Perceived Economy Declines for 5 Consecutive Months

[Asia Economy Reporter Seo So-jeong] As economic uncertainty grows, the domestic corporate sentiment index this month recorded its lowest level in 2 years and 4 months. With high inflation and ongoing economic uncertainty leading to a slowdown in demand, this trend is expected to continue through the first half of this year.

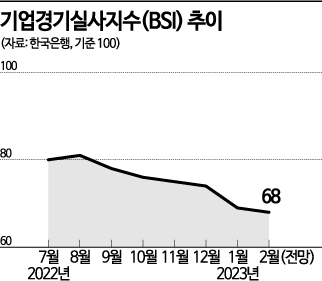

According to the January Business Survey Index (BSI) released by the Bank of Korea on the 27th, the BSI for business conditions across all industries this month fell 5 points from the previous month to 69. The sentiment has worsened for five consecutive months since last August (81), dropping to its lowest level since September 2020 (64). This index reflects corporate executives' judgments and outlooks on current business conditions, with values below 100 indicating poor business conditions. The monthly decline was also the largest since March 2020 (-11 points).

By sector, the manufacturing BSI dropped 5 points from the previous month to 66. Within manufacturing, declines were centered on electronics, video, and communication equipment (-5 points), primary metals (-9 points), and metal processing (-6 points). Kim Dae-jin, head of the Corporate Statistics Team at the Bank of Korea, explained, "The decline in electronics, video, and communication equipment was due to decreased semiconductor demand leading to reduced sales and increased inventory. The rise in raw material prices and the slowdown in upstream industries such as construction, automobiles, and shipbuilding also contributed to the significant drops in primary metals and metal processing." By company size and type, large enterprises (-8 points), small and medium enterprises (-1 point), export companies (-8 points), and domestic companies (-3 points) all reported worsening business sentiment.

The non-manufacturing BSI fell 5 points from the previous month to 71, with declines in information and communication (-14 points), professional, scientific, and technical services (-10 points), and wholesale and retail trade (-3 points). In information and communication, sales decreased due to the disappearance of year-end budget exhaustion effects and seasonal factors such as the winter off-season. The professional, scientific, and technical services sector was sluggish due to reduced demand for professional services and the end of broadcasting advertising demand following the World Cup. Wholesale and retail trade also declined due to weakened consumer sentiment amid sluggish domestic demand.

Both manufacturing and non-manufacturing companies cited uncertain economic conditions as their biggest challenge. Manufacturing companies also pointed to rising raw material prices and weak domestic demand, while non-manufacturing companies cited labor shortages, rising labor costs, and weak domestic demand as management difficulties. Accordingly, the deterioration in corporate sentiment is expected to continue through February. According to the Bank of Korea, the BSI for all industries next month is forecasted to fall 2 points from this month to 68. Kim said regarding future prospects, "With the global economic slowdown and persistently high inflation, downward pressure remains strong."

The Economic Sentiment Index (ESI) for January, which incorporates the Consumer Sentiment Index (CSI) along with the BSI, recorded 90.1, down 1.4 points from the previous month. The ESI reflects the economic sentiment of all private economic agents.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.