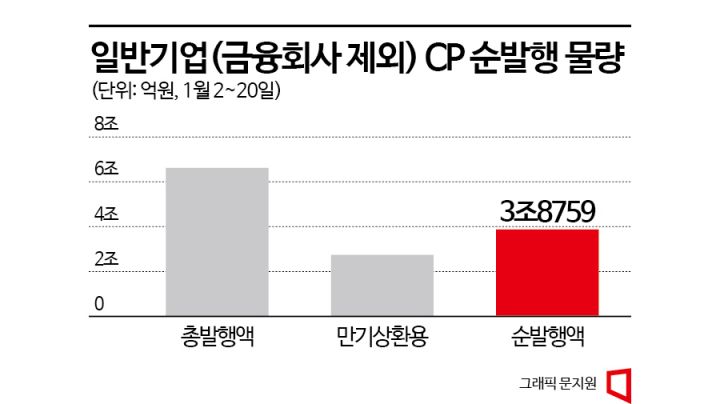

January issuance volume 6.6 trillion won... Over half are new

Lotte Group affiliates use for chemical and construction support

SK, CJ, Hanwha also raise funds through CP issuance

[Asia Economy Reporter Lim Jeong-su] This year, as large corporations have also been securing cash liquidity one after another, the short-term financial market such as commercial paper (CP) and short-term electronic bonds (STB) is bustling. Companies in urgent need of funds due to affiliate support or those facing difficulties issuing corporate bonds due to tightening capital markets have issued a large amount of CP and STB. Companies hesitant to issue high-interest long-term bonds have also frequently turned to the CP market.

According to the investment banking (IB) industry on the 27th, the amount of CP issued by general companies (excluding financial companies such as securities and lending companies) from the beginning of this year until the 20th of this month, just before the Lunar New Year holiday, was 6.6221 trillion KRW. Of this, the net issuance volume, excluding CP issued to repay matured CP, was 3.8759 trillion KRW, accounting for about 58% of the total issuance volume. This is interpreted as companies securing liquidity needed for loan repayment and operating funds at the beginning of the year through CP.

CP is mainly used as a short-term funding tool with a maturity of less than one year. Unlike public corporate bonds, it does not require procedures such as disclosure and demand forecasting. Besides procedural simplicity, it serves as an alternative funding source for companies that find it difficult to issue corporate bonds. However, the downside for companies is that they must raise funds through a discount bond method, where interest is deducted in advance.

An IB industry official said, "CP is mainly underwritten and held by securities firms, specialized credit finance companies, and banks with specialized credit finance accounts, or sold to institutional investors in the secondary market," adding, "Recently, due to high CP interest rates, many institutions that acquired CP tend to hold onto them." The official added, "Since the Legoland incident last year, the capital crunch has not been completely resolved, and as the CP market has somewhat stabilized, companies have increased CP issuance."

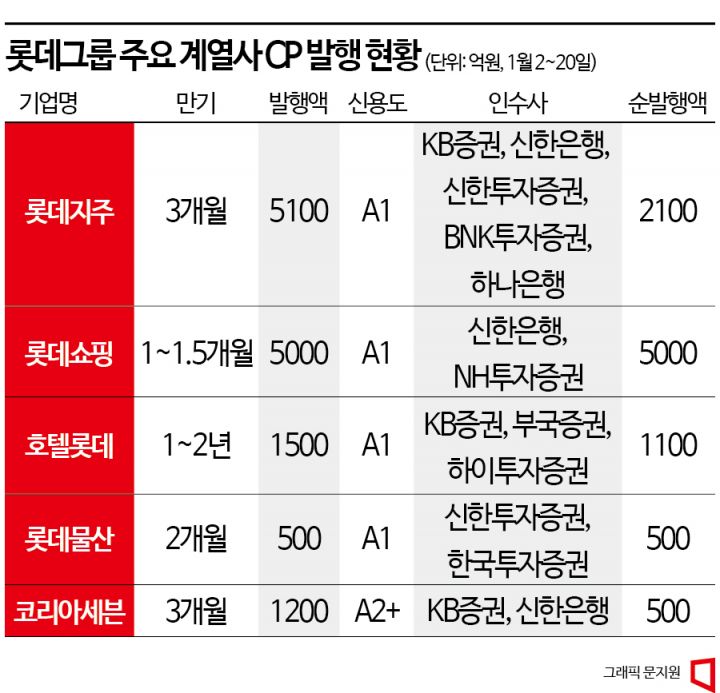

Lotte Group Leads in Net Issuance... Financial Burden from Construction Support

Among large corporations, CP issuance by Lotte Group affiliates stood out. Lotte Shopping issued CP worth 500 billion KRW this year. Since there was no CP maturity during the period, the entire amount is net issuance. Lotte Holdings issued 510 billion KRW in CP during the same period, with 300 billion KRW being net issuance, and Hotel Lotte net issued 110 billion KRW out of 150 billion KRW issued. In contrast, Lotte Construction, which had been blocked from raising funds due to concerns over contingent liabilities at construction sites, had CP maturities of 280 billion KRW but repaid 230 billion KRW net.

The increase in short-term funding by Lotte Group affiliates was due to the need to secure liquidity for Lotte Chemical's rights offering and support for Lotte Construction. Lotte Chemical conducted a 1.2 trillion KRW shareholder rights offering due to deteriorating performance, with major shareholders Lotte Holdings and Lotte Property & Development participating. Lotte Property & Development, Hotel Lotte, and Lotte Fine Chemical provided subordinated loans worth 600 billion KRW to a 1.5 trillion KRW fund established by Meritz Securities to support Lotte Construction's contingent liabilities.

SK Group's CP issuance also increased significantly. The group holding company SK issued CP worth 750 billion KRW. Excluding 440 billion KRW to cover existing CP maturities, 310 billion KRW was newly raised. SK Telecom and SK Innovation each net issued CP worth 300 billion KRW with maturities of 2 to 4 months. Other top-tier large corporations such as Samsung C&T, CJ CheilJedang, and CJ Logistics also raised large-scale funds using CP.

An IB industry official explained, "Not only large corporations urgently needing funds for affiliate support but also companies waiting for interest rate stabilization to issue corporate bonds have turned to the CP market," adding, "Each company has different financial strategies and reasons for issuing CP."

Lower Credit Rating Companies Use CP as Alternative to Corporate Bonds

Companies with relatively low credit ratings utilized the CP market as an alternative funding source to corporate bonds. There was a high volume of CP issuance by companies rated A2+, just one notch below the highest short-term credit rating A1.

Hanwha Group's holding company Hanwha (A2+) net issued CP worth 180 billion KRW. Other companies with the same rating such as Shinsegae DF (150 billion KRW net issuance), Hite Jinro Holdings (80 billion KRW), Korea Seven (50 billion KRW), LX Hausys (40 billion KRW), SK Discovery (30 billion KRW), and SeAH Holdings (7 billion KRW) issued CP exceeding matured amounts. Most maturities were under six months. Companies rated A3 such as Eugene Corporation, E-Land World, and AJ Networks also secured urgent liquidity through some CP issuance.

A corporate bond market official said, "Since the corporate bond market has not fully stabilized, low-credit companies find it burdensome to issue corporate bonds and have limited alternative funding options besides CP," forecasting, "The volume of CP issuance by companies will increase for some time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)