[Asia Economy Reporter Yoo Hyun-seok] Full-service carriers (FSCs), which lost face to low-cost carriers (LCCs) in international air passenger numbers, are launching a counterattack by increasing flights on European routes.

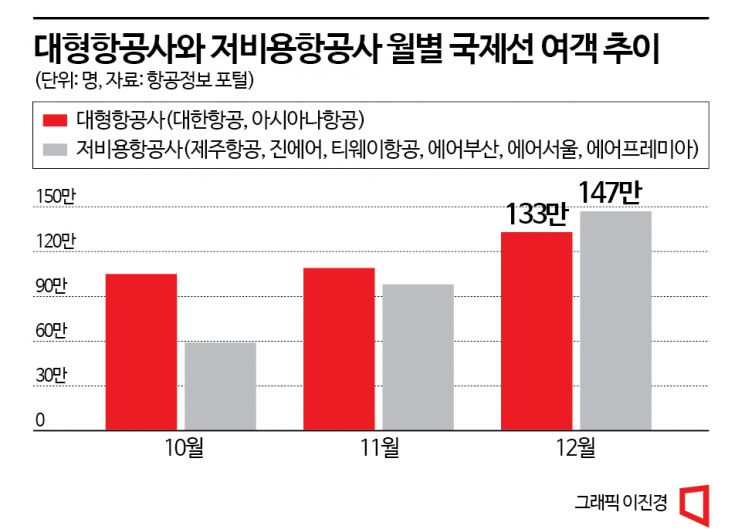

According to statistics from the Ministry of Land, Infrastructure and Transport's aviation information portal system on the 27th, in December last year, the number of international air passengers for LCCs (Jeju Air, Jin Air, T'way Air, Air Busan, Air Seoul, Air Premia) was 1.465 million, surpassing the FSCs (Korean Air, Asiana Airlines) at 1.327 million.

In October last year, LCC international passengers numbered 594,000, which was less than the FSC's 1.047 million. However, with Japan reinstating visa-free entry, LCC international passengers surged significantly. In November, LCCs recorded 983,000 passengers, closing in on the FSC's 1.091 million. As international passengers rapidly increased, LCCs reached 76.34% of the 1.919 million passengers recorded in December 2019.

On the other hand, FSCs have not even recovered half of that. At that time, FSC international passengers reached 2.837 million. FSCs are also increasing flights on medium- and long-haul routes such as Europe to secure passengers. Korean Air will operate Prague and Zurich routes three times a week starting at the end of March, followed by Istanbul and Madrid routes three times a week at the end of April. This is about three years after suspending operations in March 2020 due to COVID-19. Asiana Airlines is also considering increasing flights on London, Paris, Rome, Barcelona, and Istanbul routes starting at the end of March.

The travel industry outlook is also positive. First, the reservation rate for package tours, which reflects overseas travel demand, is increasing. A travel agency official explained, "In February, reservations for Vietnam and Western Europe increased," adding, "From March, package reservations for Western European destinations are increasing due to airlines expanding long-haul flights."

Additionally, the decrease in fuel surcharges is a favorable factor. Fuel surcharges increase proportionally with flight distance, which is one reason why airfares to countries like the U.S. or Europe feel expensive.

The fuel surcharge, which was at level 15 in December last year, dropped to level 12 this month. The same standard will apply next month. In February, Korean Air's international fuel surcharge ranges from 23,400 to 176,800 KRW, down 1,800 to 13,600 KRW from this month's 25,200 to 190,400 KRW. Asiana Airlines' surcharge also decreased by 1,200 to 6,100 KRW to a range of 25,400 to 143,600 KRW. Although the level remains the same, the surcharge decreased slightly due to a drop in exchange rates. As a result, round-trip airfare to London and Paris, which soared to 2.2 million to 3.5 million KRW when fuel surcharges spiked last year, recently dropped to 1 million to 1.5 million KRW. The increase in flights and the reduction in fuel surcharges have had a significant impact.

FSCs also have high expectations for the increase in European flights, as the Americas and Europe account for a large portion of their revenue. As of the third quarter of 2019, Korean Air's passenger route revenue share was 29% for the Americas and 19% for Europe. Asiana Airlines also had 21% for the Americas and 16% for Europe. A representative from a major airline said, "The increase in European flights is expected to be a positive signal for the recovery of long-haul overseas travel demand," adding, "Expanding long-haul routes will positively impact airlines' revenue growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)