No Clear Momentum Such as R&D or New Drug Exports

Stock Price Has Fallen for 2 Years, Increasing Price Merit

[Asia Economy Reporter Minji Lee] Although the domestic stock market has shown a notable upward trend since January, pharmaceutical and bio stocks have been left behind. This is due to the high-intensity tightening policies continuing since last year, which have cooled investor sentiment toward the bio industry, coupled with the lack of any special momentum?such as research and development (R&D) breakthroughs or new drug exports?that could boost stock prices and earnings.

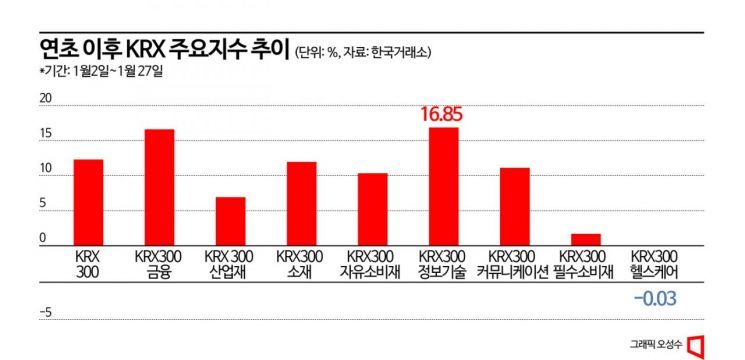

According to the Korea Exchange, from the beginning of the year until the 27th, the KRX300 Healthcare Index calculated by the Korea Exchange fell slightly by 0.03%, from 2298.81 to 2298.05. During the same period, the KRX300 Index rose by more than 12.28%, and all major KRX indices saw significant gains, but the Healthcare Index alone recorded a decline. The Healthcare Index has been on a downward trend for the past two years. Since touching the 4800 mark in November 2020, it has plummeted by more than 50% due to interest rate hike issues and the absence of mid- to long-term growth strategies.

Earlier this month, the JP Morgan Healthcare Conference, known as the "Bio Olympics," was held in person for the first time in three years, yet domestic pharmaceutical and bio stocks remained quiet. The JP Morgan Healthcare Conference is a gathering where pharmaceutical and bio companies and investors from around the world discuss licensing, investments, and mergers and acquisitions (M&A) of new drug development companies. Every year during the conference season, domestic pharmaceutical and bio companies’ stock prices have tended to rise, reflecting expectations that a ‘jackpot’ investment such as licensing or M&A might occur among participating companies.

In fact, looking at the stock price trends during the in-person conference in 2018, the KRX Healthcare Index surged 33.97% (from December 18, 2017, to January 31, 2018), showing the largest increase among major indices. In 2019, the KRX Healthcare Index rose more than 4.89% (from December 17, 2018, to January 31, 2019). In 2020, it increased by 1.5% (from December 16, 2019, to January 31, 2020), outperforming the KRX300 Index’s fluctuation rate (-1.82%).

At the end of last year, news of technology exports worth 180 billion KRW from Alteogen and technology licensing worth 1.6 trillion KRW from LegoChem Bio was announced, but overall investor sentiment toward the industry did not improve. A financial investment industry official explained, “Although there was some buying interest in certain pharmaceutical and bio stocks at the end of the year due to the in-person conference held after three years, the stock market was dominated by themes such as the robotics industry, driven by the ‘CES 2023,’ the world’s largest electronics and IT exhibition. This is why there were no significant achievements at the conference to revive investor sentiment in the industry.”

Experts diagnose that for pharmaceutical and bio-related companies’ stock prices to gain momentum, expectations of interest rate cuts and visible export achievements by domestic pharmaceutical and bio companies must appear. Considering that there are not many cases of domestic companies producing tangible results after technology licensing, it is analyzed that investor trust in new drug development is not high. It is expected that the high-interest rate impact will gradually ease from the second half of the year.

For investors who want to invest in pharmaceutical and bio companies, it is also analyzed that it is effective to focus on new drug development companies with expected R&D achievements. Kim Tae-hee, a researcher at KB Securities, explained, “Mergers and acquisitions and licensing agreements may become more active around the AACR (American Association for Cancer Research) and ASCO (American Society of Clinical Oncology) conferences in the first half of the year,” adding, “The continuous stock price decline over two years has increased price merit, which is also positive.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.