped to 2180.67 during the session the next day. It then rebounded and rose for nine consecutive trading days. After the holiday, on the 25th, it quickly surpassed the 2400 mark, and on the 27th, it closed at 2484.02, approaching the breakthrough of the 2500 level.

However, the short-term outlook for the stock market is not very bright. The securities industry expects the market to encounter technical resistance due to the rapid rise in a short period. Especially, since the driving force behind the market rise is nothing new, the upward rally is not expected to continue for a long time. Lee Kyung-min, a researcher at Daishin Securities, explained, "The current market is in a phase of reproducing existing expectations, so it is advised not to follow it," adding, "There is nothing new in the rebound momentum." Kim Sung-geun, a researcher at Mirae Asset Securities, also pointed out, "The stock market may continue the rebound trend a bit longer due to expectations about the U.S. Federal Reserve (Fed) and the economy, but caution must be maintained."

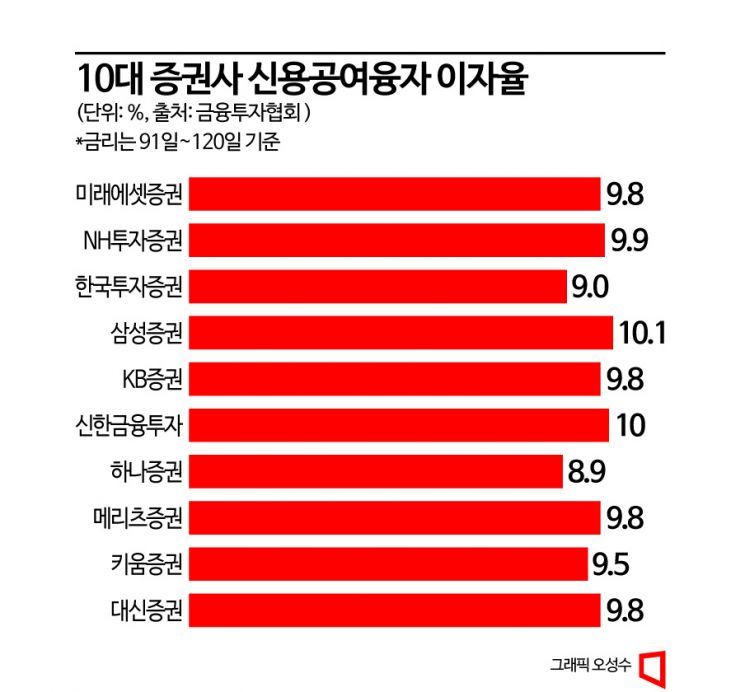

Meanwhile, debt investment is increasing. The bigger problem is that the interest rates on margin loans provided by securities firms are high, in the 9-10% range. As of the 27th, the average interest rate on margin loans (91-120 days basis) at the top 10 securities firms was 9.66%. These include Mirae Asset Securities at 9.8%, NH Investment & Securities at 9.9%, Korea Investment & Securities at 9.0%, Samsung Securities at 10.1%, KB Securities at 9.8%, Shinhan Investment Corp. at 10%, Hana Securities at 8.9%, Meritz Securities at 9.8%, Kiwoom Securities at 9.5%, and Daishin Securities at 9.8%.

Debt investment involves betting on stock price increases, but if stock prices fall, forced liquidation through margin calls may occur. Leveraged funds, including margin trading, contribute to liquidity supply and stock price momentum in a bull market, but in a bear market, they can trigger forced sales, exacerbating stock price declines. Investors may suffer losses from stock price drops as well as the burden of high-interest payments, resulting in double losses.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)